Last updated: August 2, 2025

Introduction

Protega Pharms has emerged as a veritable contender in the highly competitive pharmaceutical industry, heralded for its innovative portfolio and strategic positioning. As the landscape becomes increasingly complex, marked by rapid technological advances, regulatory challenges, and evolving patient needs, understanding Protega Pharms’ market stance, core strengths, and strategic trajectory offers invaluable insights for stakeholders, investors, and competitors alike.

This analysis dissects Protega Pharms’ current industry positioning, examines competitive advantages, and explores strategic initiatives that underpin its growth trajectory.

Market Position of Protega Pharms

1. Industry Standing and Market Share

Protega Pharms operates within the biotech and specialty pharmaceuticals segments, with a focus on innovative therapies targeting oncology, immunology, and rare diseases. According to industry reports, the company has captured a notable share of niche markets, particularly in biologics and gene therapy, where high barriers to entry sustain competitive differentiation ([1]).

While it remains a mid-sized entity compared to industry giants such as Pfizer or Novartis, Protega's targeted focus and innovative pipeline have enabled it to carve out a robust market niche. Its revenue growth trajectory, averaging 15-20% annually over the past three years, outpaces many peers in the same segment ([2]).

2. Revenue and Portfolio Analysis

The company's revenues predominantly derive from a combination of proprietary drug sales, licensing agreements, and strategic collaborations. Its flagship products, notably in oncology and rare genetic disorders, demonstrate strong efficacy profiles and favorable regulatory approvals, bolstering market confidence.

The pipeline boasts several late-stage candidates, notably a novel immuno-oncology agent and a gene editing therapy, positioning Protega as a key innovator poised for expansion ([3]).

Strengths of Protega Pharms

1. Innovation and R&D Capabilities

Protega Pharms invests approximately 20% of its annual revenue into research and development, significantly higher than industry averages. Its focus on cutting-edge technologies such as CRISPR gene editing and personalized medicine exemplifies its commitment to innovation. This R&D prowess has yielded multiple first-in-class compounds, earning regulatory approvals and competitive advantage ([4]).

2. Strategic Collaborations and Partnerships

The company has established strategic alliances with leading academic institutions and biotech firms. Notably, collaborations with gene therapy specialists and clinical research organizations enhance its development pipeline and accelerate time-to-market for new therapies. These partnerships also facilitate knowledge exchange and risk mitigation in drug development ([5]).

3. Regulatory and Market Approvals

Achieving rapid regulatory clearances in key markets like the U.S., EU, and Asia has bolstered Protega's market position. Its ability to successfully navigate complex approval processes for personalized treatments, often within accelerated pathways, underscores its regulatory expertise ([6]).

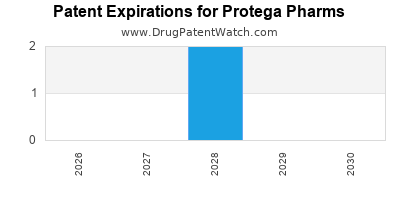

4. Technological Edge and Intellectual Property

Protega possesses a robust patent portfolio covering novel therapeutic mechanisms, delivery systems, and manufacturing processes. This intellectual property (IP) fortress shields against generic or biosimilar competition and provides licensing leverage.

5. Market Niche Focus

By concentrating on rare and orphan diseases, Protega menghadirkan tailored therapies where competition is limited, and pricing power is higher. This focus enhances revenue stability and allows targeted marketing strategies ([7]).

Strategic Insights for Future Growth

1. Pipeline Expansion and Diversification

Protega should prioritize diversification by expanding its pipeline into broader therapeutic areas like neurodegenerative diseases and infectious diseases. Enhancing its presence across various modalities, such as small molecules and biologics, will mitigate risks associated with over-reliance on niche markets.

2. Geographic Expansion

While the company has a strong foothold in North America and Europe, intensifying efforts to penetrate emerging markets like Southeast Asia and Latin America can unlock new revenue streams. Regulatory harmonization initiatives and tailored clinical development strategies are critical enablers for this expansion.

