Last updated: November 7, 2025

Introduction

Cosentyx (secukinumab), developed by Novartis, is a pioneering biologic therapy targeting interleukin-17A (IL-17A). Since its FDA approval in 2015, Cosentyx has established itself as a leading treatment for plaque psoriasis, psoriatic arthritis, ankylosing spondylitis, and later, other inflammatory conditions. Its market trajectory is shaped by an evolving competitive landscape, innovative pipeline developments, and shifting healthcare dynamics. This analysis delineates the current market forces, future growth drivers, and financial outlook for Cosentyx.

Market Overview

The global biologics market has experienced exponential growth driven by increasing prevalence of autoimmune diseases and advancements in targeted therapies. In 2022, the biologic market was valued at approximately USD 280 billion and is projected to grow at a compound annual growth rate (CAGR) of around 8-10% over the next five years [1]. Cosentyx comprises a significant share within this segment, particularly in dermatology and rheumatology.

Cosentyx’s approved indications represent a substantial segment of biologic treatments, with psoriasis alone affecting over 125 million people worldwide, and psoriatic arthritis and ankylosing spondylitis affecting an additional 60 million [2]. These extensive patient bases underpin the drug’s strong commercial foundation.

Market Dynamics

Competitive Landscape

Cosentyx faces competition from other IL-17 inhibitors, notably Eli Lilly's Taltz (ixekizumab) and Johnson & Johnson’s Stelara (ustekinumab), alongside biosimilars entering the pipeline. While biologic patent cliffs are less imminent for Cosentyx, biosimilar competition for earlier IL-17 therapies remains a threat, pressuring pricing strategies [3].

Additionally, emerging therapies targeting different pathways, such as JAK inhibitors (e.g., Olumiant, Xeljanz) and anti-IL-23 agents (e.g., Skyrizi, Tremfya), are expanding treatment options and influencing market share allocation.

Regulatory and Clinical Development Trends

Recent clinical advancements are broadening Cosentyx’s label, with approvals for axial spondyloarthritis, non-radiographic axial spondyloarthritis, and further indications. The global approval by regulatory agencies, including EMA and FDA, coupled with real-world evidence demonstrating efficacy and safety, reinforces the drug’s market presence [4].

Additionally, personalized medicine approaches and biomarkers are increasingly informing treatment selection, optimizing Cosentyx’s placement within tailored therapeutic regimens.

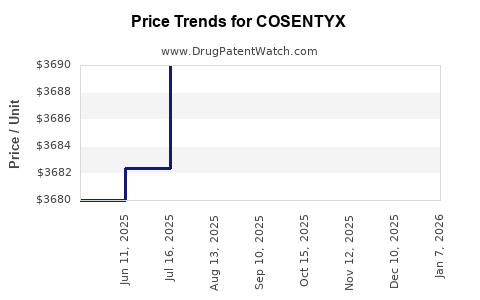

Pricing and Reimbursement Environment

Pricing strategies for biologics like Cosentyx are critical. Novartis maintains premium pricing due to clinical advantages and brand recognition, but reimbursement pressures and healthcare cost-containment measures are persistent challenges globally. Negotiations with payers often influence formulary placements, affecting overall revenue.

In the US, co-pay assistance programs and value-based agreements aim to sustain market access amid these pressures [5].

Geographic Adoption and Market Penetration

Developed regions such as North America and Europe account for most of Cosentyx’s revenues, owing to higher diagnosis rates and healthcare infrastructure. However, emerging markets (e.g., China, India) offer growth opportunities, driven by increasing disease awareness, expanding healthcare access, and government initiatives.

Novartis’s investments in local manufacturing and partnerships facilitate market penetration in these regions, critical for future growth.

Financial Trajectory and Revenue Projections

Historical Performance

Since launch, Cosentyx has demonstrated robust revenue growth, boasting a compound annual growth rate (CAGR) of approximately 20% between 2015 and 2022. In 2022, sales exceeded USD 4 billion globally, consolidating its position as one of Novartis’s top-selling drugs [6].

