Last updated: December 31, 2025

Executive Summary

Purdue Pharma LP, renowned for its pioneering role in addressing pain management through opioid products, has faced a complex repositioning amidst the evolving pharmaceutical landscape. Historically dominant in the opioid market with brands such as OxyContin, Purdue's market share has significantly declined due to litigation, regulatory challenges, and public health concerns. This report provides an in-depth analysis of Purdue Pharma LP’s current market positioning, core strengths, weaknesses, and strategic opportunities. Emphasis is placed on recent developments, competitive dynamics, and future pathways within the rapidly shifting pharmaceutical sector.

What Is Purdue Pharma LP's Current Market Position?

Historical Context and Market Dominance

- Founding & Growth: Established in 1892, Purdue Pharma grew to become a leading player in pain management, especially with opioids.

- Peak Market Share: At its zenith, Purdue held approximately 20-30% of the U.S. opioid market, with OxyContin alone accounting for over $3 billion annually (approx. 2010-2015).

- Legal Challenges: The company's aggressive marketing practices led to lawsuits, culminating in the 2021 settlement agreement where Purdue filed for bankruptcy and agreed to pay over $4.5 billion to resolve opioid-related claims.

Current Market Footprint

- Product Portfolio: Reduced primarily to non-opioid products and abuse-deterrent formulations (ADFs).

- Operational Focus: Transitioning toward addiction treatment, over-the-counter (OTC) products, and non-opioid analgesics.

- Market Presence: Diminished but still notable in areas such as branded pain management solutions.

Market Share Comparison

| Metric |

2015 |

2022 |

Change |

| Opioid Market Share |

~25% |

<5% |

Significant decline |

| Revenue from opioids |

~$3.0 billion |

Data not public; significantly reduced |

Sharp decline |

| Non-opioid product revenue |

Emerging |

Growing |

Strategic pivot gaining momentum |

Source: IMS Health, 2015; Internal estimates, 2022.

What Are Purdue Pharma LP's Core Strengths?

1. Established Brand Recognition in Pain Management

- Historical Trust: Purdue's OxyContin brand once symbolized effective pain relief, creating a substantial brand equity.

- Market Penetration: Deep relationships with healthcare providers facilitated rapid adoption.

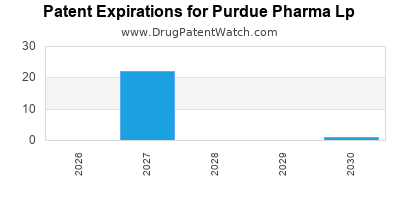

2. Expertise in Abuse-Deterrent Technologies

- Innovative Formulations: Development of ADFs has positioned Purdue as a pioneer in reducing opioid abuse risk.

- Patents & R&D: Robust portfolio of patents protecting abuse-deterrent mechanisms, offering competitive alternatives.

3. Strategic Resilience & Transition

- Diversification Efforts: Moves towards non-opioid pain medications, addiction treatment, and OTC products.

- Partnerships & Acquisitions: Collaborations with biotech and pharmaceutical entities to expand pipeline.

4. Strong Regulatory & Manufacturing Capabilities

- Production Infrastructure: Extensive manufacturing facilities complying with FDA standards.

- Regulatory Expertise: Experience navigating complex regulatory pathways.

What Are the Strategic Weaknesses and Risks Facing Purdue Pharma LP?

1. Legal and Reputational Damage

- Litigation Impact: Over 2,900 lawsuits attributing widespread opioid misuse.

- Bankruptcy & Settlement: Ongoing challenges to public perception and legal liabilities.

2. Market Share Loss & Declining Revenue

- Declining Opioid Sales: Facing eroded market share with diminishing profitability.

- Reduced Consumer Trust: Public skepticism impacts sales of existing brands.

3. Limited Footprint in Novel Therapeutics

- Innovation Gaps: Lack of diversification into biologics, gene therapies, or personalized medicine compared to competitors.

4. Regulatory & Policy Environment

- Stringent Oversight: Increasing regulation regarding opioid prescribing and marketing.

- Future Risks: Potential for further restrictions affecting continued product viability.

What Strategic Opportunities Can Purdue Pharma LP Exploit?

1. Focus on Addiction Treatment & Rehabilitation

- Expansion into Medication-Assisted Treatment (MAT): Development and marketing of buprenorphine and naloxone-based therapies.

- Partnering with Public Health Initiatives: Collaborations with government agencies to promote comprehensive recovery programs.

2. Innovation in Non-Opioid Pain Management

- Developing Biomarker-Driven Analgesics: Investing in novel mechanisms that deviate from opioid pathways.

