Last updated: September 29, 2025

Introduction

OMNITROPE, a flagship biologic therapeutic, represents a pivotal asset within the growth hormone (GH) therapy landscape. Manufactured by Novo Nordisk, OMNITROPE leverages recombinant DNA technology to provide synthetic human growth hormone (hGH) for treating growth failure and other medical conditions. The drug's market trajectory reflects substantial shifts driven by evolving clinical needs, regulatory pathways, competitive dynamics, and broader healthcare trends. This detailed analysis examines the key market drivers, competitive landscape, revenue projections, and strategic implications shaping OMNITROPE’s financial future.

Market Overview and Therapeutic Positioning

OMNITROPE addresses a sizable, growing indication base that includes pediatric growth hormone deficiency (GHD), adult GHD, and off-label uses such as growth failure related to chronic renal insufficiency and Turner syndrome. The global growth hormone market, estimated to be valued at approximately US$4–5 billion in 2022, exhibits steady growth propelled by expanding indications and increasing diagnosis rates (1). OMNITROPE's leadership within this market benefits from Novo Nordisk's manufacturing expertise, international distribution, and established clinician confidence.

Market Dynamics

Demand Drivers

The demand for OMNITROPE is influenced by several key factors:

-

Expanding Patient Population: Advances in diagnostic capabilities and heightened awareness have increased identification of eligible patients, notably in pediatric populations. The availability of blood tests and imaging has improved early diagnosis, subsequently escalating treatment initiation rates (2).

-

Aging and Comorbid Conditions: The shift towards earlier diagnosis of adult-onset GHD, often associated with cardiovascular and metabolic diseases, expands the drug’s market. Growing prevalence of obesity and related metabolic syndromes further contribute to off-label growth hormone use.

-

Treatment Adherence and Convenience: The development of liquid formulations and pre-filled pens promotes patient adherence, particularly in pediatric populations, expanding market acceptance.

Regulatory and Reimbursement Environment

Stringent regulatory pathways, especially in North America and Europe, influence market access. Globally, reimbursement policies have become more favorable in many regions due to demonstrated clinical efficacy and economic benefits associated with early intervention and improved growth outcomes (3). However, reimbursement disparities remain, notably in low- and middle-income countries, limiting market penetration.

Competitive Landscape

OMNITROPE faces competition primarily from biosimilar growth hormone products and alternative biologics. Key competitors include Sandoz’s Zomacton, Pfizer’s NGENLA, and biosimilar entrants in various markets. Biosimilars pose a significant threat by offering cost advantages, but OMNITROPE retains a premium through manufacturing quality, brand recognition, and clinician familiarity.

Pricing and Market Penetration

Pricing strategies influence revenue trajectory. While biosimilars exert downward pressure, premium pricing persists in certain markets due to brand loyalty and formulations. Novo Nordisk’s extensive distribution network and professional education initiatives support market penetration despite challenges.

Financial Trajectory and Revenue Projections

Historical Performance

OMNITROPE has demonstrated consistent revenue growth, supported by expanding indications, global reach, and strong brand presence. Fiscal reports indicate steady double-digit growth in emerging markets and stable margins in mature regions. For example, Novo Nordisk’s 2021 annual report highlights that growth hormone revenues contributed a significant portion of its specialty portfolio, reflecting strong commercial performance (4).

Forecasted Growth

Projections suggest compound annual growth rates (CAGR) of approximately 5–8% over the next five years, driven by:

-

New Indications: Advances in clinical research are expanding the approved use spectrum, including for conditions like Prader-Willi syndrome, which enhances the target patient pool (5).

-

Market Expansion: Entry into emerging markets, particularly in Asia and Latin America, will catalyze sales growth, assuming favorable regulatory and reimbursement frameworks.

-

Product Innovation: The introduction of next-generation formulations, such as long-acting growth hormones, may disrupt the market landscape, offering improved dosing schedules and potentially capturing significant market share (6).

