Last updated: July 29, 2025

Introduction

Agile Therapeutics, Inc. operates within the complex pharmaceutical and women's health sectors, primarily focusing on innovative contraceptive solutions. As a public company listed on NASDAQ, Agile’s strategic positioning reflects a targeted approach toward reproductive health, emphasizing both development and commercialization. This landscape analysis offers a comprehensive overview of Agile’s market position, core strengths, competitive edge, and strategic implications within the evolving pharmaceutical ecosystem.

Market Position Overview

Agile’s niche within the contraceptive and women’s health markets positions it as a specialized player, primarily emphasizing women-centric reproductive options. The company’s flagship product, Anya, a monthly vaginal contraceptive ring, aims to address unmet needs through high efficacy, ease of use, and reduced side effects compared to traditional hormonal methods. Its market strategy involves direct engagement with healthcare providers, targeted marketing, and ongoing clinical trials to expand its product pipeline.

Market Dynamics & Trends

The global contraceptive market is projected to reach USD 23.8 billion by 2025, driven by increasing awareness, technological advancements, and rising acceptance of female-controlled contraception [1]. Agile’s focus on a novel delivery system positions it well within an industry experiencing continued innovation and consumer preference shifts toward discreet, user-friendly options.

Competitive Positioning

Agile faces competition from established pharmaceutical giants such as Pfizer, Merck, and Bayer, which dominate conventional hormonal contraceptive markets. However, Agile’s emphasis on novel, non-systemic delivery methods offers differentiation, especially in a segment increasingly interested in non-invasive and hormone-free options.

Strengths of Agile Therapeutics

1. Innovative Product Portfolio

Agile’s flagship product, Anya, is among the few monthly vaginal rings considering commercialization. This device offers several advantages, including discreetness, reversibility, and minimal systemic hormone exposure, appealing to women seeking alternative contraceptive methods. Furthermore, Agile is actively developing additional formulations and delivery systems that align with emerging demand patterns [2].

2. Clinical and Regulatory Progress

The company’s rigorous clinical trials bolster its product credibility, with significant milestones including successful Phase III trials and breakthrough designation by regulatory agencies. This progress facilitates smoother pathways toward approvals, reducing time-to-market and fostering investor confidence.

3. Strategic Partnerships and Collaborations

Agile maintains collaborations with research institutions and manufacturing entities, enabling access to cutting-edge technologies and cost efficiencies. Strategic alliances also enhance its R&D capabilities and risk-sharing, particularly in clinical development and commercialization.

4. Focused Niche Market

Operating within the women’s health segment, Agile benefits from a concentrated target demographic with dedicated healthcare needs. This niche focus reduces competitive saturation and allows for tailored marketing and educational campaigns, fostering brand loyalty.

5. Flexibility & Agility in R&D

Agile’s comparatively lean organizational structure offers agility to pivot product development based on regulatory feedback and market signals. This responsiveness is crucial in the rapidly evolving reproductive health landscape.

Strategic Insights and Recommendations

1. Accelerate Market Entry & Commercialization

Given recent clinical success and regulatory advancements, Agile should prioritize expediting the product launch of Anya through strategic commercialization plans. Leveraging digital marketing techniques and healthcare provider education will boost early adoption.

2. Broaden Product pipeline through R&D Investment

Diversifying offerings beyond Anya—such as combining contraceptive efficacy with additional benefits like disease prevention—can help agile capture a larger market share. Investment in novel delivery mechanisms and drug-device combination products should be prioritized.

3. Expand Geographic Footprint

While primarily focused on the U.S. market, Agile should explore international opportunities, especially in emerging markets with unmet contraceptive demands. Local regulatory strategies and partnerships with regional distributors will be instrumental.

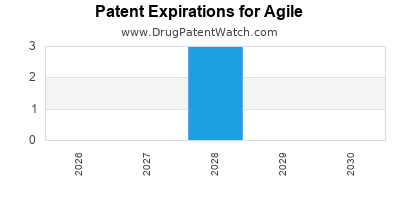

4. Strengthen Regulatory and Intellectual Property (IP) Positioning

Proactive engagement with regulatory agencies to secure streamlined approvals must be complemented by robust IP protections to safeguard market exclusivity, discouraging imitation by competitors.

5. Form Strategic Alliances for Enhanced Market Penetration

Partnering with larger pharmaceutical firms or healthcare providers can accelerate product adoption, enhance credibility, and facilitate broader distribution channels.

Challenges & Risks

Despite strengths, Agile faces notable challenges. The competitive landscape is intense, with established players rapidly innovating and expanding their portfolios. Moreover, regulatory hurdles and clinical trial risks could delay or impede market entry. Additionally, market acceptance depends on patient education, physician adoption, and insurance reimbursement policies, which can vary widely.

Conclusion

Agile Therapeutics operates a promising niche within the competitive contraceptive market, underpinned by innovative product development, strategic clinical progress, and focus on unmet market needs. To capitalize on its potential, Agile must accelerate commercialization, diversify its pipeline, and expand globally through strategic partnerships and regulatory mastery. Continuous innovation and adaptation will be vital for sustaining competitive advantage in the dynamic pharmaceutical landscape.

Key Takeaways

- Agile’s focus on vaginal contraceptive delivery distinguishes it amid fierce competition from established pharmaceutical titans.

- Near-term opportunities hinge on successful product launches, leveraging clinical progress and regulatory approvals.

- Diversification and expansion into international markets can unlock additional revenue streams.

- Protecting intellectual property and fostering strategic collaborations will be essential to sustain market dominance.

- Navigating regulatory complexities and fostering physician and consumer acceptance remain critical hurdles.

FAQs

Q1: What distinguishes Agile Therapeutics’ flagship product, Anya, from traditional contraceptive options?

Anya offers a monthly, hormone-releasing vaginal ring that is discreet, reversible, and delivers contraceptive efficacy with minimal systemic hormone exposure, addressing women's needs for non-invasive, controlled contraception.

Q2: How does Agile’s strategic approach position it against larger competitors?

Agile focuses on niche innovation, clinical validation, and targeted marketing, enabling it to differentiate through specialized products and agile R&D, providing a competitive edge against larger, more diversified firms.

Q3: What are the primary regulatory hurdles facing Agile?

Agile must navigate FDA approval processes, ensure compliance with clinical standards, and secure clear pathways for new formulations, which can be time-consuming and resource-intensive.

Q4: What market segments offer the greatest growth potential for Agile?

The U.S. and European markets present substantial opportunities due to high healthcare expenditure and awareness; emerging markets offer potential due to unmet contraceptive needs and changing social norms.

Q5: What strategic actions should Agile undertake to maximize its market potential?

Prioritizing product commercialization, expanding R&D, forming strategic partnerships, safeguarding IP rights, and planning international expansion are crucial steps toward sustainable growth.

References

[1] MarketsandMarkets. (2019). Contraceptives Market by Product, End User, and Region – Global Forecast to 2025.

[2] Agile Therapeutics. (2023). Corporate Presentation and Clinical Development Pipeline.