Last updated: September 26, 2025

Introduction

AFREZZA, a novel inhaled insulin product developed by MannKind Corporation, occupies a unique niche in diabetes management. Unlike traditional injectable insulins, AFREZZA offers an inhalation-based delivery system aimed at improving patient adherence and quality of life. As a biologic, it represents a significant segment within the pharmaceutical industry, with complex market dynamics shaped by regulatory, technological, and competitive factors. This analysis explores AFREZZA’s market landscape, financial trajectory, and strategic outlook within the broader diabetes therapeutics ecosystem.

Market Overview: The Diabetes Therapeutics Landscape

Diabetes mellitus remains a global health crisis, with the International Diabetes Federation estimating 537 million adults affected as of 2021, projected to reach 700 million by 2045 [1]. The management of diabetes, particularly Type 1 and insulin-dependent Type 2, hinges heavily on insulin therapy, which constitutes a multi-billion-dollar segment.

Historically, the insulin market has been dominated by injectable formulations from multinational giants like Novo Nordisk, Eli Lilly, and Sanofi. Despite their market dominance, patient adherence to injectable insulin regimens remains suboptimal due to discomfort and logistical challenges. This unmet need fuels interest in alternative delivery systems such as AFREZZA, positioned as a patient-centric innovation.

Market Dynamics Affecting AFREZZA

1. Regulatory Environment and Approval Pathways

AFREZZA’s market potential hinges on its regulatory journey. Initially approved by the U.S. Food and Drug Administration (FDA) in 2014, the product faced challenges including a black-box warning related to pulmonary safety concerns and inconsistent efficacy data [2]. Approval hurdles, coupled with post-marketing restrictions, constrained its commercial expansion.

The FDA’s cautious stance, emphasizing pulmonary safety, has led MannKind to concentrate on patient selection criteria and risk mitigation strategies. Future regulatory decisions, particularly mid- and long-term safety data, will crucially influence AFREZZA’s acceptance and reimbursement landscape.

2. Competitive Landscape and Market Entry Barriers

Alternatives to AFREZZA include traditional subcutaneous insulins and emerging non-invasive delivery technologies such as nanotechnology-based patches, oral insulins, and inhaled formulations from competitors like Becton Dickinson and Eli Lilly.

Barriers to entry, including technological complexity in inhaled biologics, manufacturing scalability, and regulatory approval costs, serve as inhibitors for new entrants. MannKind’s first-mover advantage, though challenged, provides a critical niche, while ongoing innovations continue to heighten market rivalry.

3. Technological and Scientific Challenges

Inhaled insulin’s inhalation route presents unique biological and engineering hurdles. Achieving consistent absorption, dose accuracy, and pulmonary safety necessitates sophisticated device design and formulation stability. AFREZZA’s proprietary Technosphere technology captures these innovations, yet they also contribute to manufacturing costs and regulatory scrutiny.

Furthermore, disparities in efficacy and safety across diverse populations influence prescriber confidence and patient uptake—factors that significantly affect market penetration.

4. Payer and Reimbursement Dynamics

Accurate reimbursement is essential for AFREZZA’s commercial viability. Insurance companies and health systems evaluate the cost-effectiveness, safety profile, and patient adherence benefits. The black-box warning and mixed clinical data have hindered widespread reimbursement, confining AFREZZA primarily to niche segments.

Recent negotiations with payers, alongside economic evaluations emphasizing improved adherence and reduced hypoglycemic events, are expected to alter reimbursement landscapes over time [3].

Financial Trajectory of AFREZZA

1. Revenue and Market Penetration

Since its launch, AFREZZA has experienced modest sales, peaking at approximately $20-30 million annually in the United States prior to 2020 [4]. The constrained growth stems from regulatory hurdles, safety concerns, and limited physician adoption.

MannKind’s strategic focus on specific patient subgroups—such as those intolerant to injections—aims to carve out niche markets. Nevertheless, the overall market share remains limited relative to dominant injectable insulins.

2. Cost Structure and Profitability

The high manufacturing costs associated with Technosphere technology, coupled with modest sales volume, have impeded profitability for MannKind. The company reported operating losses year-on-year, reflecting substantial R&D expenditure in advancing inhaled insulin technology and navigating regulatory pathways.

