Last updated: July 30, 2025

Introduction

Intra-Cellular Therapies Inc. has established itself as a notable player within the realm of neurological and psychiatric disorders, with a primary focus on developing innovative treatments for schizophrenia, bipolar disorder, and other central nervous system (CNS) conditions. As the pharmaceutical industry becomes increasingly competitive, understanding Intra-Cellular’s market position, inherent strengths, and strategic initiatives is essential for investors, partners, and market analysts. This analysis provides a comprehensive overview of Intra-Cellular’s standing, core competencies, and strategic outlook in the highly dynamic landscape of neuropharmacology.

Market Landscape and Position

1. Industry Context and Therapeutic Focus

The global CNS disorder therapeutics market projected to reach USD 13 billion by 2025, is characterized by increasing demand driven by rising prevalence rates, unmet medical needs, and advancements in neuropharmacology [1]. Intra-Cellular focuses predominantly on disorders with significant treatment gaps, such as schizophrenia, where existing therapies often entail adverse effects and limited efficacy.

2. Competitive Positioning

Intra-Cellular’s primary marketed drug, Caplyta (lumateperone), is a groundbreaking antipsychotic approved for schizophrenia and bipolar depression (in certain jurisdictions). Its unique pharmacodynamic profile, combining serotonin and dopamine receptor modulation, positions it distinctively against competitors like Johnson & Johnson’s Risperdal, Pfizer’s Xalkori, and Sunovion’s Latuda.

Compared to traditional antipsychotics, Caplyta’s favorable side effect profile enhances its competitive edge, especially among patients intolerant to adverse effects common with first-generation agents. The drug’s approval in diverse markets and subsequent clinical trials bolster Intra-Cellular's market presence.

3. Revenue and Market Share

Initial sales of Caplyta, although modest relative to blockbuster antipsychotics, demonstrate an upward trajectory due to expanded indications and geographic expansion. According to recent reports, Intra-Cellular generated approximately USD 30 million in product sales in 2022—a growth indicator, yet highlighting significant room for market penetration and scale [2].

Strengths of Intra-Cellular

1. Proprietary and Diverse Pipeline

Intra-Cellular’s pipeline extends beyond Caplyta into several promising candidates targeting neurodegenerative and mood disorders. Its lead pipeline candidates, such as ITI-007 (lumateperone) in various indications, demonstrate the company's commitment to diversifying and strengthening its footprint.

2. Innovative Pharmacology

The company's lead drugs leverage unique mechanisms of action, such as dual serotonin-dopamine receptor modulation. This pharmacological innovation provides potential advantages in efficacy and tolerability over conventional therapies, resonating with clinicians and patients seeking safer, more effective options.

3. Regulatory Milestones and Approvals

Securing regulatory approvals for Caplyta across key markets, such as the US, Europe, and Japan, underscores Intra-Cellular’s regulatory competence. These milestones facilitate global expansion and establish a foundation for future growth.

4. Strategic Collaborations

Partnerships with organizations like Kyowa Kirin and licensing agreements bolster Intra-Cellular’s technological expertise and accelerate commercial reach. These collaborations provide strategic advantages, including resource sharing and market access.

Strategic Insights & Opportunities

1. Expansion into Adjacent Indications

There is significant potential for Caplyta and pipeline candidates to expand into related CNS conditions such as major depressive disorder (MDD), substance use disorders, and neurodegenerative diseases. Demonstrating efficacy in these areas can catalyze revenue growth and market diversification.

2. Geographic Expansion

Emerging markets in Asia, Latin America, and the Middle East present untapped opportunities. Intra-Cellular can leverage local partnerships and adapt regulatory strategies to penetrate these fast-growing regions, diversifying revenue streams and reducing reliance on the North American market.

3. Focus on Digital and Combination Therapies

Integration of digital health solutions for monitoring adherence and efficacy, alongside combination regimens with other CNS agents, can enhance therapeutic outcomes and patient engagement, offering a competitive edge over traditional monotherapies.