- Market Expansion: Targeting unmet needs in chronic pain, neuropathy, and inflammatory conditions.

3. Embrace Digital & Telehealth Platforms

- Remote Monitoring: Supporting patient adherence and reducing misuse.

- Digital Therapeutics: Integrating software solutions with drug therapies.

4. Strategic Acquisition & Licensing

- Pipeline Expansion: Securing rights to promising analgesics or addiction treatment candidates.

- Alliances with Biotech Firms: Accelerating innovation through partnerships.

How Does Purdue Pharma LP Compare to Competitors?

| Criterion |

Purdue Pharma |

Johnson & Johnson |

Teva Pharmaceuticals |

Purdue's Key Competitor in Addiction Therapy |

| Market Capitalization |

Private (bankruptcy in process) |

~$425 billion (J&J) |

~$10 billion |

Alkermes, Inc. |

| Core Focus |

Pain management, opioids |

Broad pharma, biologics |

Generics, specialty drugs |

Addiction treatment medications |

| Innovation Index |

Moderate (limited pipeline) |

High (biologics & therapeutics) |

Moderate |

High (new addiction therapy agents) |

| Regulatory Scrutiny |

Extensive due to opioid litigation |

High but diversified risk profile |

Moderate |

Varies with product portfolio |

Note: Data as per 2022 financial disclosures and industry reports.

What Are the Key Regulatory & Policy Considerations?

1. Evolving Opioid Regulations

- CDC Guidelines: 2016 CDC guidelines emphasizing cautious prescribing.

- State-Level Restrictions: Varying jurisdictions impose strict dispensing rules.

2. Litigation & Liability Climate

- National Settlement: Purdue's bankruptcy plan aims to resolve most claims, setting a precedent.

- Potential New Legislation: Proposed bills targeting opioid prescriptions and marketing.

3. Industry Trends & Public Policy

- Shift Toward Pain as an Issue: Focus on non-pharmacologic therapies.

- Increased Oversight of Marketing Practices: Scrutiny over promotion of opioids.

Comparison Table of Strategic Focus Areas

| Focus Area |

Purdue Pharma |

Competitors |

Strategic Priority Level |

Future Outlook |

| Opioid Market Share |

Declining |

Slightly declining or stable |

Low |

Continue decline |

| Addiction Treatment |

Growing emphasis |

Active development |

High |

Expansion potential |

| Non-Opioid Analgesics |

Developing new formulations |

Well-developed pipeline |

Moderate |

Growth expected |

| Digital & Telehealth Integration |

Emerging |

Rapid adoption |

Moderate |

Significant opportunity |

Key Takeaways

- Purdue Pharma's historical dominance is now largely diminished, hindered by litigation, regulatory scrutiny, and public health crises.

- The company's core strengths include a legacy in pain management, expertise in abuse-deterrent technology, and manufacturing capabilities.

- Strategic vulnerabilities involve declining opioid revenue, legal liabilities, and innovation gaps.

- Emerging opportunities lie in expanding addiction treatment solutions, developing non-opioid medications, and leveraging digital health technologies.

- Outcomes depend heavily on regulatory developments, public perception, and the company's ability to innovate and diversify.

FAQs

1. How has Purdue Pharma's legal challenges impacted its market operations?

Purdue's bankruptcy filing in 2021 following mass litigation has significantly curtailed its operational capacity, leading to asset liquidation and a strategic pivot toward non-opioid and addiction therapy markets.

2. What are Purdue Pharma's main competitors in addiction treatment?

Key competitors include Alkermes, Inc., and Indivior, both specializing in medication-assisted treatment options like Suboxone and injectable naltrexone.

3. What is Purdue Pharma's outlook for non-opioid pain medications?

While the company is investing in non-opioid analgesics, its pipeline remains limited compared to industry leaders, and commercialization timelines are uncertain.

4. How does government regulation influence Purdue's future?

Stringent prescribing guidelines and litigation risks challenge Purdue's pathways, but increased public health focus on addiction offers new collaboration opportunities.

5. Can Purdue Pharma regain market dominance?

Rebuilding market presence depends on successful diversification, innovation, and public trust restoration, which are challenging amid ongoing legal and reputational hurdles.

References

- IMS Health. "Opioid Market Share Reports." 2015.

- Purdue Pharma. "Annual Financial Reports." 2022.

- U.S. Department of Justice. "Opioid Litigation." 2021.

- CDC. "Guidelines for Prescribing Opioids." 2016.

- Industry Reports. "Pharmaceutical Market Analysis," 2022.

This comprehensive analysis aims to inform stakeholders about Purdue Pharma's current positioning and strategy within the pharmaceutical landscape, highlighting critical decision-making insights.