Strategic partnerships and licensing deals could augment revenue streams, as observed with collaborations targeting emerging markets and specialty settings.

3. Future Revenue Streams and Growth Opportunities

Projected growth hinges on several pivotal factors:

- Regulatory approvals: Expanding indications or label updates confirming long-term safety could catalyze broader adoption.

- Market acceptance: Demonstrating superior adherence benefits and cost-effectiveness compared to injectable insulins can drive prescriber preference.

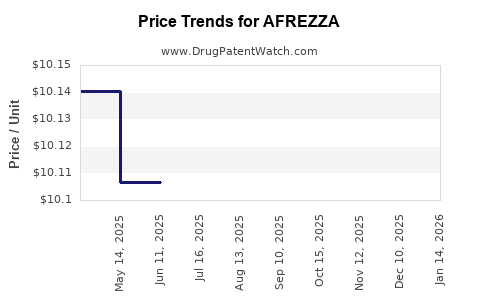

- Pricing strategies: Competitive pricing aligned with economic evaluations could enhance market penetration, especially in value-conscious healthcare systems.

- Expansion into global markets: Emerging economies, with increasing diabetes prevalence, represent lucrative territories, contingent on regulatory approvals and manufacturing scalability.

Financial forecasts suggest that, absent significant breakthroughs, AFREZZA’s revenues may remain in the low hundreds of millions annually, with margins improving only upon broader acceptance and operational efficiencies.

Strategic Outlook and Industry Trends

Innovations in biologic drug delivery are poised to reshape the diabetes treatment landscape. AFREZZA’s inhalation platform aligns with trends favoring patient-centric, needle-free therapies. Nonetheless, safety concerns, market hesitance, and competition from oral and implantable devices temper optimistic projections.

Investment in rigorous safety studies, strategic key opinion leader (KOL) engagement, and cost demarcation will be fundamental. Additionally, leveraging digital health integrations to monitor inhaler usage may bolster both safety and adherence metrics.

Key Takeaways

- Regulatory and safety concerns remain central hurdles affecting AFREZZA’s market acceptance. Future long-term safety data will be pivotal.

- Market penetration is limited by reimbursement barriers, physician familiarity, and competition; a niche strategy targeting specific patient segments offers growth potential.

- Financial trajectory suggests modest but stable revenues, with significant upside contingent on regulatory approvals, safety validation, and innovative market positioning.

- Technological complexity influences costs and scalability; ongoing innovations could reduce manufacturing expenses and enhance efficacy.

- Industry shift toward patient-centric delivery signifies an opportunity for AFREZZA if safety and efficacy profiles are convincingly established.

FAQs

Q1: What are the main safety concerns associated with AFREZZA?

A1: The primary safety issue is pulmonary safety, including concerns about lung function decline and respiratory adverse effects, which led the FDA to impose black-box warnings and restrict usage to certain patient populations.

Q2: How does AFREZZA compare cost-wise to injectable insulins?

A2: Currently, AFREZZA’s cost is comparable or higher than traditional insulins due to specialized manufacturing and device costs. Cost-effectiveness hinges on improved adherence, reduced hypoglycemia, and patient preference.

Q3: What strategies could help improve AFREZZA’s market adoption?

A3: Enhanced safety data, broader payer coverage, targeted marketing to needle-phobic patients, and evidence of improved adherence could drive adoption.

Q4: Are there global market opportunities for AFREZZA?

A4: Yes, especially in emerging markets with rising diabetes prevalence. Success depends on regulatory approvals, manufacturing scalability, and cost considerations.

Q5: What emerging technologies could challenge AFREZZA’s position?

A5: Novel oral insulins, implantable devices, and non-invasive transdermal patches are potential competitors that may offer similar or superior convenience and safety profiles in the future.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition, 2019.

[2] U.S. Food and Drug Administration. AFREZZA Prescribing Information, 2014.

[3] MannKind Corporation. Annual Reports and Investor Presentations, 2021-2022.

[4] IQVIA. Pharmaceutical Sales Data, 2022.

This comprehensive review underscores the intricate interplay of regulatory, technological, and market factors shaping AFREZZA’s future. While its innovative delivery model offers promising avenues, overcoming safety concerns, reimbursement hurdles, and fierce competition remains essential for sustainable growth.