Last updated: July 27, 2025

Introduction

Alcon Labs Inc., a global leader in eye care, specializes in the development, manufacturing, and commercialization of ophthalmic pharmaceuticals, surgical devices, and vision care products. As part of Novartis until its divestiture in 2019, Alcon has maintained its independence as a dedicated eye care specialist. This analysis examines Alcon's current market position, competitive strengths, challenges, and strategic initiatives within the highly competitive ophthalmology sector to aid stakeholders in strategic decision-making.

Market Position and Industry Overview

Alcon operates in a dynamic healthcare landscape characterized by rising global prevalence of eye disorders, technological innovation, and regulatory complexity. The global ophthalmic pharmaceuticals market was valued at approximately USD 32 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of around 4.9% through 2028 [1]. This growth is driven by aging populations, increased awareness, and technological advances like minimally invasive surgical procedures.

Alcon holds a leading position within this sector, ranking among top ophthalmic companies alongside Johnson & Johnson Vision, Bausch + Lomb, and publisher-specific niche players. Its product portfolio spans popular segments: anti-inflammatory drugs, antibiotics, intraocular lenses, surgical equipment, contact lens solutions, and diagnostic devices.

Market Share and Revenue

In 2022, Alcon reported revenues exceeding USD 8 billion, consolidating its status as a top-tier ophthalmic solutions provider [2]. Its critical market shares include dominant positions in intraocular lenses and surgical equipment segments worldwide. The company's strategic focus on innovation and geographical expansion underpin its robust revenue base.

Strengths and Competitive Advantages

1. Extensive Product Portfolio and Innovation Capabilities

Alcon boasts a comprehensive portfolio that addresses unmet clinical needs and diversifies its revenue streams. Its leading products include the AcrySyl and Tecnis intraocular lens (IOL) lines, and surgical platforms like the CONSTELLATION Vision System, designed for optimized cataract surgeries.

The company invests approximately 6-8% of its revenues into R&D annually, fostering innovation in drug delivery systems, advanced intraocular devices, and minimally invasive surgical tools [3]. Its notable recent product launches include the Air Optix family of contact lenses and CE-marked drug delivery devices, strengthening its pipeline.

2. Global Market Reach and Distribution Network

With operations in over 140 countries, Alcon's extensive distribution network enhances market penetration, especially in emerging markets such as Asia-Pacific, Latin America, and parts of Africa. This geographical footprint allows rapid adaptation to regional demand fluctuations and local regulatory landscapes.

3. Strategic Acquisitions and Collaborations

Alcon’s acquisitions, such as that of Ivantis (minimally invasive glaucoma surgery technology) in 2021, bolster its portfolio and facilitate technological gains. Collaborations with academic and clinical institutions foster innovation and credibility.

4. Strong Brand Recognition and Clinical Presence

Alcon enjoys high brand equity owing to its long-standing presence and clinical track record. Its emphasis on ophthalmology-focused marketing and partnerships with surgeons and eye care professionals consolidates customer loyalty.

5. Financial Stability and Investment Capacity

With consistently high revenue margins and strong cash flows, Alcon sustains substantial investments in R&D, marketing, and new product development, ensuring continuous innovation and competitive resilience.

Challenges and Competitive Risks

1. Intense Market Competition

Alcon faces aggressive competition from Johnson & Johnson Vision, Bausch + Lomb, and newer entrants like Oculus (a subsidiary of Facebook) exploring augmented reality therapies. Market saturation in mature regions and commoditization of certain products pressure margins.

2. Regulatory and Reimbursement Dynamics

Regulatory shifts—such as reimbursement policy changes, drug approval delays, and compliance costs—pose ongoing risks, especially amid differing international standards.

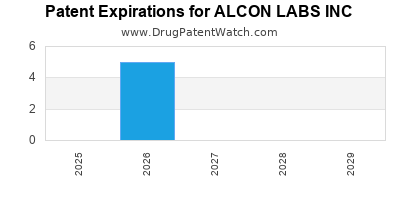

3. Patent Expirations and Generic Competition

Expiration of key patents, particularly in contact lens solutions and ophthalmic drugs, exposes Alcon to generic competition, impacting margins and market share.