Future Revenue Drivers

Several factors underpin future financial success:

-

Pipeline Expansion: Encouraging results from ongoing Phase III studies for additional indications such as Crohn’s disease and axial conditions can expand the drug’s market. Entry into new indications can generate incremental revenue streams.

-

Market Penetration: Increasing adoption in emerging markets and continued growth in established regions bolster sales growth.

-

Pricing Strategies: Maintaining premium pricing while negotiating favorable reimbursement terms sustains revenue margins.

-

Competitive Positioning: Differentiating Cosentyx through clinical efficacy, safety, and convenience can preserve market share amid competitive pressures.

Financial Projections

Analyst consensus anticipates Cosentyx’s revenue reaching approximately USD 5.5–6 billion by 2025, assuming steady growth in existing markets and successful expansion into new indications. Margins are expected to remain resilient, supported by scalable manufacturing and economies of scale.

However, price erosion due to biosimilar entries and market competition in key regions could temper growth. Contingent on pipeline success and regulatory approvals, revenues may surpass projections with additional indications, notably in Crohn’s disease and hidradenitis suppurativa.

Key Market Trends Impacting Financial Outlook

-

Emerging Biosimilars: Although patent protections delay biosimilars’ entry compared to other biologics, the eventual market entry could impact pricing and revenue, emphasizing the need for innovative differentiation.

-

Shift Toward Personalized Therapy: Advances in biomarker-guided treatment may refine patient selection, improving outcomes and possibly enabling premium pricing.

-

Digital and Real-World Data Utilization: Integrating digital health tools enhances drug adherence and monitoring, indirectly supporting revenue stability.

-

Global Healthcare Reforms: Policies promoting biosimilar adoption and value-based care will influence pricing power and market access strategies.

Conclusion

Cosentyx’s market dynamics are characterized by strong scientific foundations, expanding indications, and strategic geographic deployment. While competition and biosimilar threats present challenges, innovative pipeline developments and increasing global adoption forecast a positive financial trajectory. Responsible pricing strategies and continued clinical excellence will be vital to sustain market share and revenue growth.

Key Takeaways

-

Dominant Player in IL-17 Inhibitor Segment: Cosentyx maintains leading market share, driven by proven efficacy and expanding indications.

-

Growth Opportunities in Emerging Markets: Investment in regional access and partnerships will unlock new patient populations.

-

Pipeline and Label Expansion are Critical: Success in clinical trials for additional indications could significantly boost revenues.

-

Competitive and Regulatory Challenges: Biosimilars and pricing pressures require strategic response to safeguard profitability.

-

Resilient Financial Outlook: Projected revenue increases, supported by market expansion and innovation, position Cosentyx for sustained growth through 2025.

FAQs

-

What are the main clinical indications for Cosentyx?

Cosentyx is approved for plaque psoriasis, psoriatic arthritis, ankylosing spondylitis, and non-radiographic axial spondyloarthritis, with ongoing trials for additional indications like Crohn’s disease and hidradenitis suppurativa.

-

How does Cosentyx compare to competitors?

Cosentyx offers high efficacy and a favorable safety profile, competing closely with Lilly’s Taltz and J&J’s Stelara. Its differentiated mechanism targeting IL-17A provides unique positioning in inflammatory disease management.

-

What are the potential risks to Cosentyx’s market growth?

Key risks include biosimilar entry, pricing pressures, evolving treatment paradigms favoring oral therapies, and regulatory delays on expanding indications.

-

How significant is the emerging markets segment for Cosentyx?

Emerging markets are pivotal growth drivers due to expanding healthcare infrastructure, rising prevalence, and strategic investments by Novartis to increase accessibility.

-

What is the expected timeline for pipeline approvals impacting Cosentyx’s future?

Positive data from ongoing Phase III studies suggest potential new approvals over the next 2-3 years, which could substantially enhance revenue streams.

Sources:

[1] MarketsandMarkets. "Biologics Market by Therapy Area," 2022.

[2] World Psoriasis Atlas, 2022.

[3] IQVIA Biologics Data, 2022.

[4] U.S. Food and Drug Administration (FDA), Approvals Database.

[5] Novartis Annual Reports, 2022.

[6] Novartis Financial Reports, 2022.