Share This Page

Drug Price Trends for NOVOLIN R

✉ Email this page to a colleague

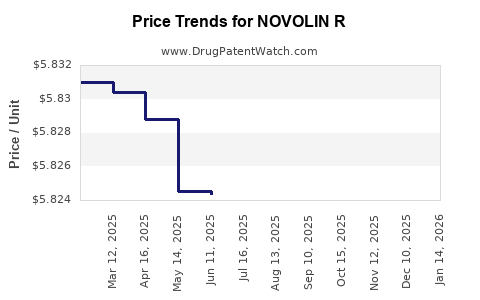

Average Pharmacy Cost for NOVOLIN R

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NOVOLIN R 100 UNIT/ML FLEXPEN | 00169-3003-15 | 5.82319 | ML | 2025-12-17 |

| NOVOLIN R 100 UNIT/ML VIAL | 00169-1833-11 | 4.62527 | ML | 2025-12-17 |

| NOVOLIN R 100 UNIT/ML FLEXPEN | 00169-3003-15 | 5.82403 | ML | 2025-11-19 |

| NOVOLIN R 100 UNIT/ML VIAL | 00169-1833-11 | 4.62778 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NOVOLIN R

Introduction

Novolin R, a recombinant human insulin product, remains a significant player in the management of diabetes mellitus, primarily type 1 and advanced type 2 diabetic populations. Manufactured by Novo Nordisk and other generic producers, Novolin R holds a critical position within the insulin market, which is characterized by evolving pricing dynamics, increasing demand, and regulatory pressures. This article provides a comprehensive analysis of the current market landscape for Novolin R, explores future pricing projections, and discusses implications for stakeholders.

Market Overview

Global Diabetes and Insulin Market Landscape

The global diabetes market is projected to reach approximately USD 85 billion by 2027, with insulin products constituting a sizeable share—estimated at USD 27 billion in 2022 [1]. The rising prevalence of diabetes, especially in low- and middle-income countries (LMICs), correlates with increased demand for affordable insulin formulations like Novolin R.

Competitive Dynamics

Novolin R operates amidst a highly competitive environment featuring established biosimilar and branded insulin products. Major competitors include Eli Lilly’s Humulin R, Sanofi’s Insuman, as well as biosimilars from emerging manufacturers. The entry of biosimilar insulins has exerted downward price pressures and expanded access, especially in markets driven by cost-sensitive healthcare systems.

Regulatory Environment and Market Access

Different regions have varying regulatory standards influencing Novolin R’s pricing. In the United States, the FDA’s biosimilar pathway accelerates approval of lower-cost alternatives, whereas in LMICs, regulation primarily aims to improve affordability. International organizations, such as WHO, advocate for the availability of affordable insulins, impacting market access strategies.

Pricing Trends and Factors Influencing Price

Current Pricing Landscape

Novolin R’s retail price varies internationally due to factors like manufacturing costs, patent status, insurance reimbursements, and local regulations. In the U.S., the retail list price hovers around USD 130–150 per 10 mL vial, though actual patient costs are often lower due to insurance negotiations [2]. Conversely, in LMICs, procurement costs may be substantially reduced through governmental bulk purchasing.

Key Drivers of Price

- Patent Expiry and Biosimilar Competition: The expiration or absence of patent protections, especially in emerging markets, facilitates biosimilar entry and drives prices downward.

- Manufacturing Costs: Advances in recombinant DNA technology have reduced production costs, aiding affordability.

- Regulatory Incentives and Price Controls: Governments' price caps and reimbursement policies influence retail prices significantly.

- Market Penetration and Demand: Growing diabetes prevalence enhances demand, potentially stabilizing or reducing unit prices due to higher volume sales.

Future Price Projections

Short-Term Outlook (1–3 Years)

In the immediate future, patent expirations in certain regions and the proliferation of biosimilars are expected to exert continued downward pressure on Novolin R prices. Additionally, shifts towards more affordable biosimilar formulations, especially in LMIC markets, are likely to intensify competition. According to industry analysts, average prices for recombinant human insulins could decline by approximately 10–20% in the next 2–3 years, driven mainly by biosimilar adoption [3].

