Last updated: July 30, 2025

Introduction

Springworks is a notable player in the biotech and pharmaceutical sector, primarily focusing on innovative treatments for dermatology, oncology, and neurological disorders. As the pharmaceutical industry becomes increasingly competitive with rapid technological advances and evolving regulatory landscapes, understanding Springworks’ market position, core strengths, and strategic trajectory is vital for stakeholders, investors, and potential partners. This analysis provides a comprehensive evaluation of Springworks' competitive stance, outlined strengths, challenges, and strategic opportunities to inform decision-making and future growth initiatives.

Market Position of Springworks

Springworks operates within a dynamic pharmaceutical landscape characterized by high R&D investments, rigorous regulatory hurdles, and a competitive array of emerging and established firms. Positioned as a biotech innovator, Springworks emphasizes targeted therapies for complex indications, leveraging cutting-edge science such as precision medicine and biologics.

Core Focus Areas and Portfolio

Springworks’ pipeline predominantly encompasses candidates for neurodegenerative diseases, immune disorders, and oncology. Notably, the company has prioritized developing treatments targeting conditions like plaque psoriasis, atopic dermatitis, advanced melanoma, and neurodegenerative syndromes. Their strategic emphasis on niche, high unmet need markets has allowed them to carve out a competitive niche amid larger pharmaceutical conglomerates.

Market Share and Revenue Trajectory

While Springworks remains a privately held entity, its strategic collaborations and clinical pipeline milestones position it as a rising player. The company's recent funding rounds, totaling approximately $500 million (per public disclosures), underscore heightened investor confidence. The trajectory demonstrates a focus on advancing clinical trials and expanding market access, setting the stage for eventual commercialization and revenue generation.

Competitive Positioning relative to Peers

Compared to larger pharmaceutical titans like AbbVie, Pfizer, and Novartis, Springworks maintains agility and innovation-driven growth. Its focus on rare and orphan diseases aligns with current industry trends favoring high-value, specialized therapies with favorable profit margins and faster regulatory pathways. Moreover, alliances with academic institutions and biotech firms reinforce its innovative edge.

Strengths of Springworks

1. Focused Therapeutic Specialization

Springworks’ concentration on underserved therapeutic areas confers a strategic advantage, allowing for tailored R&D efforts, intellectual property development, and deeper market penetration. This specialization fosters expertise and reputation in niche domains such as dermatology and neuro-oncology.

2. Robust R&D Infrastructure and Pipeline

The company’s investment in cutting-edge research facilities and collaborations with leading research institutions accelerates drug discovery and development. Their pipeline benefits from early-stage candidates progressing through clinical trials, indicating a robust innovation pipeline.

3. Strategic Partnerships and Collaborations

Springworks has established partnerships with biotech firms, research universities, and contract manufacturing organizations (CMOs). These alliances enhance resource availability, reduce operational costs, and facilitate access to novel technologies and markets.

4. Capital Rigor

Recent funding rounds and steady investor backing provide a strong financial foundation. This capital enables the company to accelerate clinical programs, expand R&D activities, and invest in market access strategies.

5. Regulatory Strategy

Springworks’ focus on rare diseases allows for expedited regulatory pathways such as Orphan Drug Designation and Fast Track status, reducing time-to-market. Their experience navigating regulatory landscapes is vital for efficient progression from clinical trials to approval.

Strategic Challenges and Risks

1. Pipeline Development Uncertainties

Exclusively focusing on clinical candidates entails substantial risks, including clinical trial failures, regulatory setbacks, and unforeseen safety issues. The company's success hinges on the timely progression and positive outcomes of its pipeline.

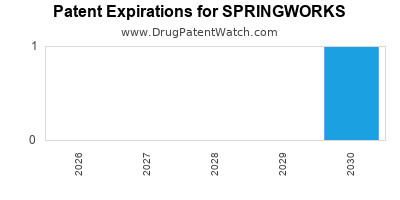

2. Competitive Landscape and Patent Challenges

Emerging and established competitors vie for the same patient populations, increasing the risk of market share dilution. Intellectual property battles over biologics and novel compounds could pose substantial hurdles.

