Last updated: July 30, 2025

Introduction

Corcept Therapeutics Incorporated stands at the forefront of pharmaceutical innovation, primarily specializing in the development and commercialization of cortisol-modulating drugs for severe metabolic, psychiatric, and oncological conditions. As the landscape evolves with increasing competition, understanding Corcept’s market position, internal strengths, and strategic trajectory is critical for stakeholders aiming to optimize investments and future collaborations.

Market Position and Industry Context

Corcept’s core portfolio revolves around its once-daily, oral, cortisol-receptor modulators, notably mifepristone (Korlym) and relacorilant. Its strategic focus on conditions such as Cushing’s syndrome—both endogenous and iatrogenic—as well as emotional and psychological disorders, positions the company in a niche yet expanding segment of endocrinology and psychopharmacology.

The global market for Cushing’s syndrome therapeutics is modest, projected to reach approximately USD 230 million by 2028, yet the unmet medical need and expanding indications bolster Corcept’s growth prospects. The company’s dominant market share in this niche, alongside its pipeline expansion into oncology and severe mental health disorders, consolidates its position as a key innovator.

In the broader endocrinology segment, competitors include AbbVie, Novartis, and specialized biotech firms developing cortisol and glucocorticoid receptor antagonists. Furthermore, the emergence of biosimilar and innovative drugs challenges Corcept’s proprietary products. Nevertheless, its first-mover advantage and ongoing clinical pipeline underpin its robust market positioning.

Core Strengths

1. Proprietary Drug Portfolio and Market Exclusivity

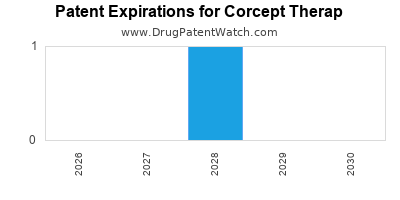

Corcept’s flagship product, mifepristone (Korlym), received FDA approval for endogenous Cushing’s syndrome in 2012. Its market exclusivity extends until the mid-2020s, with recent approvals for relacorilant expanding therapeutic options. This exclusivity provides pricing power and reduces direct competition.

2. Strong Clinical Development Pipeline

The company’s focus on expanding indications and developing next-generation therapies, including its relacorilant pipeline for oncology and depression, provides diversified revenue streams. These efforts are supported by strategic collaborations and robust R&D investment, expected to sustain long-term growth.

3. Focused Niche and High Unmet Needs

Operating in a pharmacological niche with limited current options grants Corcept a significant competitive moat. The unmet needs in Cushing’s syndrome and related disorders allow premium pricing and foster brand loyalty among clinicians.

4. Strategic Collaborations and Licensing Agreements

Partnerships with academic institutions and licensing deals with pharmaceutical firms facilitate accelerated drug development and access to novel therapeutics. Notably, collaborations with the NIH enabled the company to leverage clinical data and expand its pipeline efficiently.

5. Financial Strength and Revenue Growth

Corcept has demonstrated sustained revenue growth driven by increased sales of Korlym and relacorilant. Its high gross margins, coupled with prudent operating expense management, reinforce financial stability. The company maintains a robust cash position, supporting continued R&D investment.

Strategic Insights

1. Focus on Expanding Indications and Market Penetration

Corcept’s future growth hinges on successfully gaining approvals for relacorilant in additional indications like renal cell carcinoma and depression. Its strategic focus on expanding approved uses increases revenue potential and reduces reliance on a single product.

2. Differentiation Through Precision Medicine

Tailoring therapies to specific patient subgroups enhances treatment efficacy and minimizes adverse effects. Corcept’s emphasis on biomarkers and personalized approaches aligns with industry trends toward precision medicine, positioning it as a leader in targeted therapies.

3. Price Optimization and Reimbursement Strategies

Engaging with payers to ensure favorable reimbursement policies remains critical. The company’s strong clinical evidence supports premium pricing but must navigate evolving healthcare policies and cost-containment pressures.

4. Investment in Digital and Patient Engagement Platforms

Digital engagement with patients and healthcare providers helps improve adherence, collection of real-world data, and brand loyalty. Such investments can facilitate faster adoption of new indications and therapies.

5. Navigating Competitive and Regulatory Risks

The potential entry of biosimilars or new entrants developing glucocorticoid receptor antagonists requires vigilant IP management and continuous innovation. Staying ahead through R&D and maintaining regulatory compliance is vital.

Challenges and Risks

- Patent Expiry and Biosimilar Competition: Patent cliffs and emerging generics may erode pricing power.

- Regulatory Hurdles: Approval delays or unfavorable safety data can hinder pipeline progression.

- Market Adoption: Clinician reluctance or limited awareness could slow patient uptake.

- Pricing Pressures: Healthcare policy shifts toward price regulation threaten high-margin revenue models.

Conclusion

Corcept Therapeutics’ specialized focus, solid clinical pipeline, and strategic initiatives position it as a leader in its niche markets. While challenges such as patent expiration and competitive threats loom, its robust financial health and ongoing pipeline development provide resilience. By leveraging its strengths and adopting proactive strategic measures, Corcept is poised to sustain growth and enhance its market profile amid evolving industry dynamics.

Key Takeaways

- Market Leadership: Corcept holds a commanding position in the niche of cortisol receptor antagonists, with a first-mover advantage and FDA approvals that secure its market share.

- Pipeline Expansion: Diversification into oncology and psychiatric indications via relacorilant and other pipeline assets will be critical to future growth.

- Strategic Differentiation: Focused therapeutic areas, personalized medicine, and collaborations differentiate Corcept from broader pharma competitors.

- Financial Discipline: Steady revenue growth and cash reserves enable sustained R&D investment and strategic acquisitions.

- Risk Management: Vigilant IP management, regulatory compliance, and payer engagement are vital to mitigate competitive and market risks.

FAQs

1. What distinguishes Corcept’s core products from competitors?

Corcept’s core products are cortisol receptor antagonists with FDA approval for specific indications like Cushing’s syndrome. Their differentiated mechanism of action, high efficacy, and proprietary formulations provide competitive advantages, especially given limited alternatives for such severe conditions.

2. How does Corcept plan to expand its market presence?

Through regulatory approval of relacorilant for additional indications, developing novel therapies targeting oncology and mental health, expanding payer coverage, and increasing clinician awareness via strategic collaborations.

3. What are the main risks facing Corcept’s growth?

Patent expirations, emergence of biosimilars, regulatory hurdles, potential safety concerns, and healthcare policy changes affecting drug pricing and reimbursement.

4. How important are collaborations to Corcept’s pipeline success?

Extremely. Partnerships with research institutions and licensing agreements accelerate drug development, reduce costs, and broaden the scope of therapeutic applications, thereby de-risking pipeline progression.

5. What are the long-term prospects for Corcept in its niche market?

Given its focused therapeutic area, ongoing pipeline expansion, and a high unmet medical need landscape, Corcept’s long-term prospects appear favorable if it maintains innovation momentum and navigates industry challenges strategically.

References

[1] MarketResearch.com, "Global Cushing’s Syndrome Therapeutics Market," 2022.

[2] FDA, “Corcept Therapeutics – Korlym Approval Details,” 2012.

[3] Corcept Therapeutics Annual Reports, 2020-2022.

[4] EvaluatePharma, "Pharmacoeconomic Analysis of Cortisol Modulators," 2023.

[5] SEC Filings, Corcept Therapeutics, 2023.