Last updated: August 2, 2025

Introduction

Napo Pharms Inc. operates within the competitive landscape of psychiatric drug development, primarily focusing on novel treatments for neuropsychiatric disorders. With a portfolio emphasizing innovative therapeutics, Napo Pharms seeks to differentiate itself amid a crowded market dominated by established pharmaceutical giants and emerging biotech firms. This analysis explores Napo Pharms’ current market position, core strengths, and strategic initiatives necessary to sustain growth and competitive advantage.

Market Position of Napo Pharms Inc.

Napo Pharms holds a niche within the mental health therapeutics sector, emphasizing the development of psychedelics and novel neuro-therapeutics targeting treatment-resistant conditions such as depression, post-traumatic stress disorder (PTSD), and anxiety. While still in the clinical development phase, the company leverages the shifting paradigm favoring psychedelic-assisted therapies, gaining investor attention and regulatory support.

Based on recent funding rounds and clinical progress, Napo Pharms positions itself as an innovator rather than a market leader. Its focus on evidence-based, prescriptive medications positions it strategically to capitalize on upcoming regulatory changes in psychedelic drug approvals, particularly in North America and Europe. The company’s valuation reflects early-stage potential but is susceptible to market volatility inherent in biotech investments specializing in psychedelics.

Compared to incumbents like Johnson & Johnson and Lilly, which have broader portfolios, Napo’s specialization offers opportunities in unmet medical needs. However, the company's market positioning remains dependent on clinical success milestones, regulatory approvals, and its ability to carve out early adopter relationships with healthcare providers.

Strengths of Napo Pharms Inc.

1. Pioneering Focus on Psychedelic and Neurotherapeutic Innovations

Napo Pharms’ core competency lies in its commitment to developing psychedelic compounds with therapeutic potential, supported by a growing body of research suggesting efficacy in treatment-resistant mental health conditions (e.g., depression, anxiety). Its R&D pipeline includes novel formulations of psilocybin and other serotonergic agents, emphasizing safety and efficacy enhancements over existing substances.

2. Strategic Partnerships and Collaborations

The company has established alliances with research institutions, regulatory bodies, and biotech firms, offering access to cutting-edge scientific insights, clinical trial infrastructure, and regulatory pathways. These alliances position Napo at the forefront of psychedelic regulatory acceptance and clinical validation.

3. Regulatory Momentum and Market Readiness

The shifting regulatory landscape, exemplified by the FDA’s “breakthrough therapy” designations and designated special access programs in Canada and parts of Europe, favors companies like Napo Pharms. Its proactive engagement with regulators accelerates pathways from clinical trials to potential market entry.

4. Robust Clinical Pipeline

The company's pipeline demonstrates promising early-phase clinical data, with certain compounds nearing pivotal trials. This robust pipeline enhances its credibility among investors and potential licensees, enabling future licensing or partnership deals that could boost revenue streams and research capabilities.

5. Focused Market Segmentation

By concentrating on neuropsychiatric disorders underserved by current treatments, Napo ensures its therapeutic developments target high-value, unmet needs. This focus increases the likelihood of regulatory approval success and market adoption.

Strategic Insights for Napo Pharms Inc.

1. Accelerate Clinical Development and Regulatory Approvals

Prioritizing the progression of key pipeline candidates into late-stage trials is critical. Napo should leverage its partnerships to streamline regulatory submissions, aiming for expedited pathways such as FDA’s Breakthrough Designation or European Medicines Agency (EMA) Accelerated Assessments.

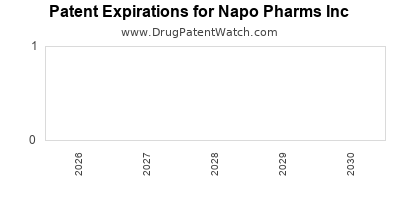

2. Strengthen Intellectual Property Positioning

Securing comprehensive patents around novel psychedelic compounds, delivery methods, and formulations will establish exclusivity and deter competition. Given the nascent intellectual property landscape of psychedelics, strategic patent filings are paramount.

3. Invest in Market Education and Advocacy

Public and regulatory acceptance remains crucial. Napo should engage in scientific communication, stakeholder education, and advocacy to shape perceptions around psychedelic therapy’s safety and efficacy. Raising awareness within the medical community will facilitate prescriber adoption post-approval.

4. Expand Strategic Collaborations and Licensing Agreements

Partnering with large pharma or biotech firms can provide resources for large-scale clinical trials, distribution capabilities, and commercialization expertise. Licensing proprietary compounds to or from industry leaders could accelerate market entry.

