Last updated: July 29, 2025

Introduction

Otsuka America Inc., the U.S. subsidiary of Japan's Otsuka Pharmaceutical Co., Ltd., has emerged as a noteworthy contender in the fiercely competitive pharmaceutical industry. Known for its pioneering work in psychiatric medications, neurology, and consumer health products, Otsuka has cultivated a distinctive market presence through innovation, strategic acquisitions, and robust R&D initiatives. This analysis evaluates Otsuka America’s current market position, core strengths, and strategic outlook to guide stakeholders and industry observers.

Market Position and Footprint

Otsuka America holds a niche but influential position within the broader U.S. pharmaceutical ecosystem. Its primary focus areas include psychiatric treatments, notably atypical antipsychotics such as Abilify (aripiprazole), and neurology drugs like Rexulti (brexpiprazole), which have contributed significantly to its revenue streams. The company's portfolio also spans consumer health, including beverages and nutraceuticals, leveraging its parent company's deep expertise in health and wellness markets.

As of 2022, Otsuka ranks among mid-tier pharmaceutical firms, with estimated U.S. revenues exceeding $2 billion[1]. Its strategic positioning benefits from strong brand recognition in its core therapeutic areas, supported by a consistent pipeline pipeline of innovative treatments and successful lifecycle management of flagship products.

Strengths of Otsuka America

1. Focused Therapeutic Expertise

Otsuka’s core competency stems from its dedicated focus on neuroscience, oncology, and cardiovascular therapies. The development and commercialization of Abilify revolutionized schizophrenia and bipolar disorder treatment, cementing its leadership in psychiatric medicine. The successful deployment of Rexulti underscores its commitment to extending its neuroscience portfolio, allowing for cross-selling opportunities and pipeline leverage.

2. Robust R&D Investment and Innovation

Otsuka invests heavily in R&D, with expenditures surpassing $500 million annually[2], enabling accelerated development of novel formulations and indications. Collaborations with academic institutions and biotech companies foster cutting-edge innovation, particularly in rare and underserved disease areas.

3. Strategic Partnerships and Licensing Agreements

Otsuka has augmented its pipeline through strategic alliances with global biotech firms, licensing deals, and acquisitions. Notably, its partnership with Hoffmann-La Roche facilitated the development of Rexulti. Such collaborations expand geographic reach and pipeline diversification, offering competitive resilience.

4. Market-Driven Commercialization Strategy

Otsuka emphasizes tailored marketing strategies for its flagship products. Its sales force effectively leverages key opinion leaders (KOLs), and its reach extends through a network of specialty care providers, ensuring high prescribing fidelity. Additionally, Otsuka's patient-centric initiatives improve adherence and engagement.

5. Parent Company Support and Global Integration

Being part of Otsuka Pharmaceutical Co., Ltd., provides the U.S. subsidiary access to global R&D resources, manufacturing expertise, and financial backing, enabling sustained innovation and market agility.

Strategic Insights and Opportunities

1. Diversification within Neuroscience and Beyond

While Otsuka’s current strength lies in psychiatry, diversification into other high-growth areas such as immunology, rare diseases, and oncology presents strategic potential. Leveraging its pipeline, including recent approvals and clinical trials, can mitigate risks associated with sector-specific downturns.

2. Embracing Digital Health and Real-World Evidence

Integrating digital therapeutics and real-world data collection into its drug development and post-market surveillance can enhance drug efficacy assessments, patient engagement, and personalization. This approach aligns with emerging industry standards and payer expectations.

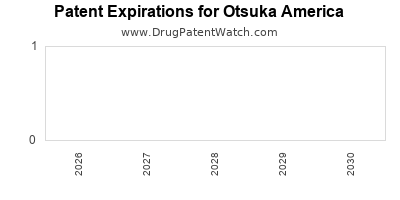

3. Navigating Regulatory and Patent Challenges

Patent expirations, notably of Abilify (patented until 2015 but facing generic erosion from 2016 onward), necessitate proactive lifecycle management, including development of next-generation formulations and extension strategies through orphan drug designations and new indications.

