Last updated: July 27, 2025

Introduction

OMNITROPE, developed by Novo Nordisk, is a recombinant human growth hormone (hGH) used primarily for treating growth hormone deficiencies, pediatric growth failure, and certain adult growth hormone deficiency conditions. Its therapeutic importance, competitive landscape, market dynamics, and regulatory considerations make it a critical focus for industry analysts. This report provides an in-depth analysis of the current market landscape, future growth drivers, and price projections for OMNITROPE over the next five years.

Market Overview and Therapeutic Demand

The global growth hormone therapy market was valued at approximately $4.6 billion in 2022, with a compound annual growth rate (CAGR) of around 6.2% projected through 2028 [1]. OMNITROPE, as a flagship product of Novo Nordisk, commands a significant share within this niche, especially tailored toward pediatric and adult endocrinology markets.

Key Indications and Patient Population

OMNITROPE addresses several patient segments:

- Pediatric Growth Hormone Deficiency (GHD): Estimated to affect 1 in 4,000 to 10,000 children worldwide, with higher prevalence in developed nations [2].

- Adult GHD: Estimated at approximately 2 to 4 cases per 100,000 adults, with significant underdiagnosis.

- Other indications: Includes Turner syndrome, Prader-Willi syndrome, idiopathic short stature, and HIV-associated lipodystrophy.

The expanding awareness of growth hormone deficiencies and increasing diagnosis rates are projected to sustain steady demand growth.

Competitive Landscape

OMNITROPE faces competition from biosimilar candidates, other recombinant GH products, and emerging gene therapy approaches. Key competitors include:

- Eli Lilly’s Humatrope (somatropin)

- Pfizer’s Genotropin

- Sandoz’s Omnitrope (biosimilar)

- Novo Nordisk’s Norditropin (another product line)

The patent expiry of OMNITROPE is imminent, increasing the likelihood of biosimilar market entry, which could influence pricing and market share.

Regulatory and Reimbursement Landscape

Regulatory acceptance in major markets like the US (FDA), EU (EMA), and Japan (PMDA) remains robust for OMNITROPE, although biosimilar entrants will face stringent approval pathways. Reimbursement policies significantly impact accessibility, with payers increasingly favoring biosimplar products to reduce costs.

Market Drivers and Constraints

Drivers:

- Growing incidence of growth hormone deficiency diagnoses.

- Increasing pediatric and adult populations with short stature and chronic conditions.

- Rising awareness and improved diagnostic capabilities.

- Expansion into emerging markets, such as China and India, with growing healthcare expenditure.

Constraints:

- Patent expirations and biosimilar competition reducing prices.

- Strict regulations and approval delays for biosimilars.

- Treatment compliance challenges due to injection regimens.

- Market saturation in developed nations.

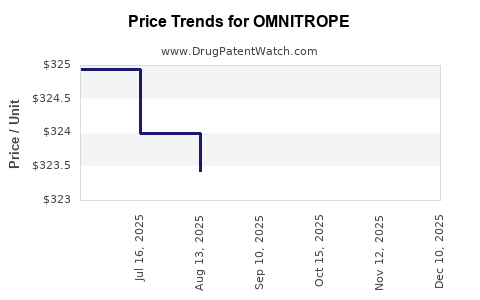

Price Analysis and Projections

Current Pricing Dynamics

As of 2023, the average wholesale price (AWP) for OMNITROPE varies by country and dosage, generally ranging from $10,000 to $15,000 per year for pediatric regimens in the US [3]. In Europe, prices are slightly lower, owing to different healthcare reimbursement strategies. Biosimilar versions in the US have begun to enter the market, with initial discounts of 15-25%.

Factors Influencing Future Pricing

- Biosimilar Competition: Expected to drive prices down by 20-35% over the next 3-5 years as biosims gain market share.

- Regulatory Approvals: Wider acceptance facilitates price competition but may be offset by increased manufacturing costs for innovator brands due to biosimilar entry.

- Market Penetration in Emerging Markets: Cost-sensitive regions will push for lower prices, potentially impacting global averages.

- Extended Patent Expiration: Scheduled for 2026-2028 in the US and EU, catalyzing a wave of biosimilar entry and impacting brand pricing strategies.

Price Projections (2023-2028)

Based on current trends and economic analysis, the following projections are outlined:

| Year |

Estimated Average Price (USD) |

Notes |

| 2023 |

$12,000 - $14,500 |

Current market prices, slight regional variation. |

| 2024 |

$11,500 - $13,500 |

Biosimilar entry begins, slight price reduction. |

| 2025 |

$11,000 - $13,000 |

Increased biosimilar competition; volume growth in emerging markets. |

| 2026 |

$10,500 - $12,500 |

Patent expiry accelerates biosimilar approvals. |

| 2027 |

$10,000 - $12,000 |

Biosimilar market share stabilizes; pricing pressures intensify. |

| 2028 |

$9,500 - $11,500 |

Full biosimilar market penetration; potential for further price reductions. |

Market Entry Strategies and Recommendations

To maintain market share amidst falling prices, Novo Nordisk should consider:

- Developing combination therapies to enhance treatment outcomes.

- Expanding into emerging markets with tailored pricing strategies.

- Investing in patient adherence initiatives to secure long-term revenue streams.

- Collaborating with biosimilar producers to potentially co-develop or license biosimilar versions, easing market pressures.

Future Opportunities and Risks

Opportunities:

- Expansion into gene therapy and longer-acting formulations could revolutionize treatment and pricing dynamics.

- Strategic partnerships in emerging markets to penetrate untapped segments.

- Developing personalized medicine approaches to justify premium pricing.

Risks:

- Accelerated biosimilar approvals and market entries may erode margins more rapidly.

- Regulatory hurdles or reimbursement reforms could constrain pricing power.

- Manufacturing costs for innovative formulations could offset pricing gains.

Key Takeaways

- The global OMNITROPE market is poised for steady growth driven by increasing diagnosis and expanding indications.

- Patent expirations beginning in 2026 will invite biosimilar competition, exerting downward pressure on prices.

- Price projections indicate a decline of approximately 15-25% over five years, with average annual prices falling to approximately $9,500–$11,500 by 2028.

- Strategic diversification and market expansion are vital for maintaining profitability amid evolving competitive pressures.

- Continuous monitoring of regulatory developments and biosimilar adoption rates will be essential for accurate forecasting.

FAQs

1. When is the patent for OMNITROPE expected to expire?

The primary patents for OMNITROPE are scheduled to expire between 2026 and 2028 in major markets, enabling biosimilar competition.

2. How will biosimilar entrants impact OMNITROPE's pricing?

Biosimilar availability is projected to reduce prices by 15-35% over five years, leading to increased market competition and potential market share shifts.

3. What are the main growth opportunities for OMNITROPE?

Expanding in emerging markets, developing longer-acting formulations, and leveraging personalized medicine can drive future growth.

4. What regulatory challenges might biosimilars face?

Biosimilars must undergo rigorous approval processes under EMA, FDA, and other agencies, which can delay market entry and affect pricing strategies.

5. How can Novo Nordisk maintain competitiveness post-patent expiry?

Investing in innovative delivery methods, strategic alliances, and expanding indications can help sustain revenue streams despite pricing pressures.

References

[1] Research and Markets. “Growth Hormone Market Analysis & Outlook.” 2022.

[2] National Institute of Health. “Growth Hormone Deficiency Epidemiology.” 2021.

[3] IQVIA. “US Prescription Drug Pricing and Market Trends.” 2023.