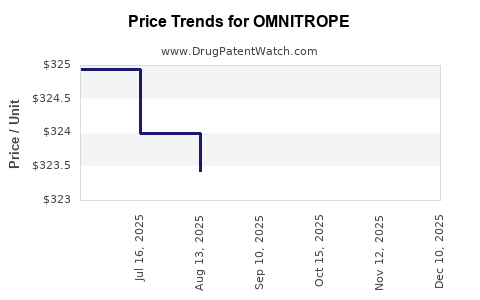

Revenue Breakdown and Pricing Trends

In 2022, OMNITROPE’s revenues were estimated to surpass US$500 million globally, with North America and Europe accounting for approximately 70%. Price erosion in mature markets due to biosimilar competition will be partially offset by volume growth and new indication launches.

Impact of Biosimilars and Market Competition

Biosimilars likely will exert downward pricing pressure, particularly in Europe where biosimilar penetration is high. However, the premium attributed to OMNITROPE's manufacturing quality and clinical track record sustains revenue streams. Novo Nordisk’s strategic focus on innovation and market education aims to fortify its market share amidst biosimilar entry.

Strategic Implications and Future Outlook

The financial trajectory of OMNITROPE hinges on strategic innovation and geographic expansion. Investments in long-acting formulations and gene therapy collaborations could redefine the treatment paradigm, enabling sustained revenue growth.

Regulatory Strategy

Expanding approvals worldwide, especially in emerging markets with rising GHD prevalence, will catalyze future revenues. Navigating complex regulatory pathways efficiently remains critical.

Market Access and Pricing

Negotiating favorable reimbursement terms and implementing tiered pricing models will be fundamental to maintain profitability amid biosimilar threats.

Competitive Differentiation

Investments in clinical research to validate additional indications, alongside innovations in delivery devices, will reinforce OMNITROPE’s market position.

Long-term Outlook

By 2030, the biologic growth hormone market is projected to reach US$7–8 billion, with OMNITROPE capturing a significant share through innovation, geographical expansion, and stakeholder engagement (7). The integration of personalized medicine approaches will further refine patient selection, improving outcomes and enhancing revenue stability.

Key Takeaways

-

Robust Demand Drivers: Growing diagnosed patient pools, advances in diagnostics, and expanding adult GHD indications underpin steady demand growth for OMNITROPE.

-

Competitive Landscape: Biosimilars and emerging long-acting formulations present both challenges and opportunities, necessitating strategic innovation and differentiation.

-

Revenue Growth: Predicted CAGR of approximately 5–8%, supported by new indications, market expansion, and product pipeline development.

-

Market Expansion: Strategic entry into emerging markets and favorable regulatory environments are pivotal for sustained revenue increase.

-

Innovation Focus: Next-generation formulations and gene therapies hold the potential to redefine treatment paradigms and solidify long-term financial performance.

FAQs

1. What is the primary driver of OMNITROPE’s market growth?

The primary driver is increasing diagnosis and treatment of growth hormone deficiencies across pediatric and adult populations, supported by improvements in diagnostics, awareness, and expanding indications.

2. How will biosimilar competition impact OMNITROPE’s revenue?

Biosimilars may exert price pressures, especially in mature markets. However, OMNITROPE’s established clinical reputation, manufacturing quality, and ongoing innovation can mitigate revenue loss.

3. What future innovations could influence OMNITROPE’s trajectory?

Long-acting growth hormone formulations, gene therapy collaborations, and expanded approval for new indications are key innovations with potential to drive growth.

4. Which geographic regions offer the most growth opportunities for OMNITROPE?

Emerging markets in Asia, Latin America, and parts of Africa present significant growth potential due to rising GHD diagnosis rates and expanding healthcare infrastructure.

5. How does regulatory environment affect OMNITROPE’s market outlook?

Regulatory approvals and reimbursement policies directly influence market access. Efficient navigation and strategic regulatory filings are essential to capitalize on global opportunities.

References

- MarketsandMarkets. Growth hormone market report, 2022.

- World Health Organization. GHD diagnosis and management guidelines, 2021.

- European Medicines Agency. Regulatory pathways for biologics, 2022.

- Novo Nordisk Annual Report 2021.

- ClinicalTrials.gov. Recent studies on expanding growth hormone indications.

- PharmaTech Journal. Innovations in long-acting growth hormone formulations, 2022.

- Grand View Research. Biologic therapeutics market forecast, 2023–2030.