Medium- to Long-Term Outlook (3–10 Years)

Over the longer term, innovations in insulin delivery, such as ultra-long-acting formulations and smart insulin patches, may alter market dynamics but will have a limited immediate impact on Novolin R’s pricing. Government-led initiatives aiming to enhance global insulin access could further reduce prices, particularly in LMICs. Experts project that in price-sensitive markets, the retail cost of Novolin R may decrease by up to 30% within the next decade as biosimilar insulin becomes more prevalent and manufacturing efficiencies improve.

Influence of Policy and Market Forces

Policy measures supporting biosimilar insulin market penetration and international procurement programs could accelerate price reductions. Additionally, global health alliances advocating for affordable insulin will likely influence market prices favorably, especially in underdeveloped regions.

Market Segments and Pricing Strategies

Institutional and Retail Markets

In high-income countries, Novolin R primarily targets institutional buyers, with prices protected by negotiation power. In LMICs, reduced procurement costs and government subsidies are pivotal, often resulting in significantly lower retail prices.

Pricing Strategies

Manufacturers are adopting tiered pricing models—premium pricing in affluent markets and volume-driven lower pricing in emerging markets—to maximize access and revenue. Smart pricing strategies, including bundling and subscription models, are emerging as means to stabilize revenue streams while enhancing affordability.

Implications for Stakeholders

- Patients: Increased biosimilar competition and price declines are projected to improve insulin affordability globally.

- Manufacturers: OEMs and biosimilar producers must navigate competitive pressures, emphasizing quality, brand trust, and distribution reach.

- Regulators: Price regulation and approval pathways significantly influence the insulin landscape.

- Investors: Market expansion opportunities are tempered by pricing pressures, necessitating strategic oversight.

Key Challenges

- Price Erosion: Sustained biosimilar competition threatens profit margins for Novolin R.

- Market Access: Regulatory variations complicate global rollout.

- Supply Chain: Ensuring consistent manufacturing quality and distribution remains vital amid lower prices and increased demand.

Conclusion

Novolin R’s market remains dynamic, shaped by technological innovation, regulatory shifts, and global health initiatives. Pricing is expected to trend downward over the next decade, spurred by biosimilar proliferation and increased demand driven by diabetes prevalence. Stakeholders must adapt strategic approaches to navigate the evolving landscape effectively, balancing affordability with profitability.

Key Takeaways

- The global insulin market is poised for substantial growth, with Novolin R’s price diminishing due to biosimilar competition and policy interventions.

- Short-term projections indicate a 10–20% decline in prices, with declines accelerating in the medium to long term.

- Market segmentation and strategic pricing are vital for manufacturers aiming to sustain revenue amidst increasing affordability pressures.

- Policy and international cooperation play pivotal roles in shaping future access and pricing for Novolin R.

- Stakeholders should monitor biosimilar market entries and regulatory developments for informed decision-making.

FAQs

-

What factors are most influential in determining Novolin R’s price in different markets?

Regulatory policies, patent status, biosimilar competition, manufacturing costs, and government procurement strategies primarily influence pricing. -

How does biosimilar competition impact Novolin R’s market share?

Biosimilar entries typically lead to price reductions and can erode market share, especially in markets where cost is a key consideration. -

What are the expected trends in Novolin R pricing over the next five years?

Prices are expected to decline by approximately 10–20% over the next three years due to biosimilar competition, with further reductions possible as market dynamics evolve. -

Which regions are likely to see the most significant price reductions for Novolin R?

Emerging markets and LMICs are anticipated to experience the most substantial price declines, driven by procurement policies and biosimilar market penetration. -

How might future innovations in insulin delivery affect Novolin R’s market?

Innovations such as ultra-long-acting insulins and smart delivery systems could reduce demand for traditional rapid-acting insulins like Novolin R, influencing future pricing strategies.

Sources:

[1] Grand View Research. Global Insulin Market Size & Trends. 2022.

[2] GoodRx. Average retail insulin prices in United States. 2023.

[3] EvaluatePharma. Biosimilar insulin projections. 2022.

More… ↓