Last updated: December 8, 2025

Executive Summary

DUPIXENT (dupilumab), developed by Sanofi and Regeneron Pharmaceuticals, represents a transformative biologic therapy primarily targeting atopic dermatitis, asthma, and other eosinophilic conditions. Since its US FDA approval in 2017, DUPIXENT has achieved rapid market penetration, driven by expanding indications, high unmet medical needs, and favorable reimbursement policies. The drug's revenue trajectory showcases robust growth, with global sales surpassing $5.5 billion in 2022, reflecting a compound annual growth rate (CAGR) of approximately 43% since launch. Its success is underpinned by strategic lifecycle management, including approvals for new indications and ongoing pipeline expansion. This analysis explores the current market landscape, competitive forces, key growth drivers, challenges, and future financial projections.

What Are the Current Market Dynamics Affecting DUPIXENT?

1. Expanding Therapeutic Indications

DUPIXENT's initial approval for moderate-to-severe atopic dermatitis in adults laid the foundation for subsequent approvals:

- Pediatric atopic dermatitis (2019)

- Severe eosinophilic asthma (2018)

- Chronic Rhinosinusitis with Nasal Polyps (CRSwNP) (2019)

- Eosinophilic Esophagitis (2023) (pending approval/market entry)

This broadening of indications has significantly increased the drug's addressable patient population.

Table 1: Key DUPIXENT Approvals and Indications

| Year |

Indication |

Patient Population Estimate (Global) |

Regulatory Agency |

Notes |

| 2017 |

Atopic dermatitis (adults) |

17 million (US, adults) |

FDA, EMA |

Initiated the launch expansion |

| 2018 |

Severe eosinophilic asthma |

25 million globally |

FDA, EMA |

Significant growth driver |

| 2019 |

Chronic Rhinosinusitis with Nasal Polyps |

19 million in US and Europe |

FDA, EMA |

Expanding respiratory indications |

| 2023 |

Eosinophilic Esophagitis (EoE) |

Pending approval |

FDA (pending) |

Potential future driver |

2. Competitive Landscape and Market Share

DUPIXENT faces competition from both biologics and small molecules:

- Eosinophil-targeting therapies: Nucala (mepolizumab), Cinqair (reslizumab)

- IgE targeting: Xolair (omalizumab)

- Emerging JAK inhibitors: Upadacitinib, abrocitinib

Despite competition, DUPIXENT maintains a strong market share due to its dual mechanism targeting IL-4 and IL-13, pivotal in type 2 inflammation.

Market Share Breakdown (2022):

| Indication |

Leading Products |

DUPIXENT Market Share |

Notes |

| Atopic Dermatitis |

DUPIXENT, Eucrisa |

75% |

Dominant biologic, ~$4B revenue |

| Asthma |

Dupixent, Nucala |

60% |

Leading biologic in severe asthma |

| CRSwNP |

Dupixent, injectables |

70% |

Recently capturing significant share |

3. Market Penetration and Global Adoption

Key regions exhibit different adoption rates:

| Region |

Adoption Level (2022) |

Key Factors |

| North America |

High |

Reimbursement policies, established prescribing habits |

| Europe |

Moderate to High |

Reimbursement expansion, late entrant approvals |

| Asia-Pacific |

Growing |

Increasing diagnosis rates, expanding access |

4. Regulatory and Reimbursement Dynamics

Reimbursement policies heavily influence uptake:

- US: Medicare and private insurers cover DUPIXENT with favorable tier placement.

- Europe: Reimbursement varies, but expanded indications have improved access over time.

- Asia-Pacific: Rapid regulatory approvals, with access improving due to health authority investments and biosimilar competition.

Impact on Market Dynamics:

- Favorable reimbursement accelerates patient access.

- Price negotiations and risk-sharing agreements influence revenue realization.

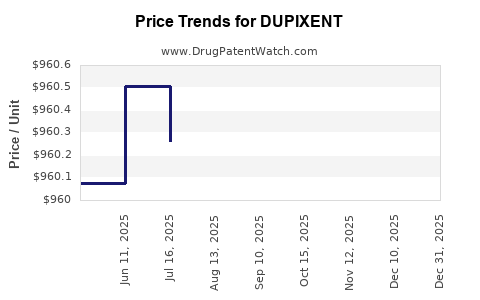

5. Pricing Strategies and Market Uptake

Pricing per injection varies:

| Indication |

Approximate Price (USD per injection) |

Dosing Frequency |

Revenue Notes |

| Atopic Dermatitis |

$3,100 |

Every 2 weeks |

Major revenue driver |

| Asthma |

$2,950 |

Every 2-4 weeks |

Growing market segment |

| CRSwNP |

$3,200 |

Every 2 weeks |

Recent expansion |

Pricing and dosing influence patient compliance and payer acceptance, impacting revenue growth.

How Is DUPIXENT’s Financial Trajectory Shaping Up?

