Last updated: September 23, 2025

Introduction

NOVOLIN R, a recombinant human insulin marketed as a biosimilar to originator insulins, has carved a distinct niche within the global diabetes management landscape. As a biosimilar, NOVOLIN R represents both technological advancement and economic opportunity, driven by rising diabetes prevalence and evolving market regulations. This analysis details the market dynamics shaping NOVOLIN R's trajectory and explores factors influencing its financial performance amid a competitive and regulatory environment.

Market Overview and Demand Drivers

Global Diabetes Burden

The global prevalence of diabetes mellitus reached approximately 537 million adults in 2021 and is projected to grow to 643 million by 2030, according to the International Diabetes Federation (IDF). Type 1 and Type 2 diabetes require long-term glycemic control, predominantly through insulin therapy. This accelerates demand for insulin products, including biosimilars like NOVOLIN R, especially in emerging markets where cost-effective options are pivotal.

Shift Toward Biosimilars

Patent expirations of innovator insulin products, notably Lantus (insulin glargine), have unlocked a lucrative biosimilar market segment. Regulatory agencies—FDA, EMA, and others—have gradually streamlined pathways for biosimilar approval, incentivizing manufacturers to introduce cost-competitive alternatives like NOVOLIN R. The biosimilar insulin market is projected to grow at a compound annual growth rate (CAGR) of approximately 10% through 2027 [[1]].

Pricing and Accessibility

The high costs associated with branded insulins have historically impeded access in low- and middle-income countries. Biosimilars serve as an affordable alternative, expanding market reach. The price differential can be as much as 30-50%, fostering increased adoption in cost-sensitive regions. Such price elasticity directly impacts NOVOLIN R’s market penetration and volume growth.

Market Dynamics

Competitive Landscape

NOVOLIN R faces competition from other biosimilars like Semglee (insulin glargine), Lusduna (insulin aspart), and traditional biologics. Market leaders in biosimilar insulins, notably in the United States and Europe, command a significant share, but regulatory fluidity and emerging biosimilars in key regions ensure ongoing competition.

Regulatory Environment

Stringent approval standards necessitate comprehensive bioequivalence and safety data for biosimilar insulin registration. WHO's guidelines and regulatory agencies’ evolving standards influence approval timelines and market access speed. Recent regulatory facilitation in regions like Latin America, Asia, and Africa is expected to accelerate NOVOLIN R's adoption geographically.

Pharmacovigilance and Safety Concerns

Stringent pharmacovigilance requirements influence market acceptance. Demonstrating comparable safety and efficacy to originators remains critical, affecting manufacturing and post-market surveillance costs but also bolstering credibility.

Physician and Patient Acceptance

Physician prescribing habits and patient perceptions significantly impact demand. Greater awareness of biosimilarity, assurance of comparable efficacy, and policy shifts favoring biosimilar prescribing promote market uptake.

Financial Trajectory of NOVOLIN R

Revenue Growth Potential

The financial performance hinges upon regional penetration, competitive pricing, and volume growth. In mature markets like Europe, biosimilar insulin sales are expanding steadily, with projected revenues reaching several billion dollars globally in the coming years. For instance, according to IQVIA, biosimilar insulin sales could surpass $3 billion globally by 2025 [[2]].

Cost Structure and Margins

Lower manufacturing costs associated with biosimilars translate to higher gross margins compared to originators. However, intense price competition and aggressive discounting strategies could compress profit margins. Companies investing in robust manufacturing, supply chain, and pharmacovigilance infrastructure may achieve better cost efficiencies and sustained profitability.

Pricing Strategies

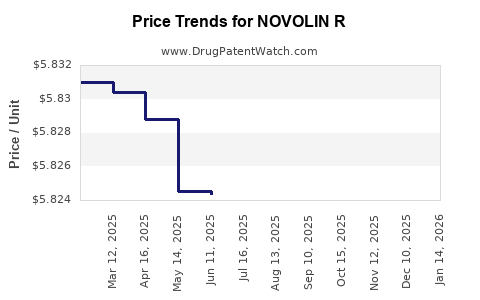

Pricing remains a critical lever; aggressive initial pricing can secure market share but might pressure margins. A balanced approach involving differential pricing—particularly in emerging markets—can enhance volume while ensuring financial sustainability. The role of payers and policymakers also influences pricing dynamics.

