Last updated: July 30, 2025

Introduction

Neos Therapeutics has established an influential presence within the pharmaceutical industry, particularly in the niche of CNS and ADHD treatment solutions. As a mid-sized pharmaceutical player, it leverages innovative drug delivery systems and targeted therapeutic approaches to carve a unique market position. This analysis assesses Neos Therapeutics' competitive standing, its core strengths, strategic initiatives, and the broader market context relevant to stakeholders, investors, and industry analysts.

Market Position and Business Overview

Founded in 2009, Neos Therapeutics specializes in developing, manufacturing, and commercializing pharmaceutical products for CNS disorders, with a significant focus on ADHD. The company's proprietary drug delivery platform, Kapvay (clonidine extended-release), exemplifies its dedication to delivering effective, sustained-release formulations that improve patient adherence and outcomes.

Neos has experienced notable growth trajectories driven by strategic acquisitions, product launches, and a focused pipeline targeting pediatric and adult patients. Its market operations extend predominantly across North America with ambitions to expand internationally.

Key Market Segments

- ADHD Therapeutics: The primary revenue generator, with products like Kapvay competing in a fragmenting ADHD landscape.

- CNS Disorders: Expansion into other CNS conditions leveraging its platform technology.

- Specialized Delivery Systems: Focus on extended-release formulations catering to unmet patient needs.

Competitive Position

Market Share and Reach

Neos holds an estimated 3-5% share within the U.S. ADHD pharmacotherapy market, which is valued at over $10 billion (IQVIA, 2022). While primarily a niche player, its strategic focus on extended-release formulations aims to differentiate it from dominant competitors like Shire (now part of Takeda) and Johnson & Johnson.

Product Portfolio & Pipeline

- Established Products: Kapvay for ADHD, approved in 2010, supports initial market penetration.

- Pipeline Candidates: Includes formulations for sleep disorders and other neuropsychiatric conditions, which are at varying stages of clinical validation.

Neos’ pipeline is strategically designed to augment its core ADHD portfolio, aiming to address diverse therapeutic needs in CNS disorders.

Strengths

- Innovative Delivery Technology: Patented extended-release systems enhance dosing convenience, reducing abuse potential and improving compliance.

- Focused Niche: Capitalization on pediatric ADHD, a consistently high-demand segment with limited high-quality pharmaceutical options.

- Agile R&D Capabilities: Smaller size enables rapid development and adaptation compared to larger competitors.

- Strategic Partnerships: Collaborations with specialty pharmacies and payers bolster market access and reimbursement strategies.

Weaknesses & Challenges

- Market Penetration: Limited market share relative to giants like Eli Lilly and Novartis.

- Pipeline Risks: Clinical development failures or delays could impact future growth.

- Pricing Pressures: Increasing emphasis on cost containment, especially in the ADHD medication space, may compress margins.

- Regulatory Risks: Ongoing need to navigate complex FDA approval processes for pipeline innovations.

Strategic Insights

Growth through Innovation

Neos’ core strategy revolves around maintaining its technological edge, especially through proprietary delivery platforms that enable extended-release formulations with better patient compliance. Investing in R&D for novel CNS indications remains pivotal.

Market Expansion and Diversification

International expansion efforts, particularly in Europe and Asia, could unlock new revenue streams. Concurrently, diversifying into adjacent CNS conditions offers avenues for growth beyond ADHD.

Partnerships and Collaborations

Forming alliances with biotech firms and academic institutions can accelerate pipeline development. Also, partnering with payers to demonstrate cost-effective benefits of extended-release formulations could foster broader reimbursement.

Competitive Differentiation

Emphasizing clinical differentiation—such as reduced abuse potential, improved adherence, and tailored dosing—can position Neos favorably against entrenched competitors.

Operational Scaling

Investing in supply chain robustness and manufacturing capacity will support increased product volume, especially if pipeline candidates receive approval.

Market Dynamics & Competitive Environment

The pharmaceutical ADHD market is characterized by a diverse array of treatments, including stimulants, non-stimulants, and novel formulations. Price sensitivity, regulatory scrutiny, and shifting prescribing patterns heavily influence market dynamics.