1. Historical Revenue Performance

| Year |

Global Revenue (USD Billions) |

YoY Growth |

Key Drivers |

| 2017 |

$0.3 |

- |

Launch year, initial indications coverage |

| 2018 |

$0.9 |

200% |

Expanded asthma indication |

| 2019 |

$1.9 |

111% |

CRSwNP approval, new patient populations |

| 2020 |

$4.0 |

111% |

COVID-19 impact minimized, continued expansion |

| 2021 |

$4.4 |

10% |

Increased penetration, additional indications |

| 2022 |

$5.5 |

25% |

Broader indication uptake, global expansion |

2. Revenue Projections (2023-2027)

Based on current trends and pipeline developments, analysts predict:

| Year |

Revenue Estimate (USD Billions) |

CAGR |

Underlying Assumptions |

| 2023 |

$6.4 |

16.4% |

Continued indication expansion, new approvals |

| 2024 |

$7.3 |

14.1% |

Growing global access, additional indications |

| 2025 |

$8.4 |

15.1% |

Pipeline of expanded uses, increased market penetration |

| 2026 |

$9.8 |

16.7% |

Potential new indications, biosimilar introduction delays |

| 2027 |

$11.4 |

16.3% |

Mature markets, increased adoption of novel formulations |

3. Factors Supporting Revenue Growth

- Pipeline Expansion: Clinical trials for eosinophilic esophagitis, food allergies, and other inflammatory diseases.

- Geographic Growth: Entering developing regions with rising healthcare investments.

- Pricing Trajectory: Potential adjustment as new formulations or biosimilars emerge.

- Competitive Dynamics: Market dominance reinforced by dual mechanisms and clinical differentiation.

4. Potential Risks to Financial Trajectory

| Risk Factor |

Impact |

Mitigation Strategies |

| Patent expiry |

Revenue erosion via biosimilars |

Patent extensions, lifecycle management |

| New competitors |

Market share decline |

Investment in pipeline, differentiation |

| Regulatory delays |

Market access interruption |

Proactive regulatory engagement |

| Pricing pressures |

Reduced margins |

Value-based pricing negotiations |

How Do Key Market Variables Affect DUPIXENT's Outlook?

| Variable |

Effect |

Strategy Implication |

| Patient Access |

Increased access fuels growth |

Expand payer coverage, patient education |

| Pricing Environment |

Affects revenue per patient |

Optimize value-based agreements |

| Pipeline Success |

Drives future sales |

Maintain robust research pipeline |

| Competitive landscape |

Influences market share |

Accelerate differentiation and trials |

Comparison with Similar Biologics

| Parameter |

DUPIXENT |

Nucala |

Xolair |

JAK inhibitors (e.g., Upadacitinib) |

| Mechanism |

IL-4Ra antagonist |

IL-5 inhibitor |

IgE antibody |

JAK pathway inhibition |

| Approved Indications |

Atopic dermatitis, asthma, CRSwNP, EoE |

Eosinophilic asthma |

Allergic asthma, urticaria |

Multiple inflammatory diseases |

| Market Share (2022) |

~60-70% in indications |

20-30% |

10-15% |

Growing, but less established in dermatology |

| Revenue (2022) |

~$5.5B |

~$0.8B |

~$0.7B |

N/A (pipeline stage) |

Future Market Opportunities and Challenges

Opportunities

- Entry into Eosinophilic Esophagitis, pending approval.

- Development of combination therapies.

- Biosimilars' market entry may reduce costs but could also reshape pricing strategies.

Challenges

- Global pricing pressures and cost containment initiatives.

- Biosimilar proliferation could threaten exclusivity.

- Potential adverse events or regulatory tightenings.

Key Takeaways

- Rapid Growth: DUPIXENT's revenues have grown from <$1 million in 2017 to over $5.5 billion in 2022, driven by broadening indications and global expansion.

- Indication Expansion: Continues to be the primary growth driver, especially with pending approvals for conditions like eosinophilic esophagitis.

- Market Dominance: Maintains a leading position in the biologic market for type 2 inflammatory diseases due to its dual IL-4/IL-13 mechanism.

- Pipeline & Global Opportunities: Critical to sustain long-term growth; strategic expansion into emerging markets and additional indications are key.

- Competitive Landscape & Risks: Biosimilar competition, pricing pressures, and regulatory shifts pose ongoing threats but are mitigated by clinical differentiation.

FAQs

Q1: What are the primary factors contributing to DUPIXENT’s revenue growth?

A1: The main factors include expanding indications (e.g., pediatric eczema, CRSwNP), global market penetration, increased patient access through favorable reimbursement policies, and ongoing pipeline development for new conditions.

Q2: How does DUPIXENT compare to its main competitors?

A2: DUPIXENT dominates many markets due to its targeted dual mechanism (IL-4 and IL-13 inhibition) and broad label coverage. It currently holds a significant market share (~60-70%) in multiple indications, outperforming competitors like Nucala and Xolair in certain segments.

Q3: What impact do biosimilars have on DUPIXENT’s future financial outlook?

A3: Biosimilars could introduce price competition, especially in mature markets. However, ongoing patent protections and differentiation strategies mitigate some risks. Lifecycle management and new indications also buffer revenue decline.

Q4: What are the key upcoming regulatory milestones for DUPIXENT?

A4: The most notable is the potential approval for eosinophilic esophagitis in 2023, which could unlock a new patient segment. Post-approval commercialization strategies will influence future sales.

Q5: How might global healthcare policy changes affect DUPIXENT’s market?

A5: Variations in reimbursement policies, cost-containment measures, and approval pathways across regions will affect accessibility and adoption rates, especially in emerging markets.

References

[1] Sanofi Regeneron Pharmaceuticals. DUPIXENT Product Label. 2023.

[2] IQVIA. The Global Use of Medicine in 2022.

[3] EvaluatePharma. Prescription Market Insights, 2023.

[4] FDA & EMA Regulatory Announcements, 2017-2023.

[5] Analysts' Revenue Forecasts, 2023-2027 (Raymond James, JP Morgan, Citigroup).

This comprehensive analysis aims to inform healthcare investors, pharma strategists, and clinicians on DUPIXENT’s evolving market landscape and its financial prospects.