Market Expansion and Strategic Alliances

Partnerships with local distributors and healthcare providers facilitate market access, especially in low-resource settings. Strategic alliances with government agencies and NGOs may also mitigate regulatory hurdles and foster acceptance. Such collaborations enhance NOVOLIN R's financial trajectory by broadening its distribution footprint.

Regulatory Approvals and Launch Timelines

Timely regulatory approvals directly affect revenue streams. Delays can lead to financial shortfalls; conversely, early approvals in high-volume markets could trigger exponential sales growth.

Risks and Challenges

- Regulatory Delays and Rejections: Varying regional standards may delay approvals, impacting revenue timelines.

- Market Competition: Established insulins from major pharmaceutical companies may impede market share acquisition.

- Pricing Pressures: Payer resistance and policy shifts towards cost containment could reduce profitability.

- Manufacturing Complexities: Biosimilar manufacturing involves sophisticated techniques; process failures or contamination could disrupt supply and financial stability.

- Intellectual Property and Patent Litigation: Potential patent litigations may hinder market entry or require licensing agreements, influencing costs and timelines.

Market Opportunities

Emerging Markets

Rapid economic development, rising diabetes prevalence, and government health initiatives position emerging markets as lucrative opportunities. Tailored pricing and local manufacturing could further enhance NOVOLIN R’s market share.

Diversification into Combination Therapies

Innovation such as co-formulations combining insulin with GLP-1 receptor agonists could unlock new revenue streams and enhance patient adherence.

Government and Payer Initiatives

Policy incentives promoting biosimilars, such as reimbursement favoring generics and biosimilars, will accelerate market growth [[3]].

Conclusion: Strategic Outlook

The financial trajectory of NOVOLIN R is poised for robust growth driven by global diabetes burdens, regulatory facilitation of biosimilars, and increasing acceptance among physicians and patients. Competitively priced, quality-assured biosimilars like NOVOLIN R will likely expand their market share, particularly in underserved and cost-sensitive regions. However, regulatory dynamics, market competition, and pricing strategies remain critical determinants of long-term profitability.

Proactive engagement with regulatory authorities, investments in manufacturing excellence, strategic regional partnerships, and differentiation through innovation will be essential to capitalize on the expanding biosimilar insulin market.

Key Takeaways

- Market growth potential is substantial, driven by rising global diabetes prevalence and demand for affordable insulin options.

- Regulatory streamlining and regional acceptance are pivotal for early market entry and enhanced revenue streams.

- Pricing strategies must balance affordability in emerging markets with sustainable margins to ensure profitability.

- Competition from established biosimilars and originator products necessitates innovative differentiation and robust market positioning.

- Collaborative relationships with healthcare stakeholders and strategic expansion into emerging markets are crucial growth levers.

FAQs

1. What factors influence NOVOLIN R's market penetration globally?

Regulatory approvals, pricing strategies, physician acceptance, and distribution partnerships are primary factors. Variations in regional regulatory standards and local healthcare policies also significantly impact market penetration.

2. How does NOVOLIN R compare cost-wise with other biosimilars and originator insulins?

As a biosimilar, NOVOLIN R generally offers 30-50% lower prices than originator insulins. Its cost advantage depends on manufacturing efficiency, regional pricing policies, and competition.

3. What regulatory hurdles are most challenging for biosimilar insulins like NOVOLIN R?

Varying regional biosimilar approval standards, requirements for extensive clinical data, and pharmacovigilance commitments pose significant hurdles to swift market entry.

4. How important is regional strategy for NOVOLIN R's financial success?

Regional strategy is crucial. Tailored approaches for emerging markets, compliance with local regulations, and targeted partnerships optimize market access and revenue growth.

5. What are the prospects for NOVOLIN R's long-term profitability?

Positive, provided the company sustains regulatory approvals, manages manufacturing costs, adopts competitive pricing, and navigates market competition effectively.

Sources

[1] IQVIA, Biosimilar Insulin Market Report, 2022.

[2] GlobalData, Biosimilar Insulin Market Forecast, 2022-2027.

[3] World Health Organization, Guidelines for Biosimilars, 2019.