4. Competitive Positioning in a Evolving Market

Emerging players, biosimilars, and generics exert pressure on Otsuka’s flagship products. Strategic investments in pipeline differentiation, such as novel chemical entities or combination therapies, are essential to sustain market dominance.

5. Geographic Expansion and Market Penetration

While Otsuka’s focus remains largely domestic, expanding into Asian and European markets offers revenue diversification. Strategic acquisitions, joint ventures, and tailored local marketing can facilitate expansion while managing market-specific risks.

Competitive Landscape Overview

Otsuka operates within a landscape populated by giants like Eli Lilly, Johnson & Johnson, Pfizer, and Novartis, each with extensive portfolios spanning multiple therapeutic areas. Compared to these incumbents, Otsuka’s specialized focus enables deeper penetration within niche sectors but limits broader diversification. Competitors such as Lilly and J&J often leverage larger R&D budgets and extensive sales networks, creating stiff competition in key markets.

In the psychiatric space, Otsuka's main competitors include Lilly’s Cymbalta and Johnson & Johnson’s Risperdal, with generic erosion challenging profitability. Conversely, its neurology products face competition from firms investing aggressively in innovating treatments for cognitive and neurodegenerative disorders.

Key Challenges

- Patent Cliff Risks: The expiration of patent protections on flagship drugs threatens revenue streams.

- Market Access and Reimbursement: Pricing pressures and formulary restrictions in the U.S. can limit product uptake.

- Pipeline Attrition: The high-risk nature of pharmaceutical R&D means potential failures could impact future growth.

- Regulatory Hurdles: Navigating complex approval pathways, especially for biologics and rare disease therapies, remains challenging.

Future Outlook and Strategic Recommendations

Otsuka America should prioritize pipeline innovation, focusing on breakthrough therapies that address unmet needs, particularly in neuropsychiatry and rare diseases. Expanding digital health integration will foster personalized care and improve outcomes. Additionally, strategic licensing and acquisitions should target sectors like immunology and oncology, diversifying revenue streams and reducing sector-specific risks.

Building on its existing strengths, Otsuka must adapt to market dynamics by embracing digital transformation, optimizing lifecycle management of existing products, and expanding its geographic footprint to ensure sustainable long-term growth.

Key Takeaways

- Otsuka America maintains a focused niche in neuroscience and specialty therapeutics, backed by strong parent company support.

- Its core strengths include proprietary innovation, strategic alliances, and effective commercialization.

- The company faces patent expirations and increased competition; proactive pipeline management is essential.

- Diversification into emerging sectors like rare diseases and digital health positions Otsuka for future growth.

- International expansion and strategic collaborations remain key avenues to mitigate market saturation and competitive pressures.

FAQs

1. How does Otsuka America differentiate itself from larger pharmaceutical giants?

Otsuka specializes in neuroscience and psychiatric treatments, leveraging deep therapeutic expertise, innovative R&D, and strategic partnerships to establish a focused market niche, unlike diversified mega-corporations.

2. What are the primary growth areas for Otsuka America in the next five years?

The company aims to expand its pipeline in rare diseases, immunology, and digital therapeutics, alongside international market expansion, particularly within Asia and Europe.

3. How vulnerable is Otsuka America to patent expirations?

While flagship products like Abilify faced patent cliffs, Otsuka mitigates these risks through pipeline innovation, lifecycle management, and developing new formulations.

4. What role does digital health play in Otsuka's strategic future?

Digital health integration can improve patient engagement and treatment personalization, enhance real-world evidence collection, and support drug development, representing a significant future focus.

5. Who are Otsuka America’s main competitors?

Major competitors include Lilly, J&J, Pfizer, and Novartis, particularly in psychiatric, neurological, and specialty medication sectors.

References

- Evaluate Pharma, 2022. Pharmaceutical Revenue Reports.

- Otsuka Pharmaceuticals Annual R&D Reports, 2022.

- IQVIA Institute, 2022. The Changing Healthcare Landscape.