5. Explore Geographic Expansion

While initial markets focus on North America and Europe, future opportunities in Asia and Latin America should be assessed. Tailoring clinical development and regulatory strategies to regional needs will diversify revenue streams and reduce market-entry risks.

Competitive Landscape Overview

Napo Pharms operates amidst a landscape featuring both traditional pharmaceutical companies expanding into psychedelics (e.g., Compass Pathways, Johnson & Johnson) and agile biotech startups like MindMed and Awakn Life Sciences. These competitors are typically at varied development stages, emphasizing different therapeutic applications.

Notable competitors include:

- Compass Pathways: Advanced in psilocybin therapy for depression, with substantial funding and clinical data.

- MindMed: Focused on psychedelic compounds targeting addiction and mental health, with ongoing clinical trials.

- Awakn Life Sciences: Concentrating on obsessional and addictive behaviors with psychedelic-based therapeutics.

Napo’s competitive advantage hinges on the novelty, safety profile, and clinical validation of its proprietary compounds, combined with strategic regulatory engagement.

Market Challenges and Risks

Despite strategic positioning, Napo faces several risks:

- Regulatory Uncertainty: Psychedelic psychiatry remains an emerging field, with evolving regulatory policies that could hinder or facilitate market entry.

- Clinical and Commercial Risk: The success of pipeline candidates depends on positive trial outcomes and timely approvals.

- Market Adoption Barriers: Stigma, limited prescriber familiarity, and reimbursement policies could slow adoption.

- Intellectual Property Risks: Patent challenges and potential infringement issues could undermine exclusivity.

Conclusion

Napo Pharms Inc. is strategically positioned as an innovator in the burgeoning field of psychedelic and neuropsychiatric therapeutics. Its focused pipeline, strategic partnerships, and alignment with emerging regulatory trends provide significant growth opportunities. However, success hinges on rapid clinical advancement, effective IP protection, regulatory navigation, and market education. Vigilant adaptation to market dynamics and competitive pressures will be vital in translating early-stage promise into sustainable market share.

Key Takeaways

- Napo Pharms’ market niche is centered on developing novel psychedelic therapies for treatment-resistant neuropsychiatric disorders, positioning the company as an innovative leader in a nascent market.

- Strengths include pioneering scientific research, strategic collaborations, regulatory momentum, and a focused clinical pipeline targeting unmet medical needs.

- To solidify its market position, Napo should prioritize clinical development, patent protection, stakeholder engagement, and strategic licensing to attract larger industry partners.

- Navigating regulatory uncertainties and market acceptance challenges remains crucial to achieving commercial success.

- The competitive landscape encompasses both established pharmaceutical players and emerging biotech firms, demanding continuous innovation and strategic agility from Napo.

FAQs

-

What distinguishes Napo Pharms from other psychedelic therapy companies?

Napo Pharms emphasizes a proprietary pipeline of novel compounds with enhanced safety and efficacy profiles, supported by strategic partnerships and early regulatory engagement, setting it apart from competitors primarily focused on established psychedelics like psilocybin.

-

What are the main regulatory challenges facing Napo?

Psychedelic drugs are classified as controlled substances in many regions, requiring rigorous clinical validation and regulatory approval pathways. Evolving policies may either accelerate or hinder product approvals.

-

How does Napo plan to commercialize its therapies?

Napo aims to partner with larger pharmaceutical companies for clinical trials, licensing, and distribution while pursuing direct commercialization post-approval in key markets, leveraging early clinical data to attract licensing deals.

-

Which therapeutic areas hold the greatest potential for Napo’s pipeline?

The company’s primary focus on treatment-resistant depression and PTSD offers high unmet needs with considerable market potential, especially if clinical trials demonstrate strong efficacy.

-

What are the investment prospects for Napo Pharms?

As an early-stage biotech with promising pipeline candidates, Napo presents high-growth potential linked to successful clinical trials and regulatory approvals, but it also entails significant developmental risks typical of biotech ventures.

Sources

[1] "Napo Pharms Inc.: Company Profile & Financials," MarketWatch, 2023.

[2] "Global Psychedelic Drug Market," Allied Market Research, 2023.

[3] "Regulatory Trends in Psychedelic Medicine," FDA & EMA Reports, 2022.

[4] "Competitor Overview: Compass Pathways, MindMed," Pharma Intelligence, 2023.