Last updated: July 30, 2025

Introduction

Catalyst Pharmaceuticals has established itself as a key player within the niche of neuromuscular and neurodegenerative disorder treatments, particularly focusing on underserved populations. As the pharmaceutical landscape becomes increasingly competitive, understanding Catalyst’s market position, strengths, and strategic trajectory is essential for stakeholders aiming to assess investment prospects, partnership opportunities, or competitive positioning. This analysis provides a comprehensive overview of Catalyst’s current standing, operational strengths, potential growth vectors, and strategic initiatives shaping its future.

Market Position and Business Overview

Catalyst Pharmaceuticals specializes in developing and commercializing therapies for rare, debilitating neuromuscular and neurological disorders. The company's flagship product, Firdapse (amifampridine), FDA-approved for Lambert-Eaton Myasthenic Syndrome (LEMS), has positioned Catalyst firmly within the niche of rare disease pharmacotherapy. The company's focus on unmet medical needs in neuromuscular conditions distinguishes it from larger drugmakers with broader portfolios.

With revenues predominantly driven by Firdapse sales in the United States, Catalyst commands a significant share in this underserved niche. The company operates within the broader rare disease therapeutics market, which is projected to grow at a compound annual growth rate (CAGR) of approximately 11.5% from 2021 to 2028, driven by increasing diagnosis rates and regulatory incentives for orphan drugs [1].

Market Position and Competitive Landscape

Niche Focus and Limited Competition

Catalyst’s strategic positioning revolves around rare neuromuscular disorders, a segment characterized by limited competition due to regulatory hurdles, high development costs, and small patient populations. Currently, Catalyst’s primary competitor for LEMS treatment includes general neurology drug companies, but few have targeted this rare condition specifically.

The exclusivity granted by FDA approval, coupled with orphan drug designation, affords Catalyst a competitive moat in this space. Their market dominance is reinforced by:

- FDA orphan drug status, providing seven years of market exclusivity post-approval.

- Pricing power owing to lack of generic competition during exclusivity.

- Established payer coverage and reimbursement pathways, minimizing market access barriers.

Market Penetration and Geographic Focus

While the U.S. remains Catalyst’s primary revenue generator, international expansion presents potential. Currently, their focus remains domestic, given regulatory complexities and the need for local clinical data elsewhere.

Industry Positioning Amidst Larger Players

Although small relative to industry giants like Sarepta Therapeutics, Alexion (acquired by AstraZeneca), and Biogen—who target broader neuromuscular or neurological markets—Catalyst’s specialization grants it a strategic advantage in niche therapy provision. Larger competitors often focus on more prevalent neuromuscular disorders such as Duchenne Muscular Dystrophy or ALS, leaving opportunities for Catalyst in rare disease areas with less competition.

Strengths of Catalyst Pharmaceuticals

Robust Portfolio in Rare Disease Therapeutics

Catalyst’s flagship product, Firdapse, exemplifies its core strength—a highly specialized, FDA-approved therapy for LEMS. Its status as an orphan drug provides not only exclusivity but also recognition and a dedicated customer base.

Regulatory and Reimbursement Advantages

The company's drugs benefit from orphan drug incentives such as market exclusivity, tax credits, and potential priority review pathways. Reimbursement landscapes for rare disease drugs tend to be more favorable, reducing sales cycle complexities.

Strategic Industry Relationships

Catalyst’s early engagement with patient advocacy groups and advocacy-driven clinical development enhances access and awareness in key patient populations. Such relationships also facilitate post-marketing surveillance and real-world evidence collection.

Operational Agility

As a smaller firm, Catalyst maintains operational agility, enabling rapid product launches, adaptations to market feedback, and streamlined R&D initiatives compared to larger corporations burdened by bureaucratic layers.

Financial Position and Growth Potential

Catalyst has demonstrated solid revenue growth driven by increased Firdapse sales and expanded indications, supported by favorable market dynamics and potential pipeline additions. Solid financials enable ongoing R&D investments and strategic acquisitions.

