Last updated: July 30, 2025

Introduction

Deciphera Pharmaceuticals (NASDAQ: DCPH) has carved a significant niche in the global oncology therapeutics space through innovative kinase inhibitor development. With a focused pipeline targeting novel molecular pathways and strategic collaborations, Deciphera is emerging as a formidable player in the pharmaceutical industry. This analysis dissects Deciphera’s market position, core strengths, competitive advantages, and strategic outlook, providing a comprehensive understanding for stakeholders aiming to navigate the oncology pharmaceutical landscape.

Market Position of Deciphera Pharmaceuticals

Deciphera’s positioning hinges on its proprietary kinase inhibitor platform and a pipeline that addresses high unmet medical needs, primarily in cancer therapeutics. Since its IPO in 2019, Deciphera has concentrated on developing precision medicines that target specific molecular vulnerabilities in tumors.

Key Metrics and Market Presence

- Market Capitalization & Financials: As of early 2023, Deciphera’s market cap hovers around $1.4 billion, reflecting investor confidence in its pipeline potential. The company reported revenues primarily from collaborations, with pipeline advancements showing promise.

- Pipeline Focus: Central to Deciphera’s portfolio is Vitrakvi (vitrakvi), an investigational agent aimed at solid tumors with specific genetic markers; Qinlock (ripretinib), approved for gastrointestinal stromal tumors (GIST); and other novel inhibitors in clinical stages targeting metastatic cancers.

- Partnerships & Licensing: Strategic alliances, such as the license agreement with Qilu Pharmaceutical for Qinlock in China, amplify Deciphera’s reach, positioning it as an emerging global player.

Competitive Landscape Context

Deciphera operates amid giants like Roche, Novartis, and Pfizer, which dominate the oncology segment. However, its niche focus on developing next-generation kinase inhibitors, targeting resistant and rare tumor types, differentiates it within the competitive arena.

Core Strengths and Competitive Advantages

A. Robust Scientific Foundation and Innovation

Deciphera’s strength lies in its proprietary kinase inhibition platform, designed to target key oncogenic drivers with high specificity. This platform enables the rapid development of novel compounds optimized for efficacy and safety. Notable is Rebastinib, a candidate targeting MKL1-driven malignancies, exemplifying Deciphera’s commitment to pioneering molecular targeted therapies.

B. Strategic Pipeline and Clinical Leadership

The company boasts a diversified pipeline:

- Qinlock (Ripretinib): Approved for GIST, representing proven clinical success.

- Ripretinib Expansion: Ongoing trials in other solid tumors broaden the application scope.

- Investigational Agents: Compounds like DCC-3116 aiming at KRAS mutations signify strategic innovation beyond existing frontiers.

C. Regulatory Progress and Commercialization Capabilities

Deciphera’s ability to fast-track certain candidates through regulatory pathways and establish commercial manufacturing provides a competitive edge. The approval and commercialization of Qinlock showcase effective go-to-market strategies.

D. Global Expansion through Collaborations

Partnerships in Asia and Europe position Deciphera as a global entity, leveraging local regulatory expertise and market access. This expansion mitigates risks associated with regional regulatory and competitive complexities.

E. Focused Oncology Expertise

The company’s specialized focus on kinase inhibitors in oncology allows tailored R&D efforts, agility in clinical development, and targeted marketing strategies, differentiating it from broader biotech firms.

Strategic Insights and Market Dynamics

1. R&D Investment and Innovation Trajectory

Deciphera’s commitment to enhancing its pipeline via internal innovation and strategic acquisitions is crucial. It must sustain a strong innovation pipeline, considering the high attrition rates typical in oncology R&D.

2. Competitive Positioning against Industry Giants

While Deciphera is a specialized niche player, the presence of dominant players investing heavily in targeted therapies necessitates continuous pipeline innovation and strategic collaborations to stay competitive.

3. Regulatory Navigation and Market Access

Effective navigation of regulatory landscapes, especially in emerging markets like China, will be pivotal. The company’s licensing agreements facilitate broader access but require diligent compliance and adaptation strategies.

4. Market Penetration in Rare and Resistant Tumors

Deciphera’s focus on resistant and rare tumor types positions it advantageously as personalized medicine gains prominence. Its pipeline’s targeted nature aligns with shift towards genomics-driven oncology treatments.

5. Financial Sustainability and Growth Strategy

Deciphera’s revenue is heavily reliant on partnership deals and licensing fees. Strengthening direct commercialization capabilities and expanding pipeline outputs will be key to long-term growth.

Challenges and Risks

- Clinical and Regulatory Risks: Clinical failures or regulatory setbacks remain inherent risks, particularly for investigational drugs.

- Market Competition: Larger pharma firms might acquire or develop competing agents, intensifying competitive pressure.

- Pricing and Reimbursement: Oncology drugs face pricing scrutiny; achieving favorable reimbursement will influence commercial success.

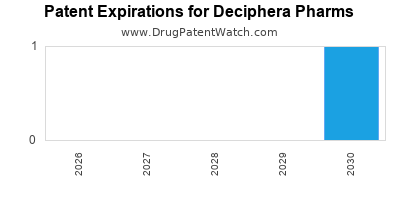

- Intellectual Property Risks: Patent challenges and expiry timelines could impact product exclusivity.

Future Outlook and Strategic Recommendations

Deciphera should continue investing in its pipeline’s innovation, particularly in expanding indications for approved agents like Qinlock. Strengthening global regulatory and commercialization capabilities, especially in emerging markets, could unlock significant revenue streams. Enhanced strategic collaborations and potential acquisitions, tailored toward novel kinase targets, may fuel growth.

Furthermore, leveraging digital health tools and biomarker-driven diagnostics could augment personalized treatment offerings, further differentiating Deciphera in the highly competitive oncology landscape.

Key Takeaways

- Deciphera’s strategic focus on kinase inhibitor innovation positions it within a high-growth niche of oncology therapeutics.

- Its proven clinical success with Qinlock provides a foundation for expansion into other tumor types and markets.

- Collaborations across geographies enhance global reach but necessitate effective regulatory and market strategies.

- Continuous pipeline development, coupled with strategic innovation, is critical to sustain competitive advantage amid industry giants.

- Financial growth hinges on balancing partnership revenues with eventual direct commercialization to nurture long-term sustainability.

FAQs

1. What distinguishes Deciphera’s kinase inhibitor platform from competitors?

Deciphera’s platform emphasizes high selectivity for oncogenic kinases, enabling the development of tailored therapies with improved safety profiles and efficacy, differentiating it from broader-spectrum kinase inhibitors.

2. How does Deciphera’s strategic partnership model enhance its market position?

Partnerships with regional firms and licensing agreements in key markets expand Deciphera’s global footprint, reduce market entry barriers, and facilitate local regulatory compliance.

3. What are Deciphera’s primary growth areas over the next five years?

Expansion of the Qinlock franchise into new indications, pipeline maturation in KRAS-driven and resistant tumors, and entry into emerging markets represent pivotal growth avenues.

4. What risks could impact Deciphera’s pipeline and commercial success?

Clinical failures, regulatory delays, adverse reimbursement decisions, and competitive threats from larger pharma companies pose significant risks.

5. How should investors evaluate Deciphera’s long-term prospects?

Investors should consider Deciphera’s innovation pipeline, strategic collaborations, recent clinical progress, and its ability to navigate regulatory environments within its niche oncology focus.

Sources:

- Deciphera Pharmaceuticals official website.

- SEC filings and investor presentations.

- Industry reports on kinase inhibitors and oncology therapeutics.

- Clinical trial registries and recent trial data publications.