Neos’ emphasis on non-stimulant, extended-release formulations positions it within a niche that mitigates some stimulant abuse concerns but confronts challenges in widespread adoption compared to established stimulant therapies. Its competitors leverage extensive marketing networks and brand recognition, requiring Neos to innovate and differentiate effectively.

Additionally, trends toward personalized medicine and digital therapeutics are reshaping the CNS treatment landscape. Neos’ ability to integrate these trends could serve as a competitive advantage.

Regulatory and Commercial Outlook

The regulatory environment remains cautiously optimistic for Neos. FDA's evolving stance on abuse-deterrent formulations aligns with Neos’ product design goals, likely facilitating faster approvals for pipeline candidates. Commercially, reimbursement policies favor formulations demonstrating improved adherence and reduced healthcare costs, aligning well with Neos’ value proposition.

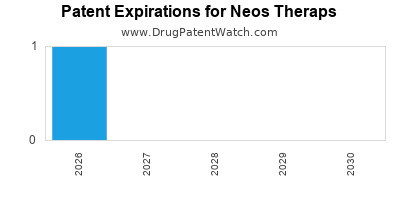

However, competition from generic manufacturers post-patent expiry, and market saturation, necessitate strategic agility. Continuous engagement with healthcare providers, payers, and patient advocacy groups will be critical for sustained growth.

Conclusion

Neos Therapeutics occupies a specialized but strategically advantageous position within the CNS and ADHD treatment markets. Its technological innovations, focused pipeline, and targeted market approach allow it to differentiate from larger incumbents. Nevertheless, it faces inherent challenges in expanding market share, scaling operations, and navigating regulatory complexities.

To maintain its competitive edge, Neos should prioritize pipeline development, forge strategic partnerships, and expand geographic reach. Emphasizing clinical differentiators and demonstrating cost-effectiveness will underpin its ability to capitalize on evolving market trends.

Key Takeaways

- Innovative Delivery Platforms Drive Differentiation: Neos’ proprietary extended-release formulations enhance adherence and reduce abuse, offering competitive advantages in ADHD therapy.

- Niche Focus Supports Market Positioning: Concentration on pediatric and adult ADHD allows for tailored marketing and development strategies, catering to unmet needs.

- Pipeline Expansion is Critical: Diversification into additional CNS indications and novel formulations can propel future growth and reduce dependence on a limited product portfolio.

- International Growth Opportunities Exist: Strategic ventures into global markets could significantly augment revenue streams, contingent on regulatory pathways and market acceptance.

- Regulatory and Reimbursement Navigation is Key: Proactive engagement with regulators and payers ensures quicker approvals and broader market access for innovative products.

FAQs

1. How does Neos Therapeutics differentiate itself from major competitors in the ADHD market?

Neos focuses on proprietary extended-release formulations that improve medication adherence and reduce abuse potential, targeting unmet patient needs and offering a clinical differentiation from stimulant-based therapies.

2. What are the primary growth drivers for Neos in the coming years?

Key drivers include pipeline expansion into new CNS indications, international market entry, strategic partnerships, and continued innovation in drug delivery technologies.

3. What challenges does Neos face in increasing its market share?

Challenges include stiff competition from established pharmaceutical giants, patent expiries, reimbursement hurdles, and the inherent risks of clinical development.

4. How can Neos leverage digital health trends within the CNS space?

By integrating digital therapeutics, remote monitoring tools, and data analytics into its product ecosystem, Neos can enhance personalized treatment approaches and differentiate its offerings.

5. What is the outlook for Neos’ pipeline products?

While early-stage candidates hold promise, their success hinges on clinical trial outcomes and regulatory approval processes, which historically pose both opportunities and risks within the CNS domain.

References

[1] IQVIA. (2022). U.S. Prescription Drug Markets.

[2] FDA. (2021). Guidance Documents on CNS Drug Approvals.

[3] Neos Therapeutics. (2022). Company Overview & Pipeline Pipeline Data.

[4] MarketWatch. (2022). ADHD Therapeutics Market Size & Forecast.

[5] Strategic Business Reports. (2022). CNS and Psychiatric Drug Market Trends.