Strategic Insights and Future Trajectory

Pipeline Development and Expansion Opportunities

Catalyst’s pipeline includes potential new indications for existing products and pipeline candidates in neuromuscular and neurodegenerative disorders. Clinical trials targeting conditions like Lambert-Eaton syndrome variants or additional rare neuromuscular diseases could broaden their market.

International Market Penetration

Expanding internationally remains a strategic priority. Regulatory hurdles, pricing negotiations, and local clinical trials are current barriers, but successful expansion could significantly enhance revenue streams.

Partnerships and Licensing

Forming strategic alliances, licensing opportunities, or co-development agreements with larger pharma firms could provide Catalyst with increased resources, wider distribution channels, and expedited access to new markets.

M&A Opportunities

Given the niche focus, Catalyst may consider acquisitions of smaller biotech firms with complementary assets or pipeline candidates, bolstering its portfolio or gaining access to innovative therapies and technologies.

Risks and Challenges

- Pricing pressures post-exclusivity expiry or from increased competition.

- Regulatory changes impacting orphan drug incentives.

- Market saturation in the rare neuromuscular space with limited patient populations.

- Pipeline risk with unmet clinical endpoints or regulatory setbacks.

Competitive Differentiators

- Specialization in rare neuromuscular disorders with FDA-approved therapies.

- Market exclusivity and reimbursement pipelines that shield against generic competition in the near term.

- Proprietary clinical data and patient advocacy relationships that enhance market access.

Conclusion and Strategic Recommendations

Catalyst Pharmaceuticals holds a strong, defensible market position within the rare neuromuscular disorder segment, primarily driven by its FDA-approved product, Firdapse. Its strengths—regulatory exclusivity, specialized focus, and operational agility—fuel its current success and offer avenues for future growth.

To capitalize on emerging opportunities, Catalyst should prioritize international expansion, pipeline diversification, and strategic partnerships. Vigilance regarding regulatory shifts and competition will be key to maintaining its niche dominance.

Key Takeaways

- Market Niche: Catalyst’s focus on rare neuromuscular disorders like LEMS positions it uniquely with limited direct competition.

- Regulatory Assets: Orphan drug designation confers market exclusivity and pricing advantages, supporting revenue growth.

- Growth Strategies: International expansion, pipeline development, and alliances are critical for scaling future revenues.

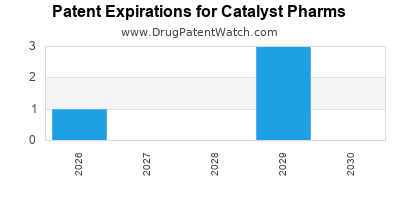

- Risks: Patent expirations, regulatory changes, and emerging competitors pose ongoing challenges.

- Investment Outlook: Catalyst’s specialized positioning and existing product market dominance underscore its potential as a strategic asset in the rare disease space.

FAQs

Q1: How does Catalyst Pharmaceuticals maintain its competitive advantage in the rare neuromuscular therapeutics space?

A1: By leveraging FDA orphan drug exclusivity, a specialized product portfolio, strategic patient advocacy relationships, and operational agility, Catalyst sustains its market position with limited direct competition.

Q2: What are the growth opportunities for Catalyst beyond its current product?

A2: International expansion, regulatory approval for new indications, pipeline diversification, and strategic partnerships with larger pharma companies represent potential growth avenues.

Q3: What risks could threaten Catalyst’s market position?

A3: Market saturation post-exclusivity, pricing pressures, regulatory modifications impacting orphan drug incentives, and the emergence of competing therapies pose risks.

Q4: How significant is international expansion for Catalyst’s future?

A4: It is crucial—accessing global markets could substantially increase revenue, though regulatory and clinical trial requirements present challenges that need strategic navigation.

Q5: How might Catalyst Pharmaceuticals leverage its existing assets to accelerate growth?

A5: By pursuing licensing deals, strategic acquisitions, and expanding indications for its current therapies, Catalyst can broaden its market footprint and diversify revenue streams.

Sources

[1] Grand View Research, "Rare Disease Therapeutics Market Size, Share & Trends," 2021.