3. Market Access and Commercialization

Transitioning from clinical-stage to market-stage involves complex commercialization strategies, reimbursement negotiations, and patient access programs—areas where smaller firms often face resource constraints.

4. Regulatory and Political Risks

Evolving regulatory policies, especially concerning biologics and personalized medicine, may introduce delays or additional compliance requirements. Political and policy shifts towards drug pricing reforms also pose financial risks.

5. Limited Scalability and Market Penetration

As a growing biotech entity, scaling manufacturing and establishing a foothold in global markets may challenge Springworks given its size and resources. Competition for market access agreements with larger firms can limit their commercial reach.

Strategic Insights and Recommendations

1. Emphasize Pipeline Diversification

While specialization offers advantages, diversifying into complementary indications could distribute risk and expand market opportunities. Investing in adjacent therapeutic areas may buffer potential setbacks in core segments.

2. Strengthen Strategic Alliances

Further partnerships with global pharmaceutical companies can accelerate development, provide co-marketing opportunities, and enhance distribution channels, especially in international markets.

3. Leverage Regulatory Advantages

Continued pursuit of expedited approval pathways such as Breakthrough Therapy Designation can hasten market entry. Proactive engagement with regulatory agencies will streamline approval processes.

4. Enhance Market Access and Reimbursement Strategies

Developing comprehensive patient access and reimbursement strategies early in the pipeline can mitigate commercialization risks and ensure smoother market penetration post-approval.

5. Invest in Manufacturing Capabilities

Building or partnering with manufacturing entities ensures quality control, cost efficiency, and scalability, positioning Springworks favorably for commercialization.

6. Focus on Intellectual Property Strength

Aggressive patent filing and defending existing patents are essential to safeguard innovations from competitors and retain market exclusivity.

Conclusion

Springworks stands out as a dynamic and specialized biotech firm poised for growth within high-value niches. Its robust pipeline, strategic collaborations, and focus on expedited regulatory pathways provide a strong foundation. However, it must navigate inherent risks associated with pipeline development, market access, and competition. A strategic focus on diversification, partnership expansion, and operational scalability can strengthen its market position and unlock future value.

Key Takeaways

- Springworks’ targeted focus on high unmet need markets positions it as an innovative biotech player with significant growth potential.

- The company’s strong pipeline, fueled by strategic collaborations and capital backing, underscores its readiness for future commercialization.

- Challenges such as pipeline risks, competitive pressures, and market access complexities require proactive strategic planning.

- Expedited regulatory pathways and intellectual property protection are pivotal to securing a competitive edge.

- Diversification and enhanced manufacturing and partnership strategies will be critical to scaling and sustainable growth.

FAQs

1. What are Springworks’ primary therapeutic focus areas?

Springworks specializes in dermatology, oncology, and neurodegenerative diseases, aiming to develop targeted therapies for high unmet need indications such as psoriasis, melanoma, and neurological syndromes.

2. How does Springworks differentiate itself from larger pharma companies?

Its agility, focus on niche high-value markets, innovation-driven pipeline, and pursuit of expedited regulatory pathways enable it to operate with a nimble approach, contrasting with the broader scope of larger firms.

3. What risks does Springworks face in its growth trajectory?

Potential risks include clinical trial failures, regulatory delays, intellectual property disputes, market access challenges, and competition from both biotech and large pharmaceutical companies.

4. How important are collaborations and partnerships for Springworks?

Critical. They provide access to new technologies, research expertise, manufacturing capabilities, and market channels, accelerating development and expansion strategies.

5. What strategic moves should Springworks prioritize to enhance its competitive advantage?

Focusing on pipeline diversification, strengthening international partnerships, advancing manufacturing capacity, leveraging regulatory pathways, and protecting IP rights are essential strategic priorities.

Sources:

[1] Company disclosures and investor presentation materials.

[2] Industry reports on biotech and pharmaceutical market trends.

[3] Publicly available funding data and partnership announcements.