4. Innovation and Technological Disruption

The rapidly evolving field necessitates continuous innovation. Disruption by new technologies, such as gene therapies for degenerative eye diseases or AI-enabled diagnostic tools, could reshape competitive dynamics.

5. Supply Chain and Manufacturing Vulnerabilities

Global supply chain disruptions, notably post-pandemic, impact production of high-precision ophthalmic devices and pharmaceuticals, affecting delivery timelines and customer satisfaction.

Strategic Initiatives and Future Outlook

1. Focus on Innovations and Digital Transformation

Alcon’s strategic drive emphasizes pharmacological innovations, surgical device advancements, and digital health solutions. The company is investing in AI-powered diagnostics and teleophthalmology, aiming to enhance precision medicine and patient engagement.

2. Expanding Presence in Emerging Markets

Targeted investments in infrastructure, local manufacturing, and partnerships underpin Alcon’s growth strategy in underserved markets with rising eye care needs.

3. Strategic Mergers and Acquisitions

Alcon aligns with its growth ambitions through acquisitions like the recent buyout of eye care tech firms pursuing minimally invasive procedures and drug delivery systems.

4. Enhancing Portfolio through Personalized Medicine

Development of bespoke treatment options incorporating pharmacogenomics and targeted therapies positions Alcon at the forefront of personalized ophthalmology.

5. Sustainability and Regulatory Excellence

Adapting to global sustainability standards, and investing in compliant, eco-friendly manufacturing processes, supports corporate social responsibility and brand reputation.

Conclusion

Alcon remains a formidable player in the ophthalmic industry, credited to its diversified product offerings, innovation focus, and extensive global footprint. However, it must navigate considerable competitive pressures, regulatory complexities, and technological shifts to sustain its market leadership. Strategic investments in digital health, emerging markets, and personalized medicine will likely define its long-term trajectory.

Key Takeaways

- Market Leadership: Alcon holds a prominent position in laser and surgical ophthalmology segments, supported by a diversified portfolio.

- Innovation Focus: Heavy investment in R&D enables continuous pipeline development, facilitating adaptation to clinical and technological trends.

- Global Reach: Extensive international presence ensures access to emerging markets with rising eye care demands.

- Competitive Risks: Facing patent expirations, market saturation, and disruptive innovation, Alcon must maintain agility and strategic foresight.

- Strategic Pathways: Emphasizing digital transformation, acquisitions, and personalized solutions will be critical to sustained growth.

FAQs

1. How does Alcon differentiate itself from competitors like Johnson & Johnson Vision?

Alcon emphasizes a comprehensive ophthalmic portfolio with a strong focus on surgical innovation and personalized therapies. Its relentless R&D investment and strategic acquisitions bolster differentiation through novel products and advanced surgical platforms.

2. What are the primary growth areas for Alcon over the next five years?

Emerging markets, minimally invasive surgical procedures, digital health integration, and personalized ophthalmic treatments represent key growth avenues, supported by strategic investments and geographic expansion.

3. How has Alcon’s divestiture from Novartis impacted its market strategy?

Post-divestiture, Alcon operates as an independent entity with a dedicated focus on eye care innovation, enabling more agile decision-making and tailored strategic initiatives, accelerating its growth trajectory.

4. What regulatory challenges does Alcon face globally?

Alcon navigates complex regulatory environments across regions, including FDA approvals in the U.S., EMA standards in Europe, and local market regulations, which can delay product launches and influence pricing.

5. How is Alcon addressing the rising demand for digital health solutions in ophthalmology?

Alcon is developing AI-powered diagnostic tools, telemedicine platforms, and connected surgical devices to enhance clinical outcomes, streamline workflows, and improve patient engagement.

References

[1] MarketWatch. "Ophthalmic pharmaceuticals market size & trends." 2022.

[2] Alcon Annual Report 2022.

[3] Reuters. "Alcon invests heavily in R&D to sustain growth." 2022.