Last updated: July 30, 2025

Introduction

Horizon Therapeutics US stands out as a pivotal player in the niche, high-value pharmaceutical market, particularly within rare diseases and specialized conditions. As the healthcare landscape becomes more dynamic with technological advancements and regulatory shifts, understanding Horizon’s market positioning, core strengths, and strategic initiatives is essential for stakeholders aiming to navigate this competitive environment effectively. This analysis provides an in-depth examination of Horizon Therapeutics' current standing in the US market, highlighting its strategic pursuits, competitive advantages, and pathways to sustainable growth.

Market Position and Business Overview

Horizon Therapies, headquartered in Deerfield, Illinois, specializes in developing treatments for rare and orphan diseases, including chronic autoimmune disorders, rare genetic conditions, and certain acute illnesses. Its flagship products, such as Tepezza (teprotumumab) for thyroid eye disease, Krystexxa (pegloticase) for chronic gout, and Lupkynis (voclosporin) for lupus nephritis, exemplify its focus on underserved patient populations.

In the US, Horizon has carved out a distinctive market niche through strategic acquisitions, innovative R&D, and tailored commercial strategies. As of 2023, Horizon's market share in its primary therapeutic areas has expanded, driven by the successful launch of Tepezza—becoming a key revenue generator and consolidating Horizon’s position as a leader in thyroid eye disease treatment.

According to IQVIA data, Horizon's US fiscal revenue expanded at a compound annual growth rate (CAGR) of approximately 15% over the past three years, notably outpacing broader autoimmune and orphan drug markets, which exhibit moderate growth due to patent protections, favorable reimbursement policies, and high unmet needs.

Strengths Underpinning Horizon's Competitive Advantage

1. Specialty Focus and Innovation in Rare Diseases

Horizon’s strategic focus on rare and specialized conditions enables it to operate under less generic competition and leverage orphan drug incentives such as extended market exclusivity and tax benefits. Its commitment to innovation is evidenced by ongoing clinical trials targeting unmet medical needs, including advancements in autoimmune and inflammatory disorders. The approval of Tepezza marked a significant milestone, establishing Horizon as a pioneer in thyroid eye disease, a rare condition with limited existing therapies.

2. Robust Portfolio and Pipeline

The company's diversified portfolio and deep pipeline enhance resilience and growth prospects. Horizon’s pipeline includes multiple candidates in late-stage development targeting rare diseases such as neurology, metabolic disorders, and oncology, which are poised to diversify revenue streams and extend market dominance.

3. Strategic Collaborations and Acquisitions

Horizon’s strategic acquisitions, such as the buyout of Viela Bio in 2021, expanded its footprint in neurology and immunology. These acquisitions grant access to promising assets and scalable R&D infrastructure, bolstering Horizon's ability to rapidly advance innovative therapies.

4. Market Access and Pricing Strategies

Horizon employs aggressive yet sustainable pricing strategies aligned with value-based care models. Its early engagement with payers and institutional stakeholders facilitates favorable formulary placements and reimbursement pathways, critical for maximizing patient access and revenue realization.

5. Focused Commercial Operations

Horizon has built a highly specialized sales and marketing team, tailored toward rare disease markets requiring high-touch engagement with healthcare providers and patient advocacy groups. This approach fosters stronger brand recognition, patient adherence, and loyalty.

Strategic Insights and Opportunities

1. Expanding Rare Disease Footprint

Horizon’s core competency suggests continued expansion into other rare diseases through internal R&D and acquisitions. Developing therapies for conditions with high unmet needs could unlock new revenue streams and strengthen its market position.

2. Leveraging Digital and Patient-Centric Technologies

Investing in digital health solutions and real-world evidence (RWE) generation can enhance clinical development, optimize market access, and improve patient outcomes. Horizon’s emphasis on patient-centric care creates opportunities for digital engagement and remote monitoring, aligning with industry trends.

3. Navigating Regulatory Landscapes

Proactive engagement with FDA and other regulatory bodies can expedite approval processes, especially through programs like Breakthrough Therapy Designation and Priority Review. Horizon’s previous success indicates a strong regulatory strategy that could be leveraged for upcoming therapies.

4. Capitalizing on Competitive Advantages in Orphan Drugs

As orphan drugs generally face less price erosion and higher margins, Horizon’s continued focus on this segment offers lucrative opportunities. Its ability to secure orphan designation for new candidates will be pivotal.

