Last updated: July 28, 2025

Introduction

Idorsia Ltd., a Swiss-based biopharmaceutical company, has emerged as a significant player within the highly competitive pharmaceutical sector. Established in 2017 as a spin-off from Actelion, Idorsia quickly positioned itself as an innovative entity focusing on central nervous system (CNS), allergy, and cardiovascular therapeutics. This analysis examines Idorsia’s current market stance, strengths, competitive strategies, and future outlook to inform stakeholders seeking strategic clarity in an evolving pharmaceutical landscape.

Market Position of Idorsia

Strategic Niche and Portfolio Focus

Idorsia specializes predominantly in niche therapeutic areas, notably CNS disorders, rare diseases, and novel metabolic pathways. Its pipeline comprises approximately 15 to 20 investigational and marketed compounds, with prioritized assets including clazosentan (for cerebral vasospasm), lucerastat (for Fabry disease), and zandelisib (for B-cell malignancies).

Compared to large peers like Novartis, Roche, and Pfizer, Idorsia’s market footprint is relatively modest, addressing specialized segments with high unmet needs. Its revenue generation remains limited but is expected to grow as late-stage developments advance and new approvals occur.

Revenue and Financial Metrics

In 2022, Idorsia reported revenues of approximately CHF 679 million, marking a significant increase from prior years, driven by increased commercialization of daridorexant (a sleep-wake disorder treatment) and licensing income. However, the company remains EBITDA-negative, highlighting its R&D intensive strategy and early-stage focus.

Competitive Positioning

Idorsia’s competitive advantage stems from its ability to leverage internal innovation, strategic licensing, and acquisitions—most notably, the purchase of Ruthigen in 2019 to bolster its antibiotic pipeline. Its agility and focus on high-value, under-addressed therapeutic areas differentiate it from bigger, more diversified pharmaceutical conglomerates.

Strengths

Innovative Pipeline and Derisked Assets

Idorsia’s R&D pipeline boasts a mix of phase 2 and phase 3 assets, emphasizing CNS disorders such as insomnia, anxiety, and neurological diseases. Daridorexant, approved in 2022 for insomnia, marks a crucial milestone. Its commercialization experience and clinical data position it for repeatable revenue streams. The company’s focus on precisely targeted therapies enables higher potential success rates compared to broader-spectrum approaches.

Strong Scientific Base and Intellectual Property

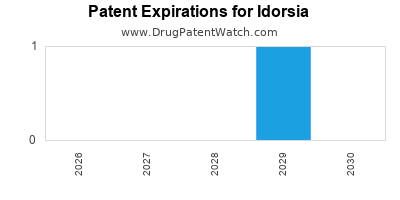

With approximately 620 patents, Idorsia maintains a robust IP portfolio that guards its core innovations. Its scientific expertise is centered on G protein-coupled receptor (GPCR) modulation, a highly lucrative domain given the receptor’s role in various diseases.

Agility and Niche Market Penetration

As a mid-sized biotech, Idorsia exhibits operational agility, enabling faster decision-making and tailored market entry strategies. Its ability to focus on niche markets with high unmet medical needs reduces direct competition concentrated on blockbuster drugs.

Financial Backing and Strategic Collaborations

Supported by a strong cash position (over CHF 600 million in 2022), Idorsia sustains aggressive R&D investments. Strategic partnerships with pharmaceutical giants such as Janssen (for clazosentan) and licensing agreements diversify revenue sources and de-risk pipeline development.

Strategic Insights

Differentiation Through Precision Medicine

Idorsia’s focus on targeting specific receptor pathways allows for personalized therapeutic approaches. Its pipeline’s design prioritizes conditions where traditional treatments have limitations, creating potential for rapid adoption upon approval.

Investments in CNS and Rare Diseases

Given the high unmet need and limited competition, Idorsia’s concentration on CNS and rare diseases offers a competitive moat. Lucerastat and APD418 (peripheral artery disease) are examples of this strategic focus.

R&D Expansion and Diversification

Looking forward, Idorsia’s pipeline expansion, especially in immunology and metabolic disorders, aims to diversify its revenue sources. Continual investment in innovative platforms and digital therapeutics could further enhance its value proposition.

Challenges and Risks

Despite strengths, Idorsia faces challenges including lengthy drug development timelines, high R&D costs, and regulatory hurdles. Competition from larger firms with established market shares and broad portfolios could impede market penetration for some assets. Additionally, the need for successful commercialization of new drugs persists.

Future Outlook and Strategic Recommendations

Idorsia’s trajectory depends heavily on the successful commercialization of daridorexant and upcoming regulatory approvals for its pipeline compounds. The company should focus on strategic partnerships, accelerated clinical development, and market penetration strategies in specialist segments. Diversification into adjacent therapeutic areas remains vital to mitigate sector-specific risks.

Furthermore, increased investment in digital health initiatives and data-driven personalized medicine could amplify its competitive advantage, especially within CNS disorders.

Key Takeaways

- Niche Focus and Innovation: Idorsia’s concentrated efforts in CNS and rare diseases, supported by a strong IP portfolio, position it uniquely in an underserved segment.

- Pipeline Momentum: The successful launch of daridorexant underscores its capability to translate R&D into commercial success, serving as a blueprint for future product launches.

- Financial Flexibility: Current strong cash reserves enable ongoing R&D investment and strategic acquisitions, with focus on de-risking its pipeline.

- Market Challenges: The path to profitability remains contingent upon regulatory approvals, successful commercialization, and competitive response.

- Strategic Growth: Expansion into immunology, metabolic pathways, and digital therapeutics presents opportunities for growth and diversification.

Conclusion

Idorsia’s strategic positioning as an innovative, niche-focused biotech enables it to carve out a resilient segment within the competitive pharmaceutical market. While it faces inherent R&D risks, its pipeline strength, financial backing, and scientific expertise underpin a promising outlook. Realizing its full potential hinges on successful clinical development, regulatory navigation, and strategic collaborations.

FAQs

1. What are Idorsia’s core therapeutic areas?

Idorsia primarily targets central nervous system (CNS) disorders, rare diseases, and metabolic pathways. Its notable assets include daridorexant for insomnia and lucerastat for Fabry disease.

2. How does Idorsia differentiate itself from larger pharmaceutical firms?

By focusing on high-uncertainty, niche segments and leveraging its scientific expertise in GPCRs, Idorsia maintains agility and targets unmet medical needs, setting itself apart from broader-spectrum competitors.

3. What are the risks associated with Idorsia’s growth strategy?

Risks include regulatory delays, clinical trial failures, intense competition, and the high cost of R&D. Successful commercialization remains critical to profitability.

4. What strategic partnerships does Idorsia have?

Idorsia has partnerships with Janssen for clazosentan and licensing agreements supporting its pipeline development and commercialization efforts.

5. What is the outlook for Idorsia’s pipeline development?

With ongoing late-stage trials and recent product approvals, the pipeline shows promise. Future success depends on clinical trial outcomes, regulatory approval, and efficient market entry.

References

- Idorsia Ltd. Annual Report 2022. [Link to financial reports]

- European Medicines Agency (EMA). Review of daridorexant.

- Industry analysis reports from EvaluatePharma & GlobalData.

- Company pipeline updates and press releases.

- Swiss Biotech Association Market Insights.