Last updated: September 23, 2025

Introduction

FIASP (Fast-acting Insulin Aspart), a groundbreaking biologic drug developed by Novo Nordisk, represents a significant advancement in diabetes management. As a rapid-acting insulin formulation, FIASP’s unique pharmacokinetics aim to optimize post-meal glucose control, improve patient adherence, and reduce long-term complications associated with diabetes. This detailed analysis explores FIASP’s market dynamics, competitive landscape, regulatory influences, and its projected financial trajectory, equipping stakeholders with critical insights into its commercial potential.

Market Overview: The Global Diabetes Therapeutics Landscape

The global diabetes market exhibits robust growth driven by rising prevalence, technological innovations, and shifting therapeutic paradigms. According to the International Diabetes Federation (IDF), approximately 537 million adults experienced diabetes in 2021, with projections surpassing 700 million by 2045 [1]. Insulin therapies constitute a core pillar of diabetes treatment, especially in type 1 and advanced type 2 diabetes cases.

Biologics, including insulin analogs like FIASP, command a significant share of the insulin market, fueled by their superior pharmacokinetic profiles. The shift from human insulin to analogs reflects patient-centric demands for rapid onset and reduced hypoglycemia risk. In this context, rapid-acting insulins, such as FIASP, are front and center, aligning with the broader movement toward personalized and flexible diabetes care.

Product Positioning: FIASP’s Unique Value Proposition

FIASP is a novel formulation combining insulin aspart with the excipient niacinamide (vitamin B3), which accelerates absorption and onset of action [2]. Compared to traditional rapid-acting insulins like NovoRapid (insulin aspart) and Humalog (insulin lispro), FIASP offers an approximate 6-minute faster onset and better post-meal glucose control [3]. These pharmacodynamic enhancements position FIASP as an attractive option for patients seeking tighter glycemic control with flexibility around mealtime.

Its convenience and improved efficacy underpin its rapid uptake in clinical settings, especially among adults and pediatric patients with type 1 and type 2 diabetes. The product’s attributes dovetail with growing demand for insulins that mimic physiological insulin response more closely.

Regulatory Landscape and Market Access

FIASP received initial approval from the U.S. Food and Drug Administration (FDA) in 2017 and subsequent approvals across key markets including the EU and Asian countries. Regulatory acceptance hinges on demonstrating superior pharmacokinetic profiles, safety, and efficacy. Reimbursement policies and formulary placements substantially influence market penetration; thus, collaboration with healthcare payers remains essential.

Despite broad regulatory approval, access disparities persist across regions due to pricing, reimbursement limits, and market competition. Novo Nordisk’s global presence facilitates early adoption in key healthcare systems, yet local approval delays or restrictions can temper growth prospects.

Competitive Dynamics: The Insulin Market Contest

FIASP enters a competitive space populated by established insulin analogs such as Humalog, NovoRapid, and newer entrants like Lilly’s Lyumjev (insulin lispro-aabc), and biosimilar insulins. Key competitors differ primarily in pharmacokinetic profiles and cost structure.

Pfizer’s rapid-acting inhaled insulin (Afrezza) and recent developments in smart insulin devices also influence the landscape, emphasizing the shift toward more convenient delivery formats. Biosimilars and patent expirations threaten branded insulin markets, implying downstream pricing pressures but also opening opportunities for FIASP to capture premium segments.

Moreover, ongoing innovation in ultra-long-acting insulins and closed-loop insulin delivery systems (artificial pancreas) redefine therapeutic standards, indirectly impacting the market size and growth trajectory for rapid-acting insulins.

Market Penetration Strategy and Adoption Drivers

-

Physician and Patient Acceptance: Clinical evidence favoring FIASP’s improved postprandial glucose control boosts prescriber confidence. Patient preference for flexible dosing schedules enhances its adoption.

-

Formulary Inclusion: Integration into national and institutional formularies bolsters market access, demanding strategic engagement with payers and regulatory agencies.

-

Innovative Delivery Devices: Compatibility with insulin pens and potential inclusion in closed-loop systems accelerates usage among technologically progressive patients.

-

Pricing and Reimbursement: Competitive pricing aligned with value evidence shapes accessibility. Novo Nordisk’s pricing strategies play a pivotal role in gaining market share.

Financial Trajectory and Market Forecast

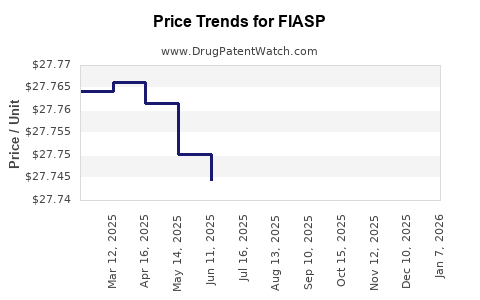

Revenue Growth: FIASP’s revenue prospects depend on global adoption rates, pricing policies, and evolving competitive pressures. Market analysts project a Compound Annual Growth Rate (CAGR) of approximately 8–10% over the next five years, driven by expanding indications, increasing diabetic populations, and technological integration [4].