5. Global Expansion and Market Diversification

While primarily focused on the US market, Horizon’s expansion into European and Asian markets presents significant opportunities. Tailoring market entry strategies and navigating local regulatory environments can accelerate global growth, reducing reliance on US market dynamics.

Competitive Landscape and Key Competitors

Horizon operates within a highly competitive environment alongside global giants such as Amgen, Regeneron, and Sanofi, and niche players like Alexion (now AstraZeneca) and Hoffmann-La Roche.

- Amgen: A leader in autoimmune and rare disease therapies, leveraging broad R&D capabilities and global reach.

- Regeneron: Known for innovative biologics, with a robust pipeline targeting autoimmune, metabolic, and ophthalmologic conditions.

- Sanofi: Offers a diverse portfolio including rare disease drugs, backed by extensive global manufacturing infrastructure.

- Alexion (AstraZeneca): Specializes in complement-mediated rare diseases, offering strong competition in the orphan space.

Horizon’s competitive edge hinges on its agility within niche markets, innovative pipeline, and targeted patient engagement. While large competitors benefit from scale, Horizon’s specialized focus and innovative treatments afford it a strategic advantage in particular therapeutic areas.

Challenges and Risks

Despite its momentum, Horizon faces challenges such as:

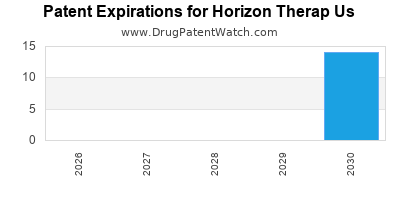

- Patent expirations: Potential erosion of exclusivity on flagship products.

- Pricing pressures: Stricter value-based reimbursement policies could impact margins.

- Regulatory hurdles: Delays or failures in clinical trials could impede pipeline progress.

- Market access constraints: Variability in payer acceptance and formulary placements.

Proactively managing these risks through diversified pipeline development, strategic partnerships, and stakeholder engagement is imperative.

Conclusion

Horizon Therapeutics US positions itself as a specialist-driven innovator with a strategic focus on rare and underserved diseases. Its strengths—comprehensive pipeline, targeted marketing, and agility—support a resilient competitive stance. Strategic growth through pipeline expansion, digital health integration, and global diversification remains crucial for maintaining market leadership and capitalizing on evolving industry opportunities.

Key Takeaways

- Horizon’s niche focus on rare diseases offers high-margin, low-competition market segments that support sustainable growth.

- Its innovative portfolio, exemplified by Tepezza, cements its role in orphan drug markets with expanding revenues.

- Acquisitions and pipeline development are critical to diversify therapy offerings and mitigate patent and regulatory risks.

- Digital engagement and real-world evidence data provide avenues to strengthen market access, patient adherence, and clinical credibility.

- Navigating competitive pressures and regulatory landscapes requires strategic agility and stakeholder collaboration.

FAQs

1. What differentiates Horizon Therapeutics from other biotech firms?

Horizon’s exclusive focus on rare, underserved conditions allows it to develop specialized therapies with high unmet needs, supported by a nimble organizational structure and targeted commercialization strategies.

2. How significant is Tepezza to Horizon’s market position?

Tepezza is Horizon’s flagship product, responsible for a substantial portion of revenue, and marks its emergence as a leader in thyroid eye disease, a rare autoimmune disorder.

3. What are Horizon’s main strategic growth avenues?

Expansion into new rare diseases, acquisitions, global market entry, and leveraging digital health solutions are key avenues to sustain growth.

4. How does Horizon manage competitive pressures from larger pharma entities?

By maintaining a focused portfolio, rapid innovation, strong stakeholder relationships, and agile commercialization, Horizon effectively competes in its niche markets.

5. What risks should investors monitor regarding Horizon’s future?

Patent expirations, pricing reforms, clinical trial outcomes, and regulatory delays are critical risk factors that could impact Horizon’s long-term viability.

Sources

[1] IQVIA, 2023. US Pharmaceutical Market Data.

[2] Horizon Therapeutics, Company Reports, 2022-2023.

[3] FDA, Orphan Drug Designation and Approvals Data.

[4] Evaluate Pharma, 2023 Global Rare Disease Market Insights.