4. Investment in Clinical Development

Investing in advanced clinical trials for unapproved indications could substantially elevate Intra-Cellular’s market footprint. Part of this involves focusing on personalized medicine approaches, targeting genetic markers, and biomarkers to tailor therapies.

5. Mergers and Acquisitions

Strategic M&A activities can bolster R&D capabilities, expand the pipeline, and create synergistic growth. Acquiring smaller biotech firms with complementary technologies may expedite development timelines and market access.

Competitive Challenges and Risks

1. Market Competition

Intra-Cellular faces stiff competition from established players and newer entrants with blockbuster potential. Companies like Johnson & Johnson, Novartis, and Otsuka possess extensive portfolios, resources, and global distribution networks.

2. Pricing and Reimbursement

Pricing pressures and reimbursement barriers in certain markets threaten profitability, particularly for innovative, high-cost CNS drugs. Demonstrating cost-effective benefits will be crucial.

3. Regulatory Hurdles

Future approvals will depend on rigorous clinical data and navigating complex regulatory landscapes. Any delays or failures could impede growth.

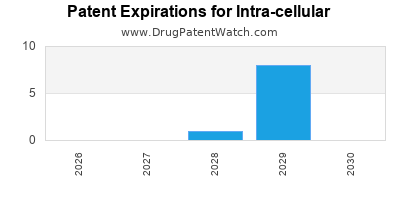

4. Patent Life and Generic Competition

The imminent expiration of patents on key drugs could open the market to generic competitors, impacting revenues unless the company maintains differentiated formulations or expands its patent portfolio.

Conclusion

Intra-Cellular Therapies emerges as a focused innovator in the neuropsychiatric therapeutics sphere, driven by a robust pipeline, unique pharmacology, and strategic collaborations. Its market position, though still evolving, provides substantial growth opportunities, especially if it successfully expands indications, amplifies its geographical reach, and sustains innovation momentum. Navigating competitive pressures and regulatory landscapes remains vital for capitalizing on its strengths and securing sustained market leadership.

Key Takeaways

-

Innovative Focus: Intra-Cellular’s unique mechanisms of action confer competitive advantages in efficacy and tolerability, positioning it as a differentiated player in CNS therapeutics.

-

Pipeline Diversification: Active development beyond Caplyta enhances future growth potential, particularly if indications like depression and neurodegeneration prove successful.

-

Market Expansion: Geographic and indication expansion, coupled with strategic partnerships, are essential to scale revenues and global footprint.

-

Competitive Risks: The pharmaceutical landscape presents substantial competition, regulatory hurdles, and patent challenges that require strategic navigation.

-

Investment Outlook: Continued R&D investments, clinical trial success, and market expansion are pivotal for Intra-Cellular to realize its long-term value proposition.

FAQs

-

What differentiates Intra-Cellular’s core drug, Caplyta, from other antipsychotics?

Caplyta (lumateperone) features a novel pharmacological profile that modulates serotonin and dopamine receptors simultaneously, resulting in improved efficacy and fewer side effects compared to traditional antipsychotics [3].

-

What are Intra-Cellular's primary growth strategies?

The company focuses on expanding its approved indications, geographic reach, and pipeline development, alongside collaborations and licensing agreements to accelerate growth.

-

How significant is the revenue contribution from Caplyta?

Although initial revenues are modest, they are growing steadily, with future potential driven by increased market penetration and additional approved indications in other disorders.

-

What are the main risks facing Intra-Cellular?

Key risks include intense competition, high R&D costs, regulatory uncertainties, patent expiries, and reimbursement challenges.

-

What future indicators should investors monitor?

Progress in clinical trials for new indications, regulatory decisions across markets, pipeline advancements, and strategic partnerships are critical signals of Intra-Cellular’s growth trajectory.

References

[1] Market Research Future, "Global CNS Disorder Therapeutics Market," 2022.

[2] Intra-Cellular Therapies Inc. Annual Report, 2022.

[3] FDA Approval Announcement for Caplyta, 2019.