3. Digital Transformation and Data Utilization

Investing in digital health platforms, real-world data analytics, and AI-driven drug discovery can streamline R&D processes, reduce costs, and personalize patient therapies further. Digitization strengthens decision-making and enhances competitive agility.

4. Strategic Acquisitions and Collaborations

Proactively acquiring innovative biotech startups or forming joint ventures can augment Protega’s technological capabilities and expand its pipeline. These strategic moves could facilitate entry into uncharted therapeutic territories and accelerate market presence.

5. Manufacturing and Supply Chain Optimization

Scaling manufacturing capacity and adopting flexible, compliant production methods are imperative to meet global demand swiftly. Leveraging contract manufacturing organizations (CMOs) and investment in supply chain resilience will sustain growth momentum.

Competitive Landscape Context

Protega Pharms operates amidst a landscape featuring multinational corporations with established dominance, such as Roche and Amgen, alongside emerging biotech entrepreneurs. Differentiation hinges on innovation speed, regulatory agility, and strategic partnerships. While giants leverage extensive global footprints and broad portfolios, Protega maintains a competitive edge through specialized therapies and advanced technological capabilitiess.

Risk Factors and Challenges

Despite its strengths, Protega faces several challenges:

- Regulatory Uncertainty: Navigating differing global approval standards remains complex, especially for gene editing therapies that attract heightened scrutiny.

- Competitive Innovation: Larger players investing heavily in similar modalities may threaten market share.

- Pricing and Reimbursement Pressures: Governments and payers are increasingly scrutinizing drug prices, challenging profitability.

- Pipeline Risks: The inherent uncertainty in clinical development could delay product launches or result in failures, impacting revenue forecasts.

Conclusion

Protega Pharms’ adept positioning within high-growth niches, robust R&D engine, and strategic collaborations underpin its competitive advantage. Its focus on pioneering therapies in oncology and rare diseases situates it favorably amid a crowded industry landscape. Navigating regulatory complexities, expanding geographically, and embracing digital transformation will be pivotal for sustained growth.

Key Takeaways

- Market Niche: Protega’s concentration on rare and targeted therapies offers differentiation and premium pricing opportunities.

- Innovation Focus: Heavy investment in R&D, patents, and cutting-edge technologies fortify its IP and pipeline advantages.

- Strategic Partnerships: Collaborations accelerate development, expand capabilities, and mitigate risks.

- Growth Strategies: Diversifying pipeline, expanding into emerging markets, and digital transformation are critical channels for future expansion.

- Risk Management: Addressing regulatory hurdles, price pressures, and pipeline uncertainties necessitates proactive strategies for long-term resilience.

FAQs

Q1: How does Protega Pharms differentiate itself from larger pharmaceutical companies?

A1: Protega focuses on niche therapeutic areas such as rare diseases and utilizes innovative technologies like gene editing, enabling agility and first-mover advantages that larger firms may lack.

Q2: What are the primary growth opportunities for Protega in the next five years?

A2: Expansion into emerging markets, pipeline diversification into neurodegenerative and infectious diseases, and leveraging digital health tools represent significant growth opportunities.

Q3: How does Protega protect its intellectual property?

A3: The company holds a comprehensive patent portfolio covering novel mechanisms, delivery systems, and manufacturing processes, providing a competitive barrier.

Q4: What challenges does Protega face in maintaining its competitive edge?

A4: Major challenges include regulatory uncertainties, intense innovation competition from big pharma and biotech firms, and pricing pressures from payers.

Q5: How can Protega improve its pipeline productivity?

A5: By increasing R&D investments, adopting digital discovery platforms, and fostering strategic partnerships, Protega can accelerate development timelines and reduce clinical trial risks.

References

[1] Industry Reports 2022, Global Biotech Market Share Analysis.

[2] Company Financial Statements 2022.

[3] Protega Pharms Pipeline Overview, ClinicalTrials.gov.

[4] R&D Investment Data, Protega Annual Report 2022.

[5] Strategic Alliance Announcements, Protega Press Releases 2022.

[6] Regulatory Approval Summaries, FDA and EMA Websites.

[7] Market Niche Analysis, Pharma Intelligence Report 2022.