Market Penetration Projections: By 2027, FIASP is expected to capture a notable segment of the rapid-acting insulin market, especially in North America and Europe, where diabetes prevalence is high, and healthcare systems favor innovative therapies.

Revenue Contributions: While FIASP currently accounts for a smaller fraction of Novo Nordisk’s overall insulin portfolio, its innovative positioning suggests a rising share—potentially contributing 10–15% of the global insulin revenue by 2027, contingent on market acceptance and competitive dynamics.

Profit Margins: As a premium biologic, FIASP benefits from higher margins compared to traditional insulins. However, ongoing biosimilar entry and price competition could moderate inflation of profit margins over time.

R&D and Future Investment: Continued investment in formulation enhancements, device integration, and indication expansion will underpin long-term financial robustness. Strategic collaborations and market expansion into emerging economies further influence growth.

Regulatory and External Risks

-

Patent Cliff and Biosimilar Competition: Patent expirations threaten exclusivity, necessitating innovation and patent extensions to sustain revenue streams.

-

Pricing Pressures: Payer-driven price negotiations, especially in cost-sensitive markets like India and Africa, can compress margins.

-

Market Adoption Barriers: Resistance from prescribers unfamiliar with FIASP’s benefits or concerns over reimbursement limits could slow uptake.

-

Emerging Technologies: Advances in digital health, smart insulin devices, and closed-loop systems could shift patient preferences away from injectable insulins, impacting long-term demand.

Strategic Recommendations

-

Enhance Clinical Evidence: Strengthen data showcasing FIASP’s superior postprandial control and patient outcomes to support formulary positioning.

-

Expand Geographical Reach: Accelerate regulatory submissions in emerging markets with rising diabetes prevalence.

-

Invest in Delivery Device Innovation: Develop connected insulin pens and integrate with digital health platforms to align with modern diabetes management trends.

-

Monitor Competition and Biosimilar Entries: Implement proactive patent strategies and encourage lifecycle management initiatives to preserve market exclusivity.

-

Engage in Payer Dialogue: Demonstrate cost-effectiveness and quality-of-life improvements to secure favorable reimbursement pathways.

Key Takeaways

-

FIASP is positioned as a clinically advantageous rapid-acting insulin with a promising growth trajectory projected at an 8–10% CAGR over the coming years.

-

Its success hinges on expanding regulatory approvals, integrating into healthcare systems, and competing effectively against biosimilars and emerging therapies.

-

Biologic innovation, device integration, and favorable reimbursement policies are vital levers for maximizing FIASP’s financial impact.

-

Market challenges, including biosimilar competition and evolving standards of care, necessitate strategic agility.

-

Continued investment in clinical evidence and technology is crucial to sustain FIASP’s market leadership in insulin therapies.

FAQs

1. What makes FIASP different from other rapid-acting insulins?

FIASP uniquely combines insulin aspart with niacinamide, which accelerates absorption, resulting in a faster onset of action and improved post-meal glucose control compared to traditional rapid-acting insulins [2].

2. How does FIASP's market growth compare to its competitors?

Projected at a CAGR of approximately 8–10%, FIASP’s growth aligns with broader rapid-acting insulin market expansion. Its innovation-centric positioning offers a competitive edge over older formulations, though biosimilar threats remain.

3. What are the main barriers to FIASP’s wider adoption?

Regulatory delays in some regions, reimbursement challenges, prescriber familiarity, and pricing strategies impact clinician prescribing patterns and patient access.

4. How does patent expiry influence FIASP’s financial outlook?

Patent expirations could open the market to biosimilar competition, potentially reducing prices and margins. Strategic patent extensions and lifecycle management are crucial to mitigating this risk.

5. What future developments could impact FIASP’s market trajectory?

Advancements in digital health, smart insulin delivery systems, and emerging biosimilar products will shape the competitive landscape, requiring continual innovation and strategic adaptation.

References

- International Diabetes Federation. IDF Diabetes Atlas, 9th Edition, 2021.

- Novo Nordisk. FIASP (insulin aspart injections) product dossier.

- Heise T, et al. Pharmacokinetics and pharmacodynamics of faster-acting insulin aspart versus insulin aspart and insulin lispro. Diabetes Obes Metab. 2017.

- MarketWatch. Insulin Market Size & Share Analysis, 2022–2027.