Last updated: July 30, 2025

Introduction

JUNEL 1.5/30, a combined oral contraceptive containing 1.5 mg of levonorgestrel and 30 micrograms of ethinylestradiol, remains a staple in the contraception market. Its pharmacological efficacy, safety profile, and minimal side effects enable it to retain a pivotal position amid evolving reproductive health demands. Understanding the market dynamics and financial trajectory of JUNEL 1.5/30 involves analyzing regulatory landscapes, competitive positioning, consumer preferences, and emerging trends in contraception.

Market Overview and Demand Drivers

The global contraceptive market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 4.3% between 2022 and 2028, driven by increasing awareness of reproductive health, rising women’s workforce participation, and expanding healthcare infrastructure [1]. JUNEL 1.5/30, as a well-established generic product, benefits from these macro trends.

In developed regions such as North America and Europe, contraception remains a consumer preference due to heightened awareness and demand for reversible, low-risk options. Meanwhile, in emerging markets—Asia-Pacific, Latin America, and Africa—improvements in healthcare access and education are fueling increased adoption of oral contraceptives, including JUNEL 1.5/30 [2].

Regulatory and Intellectual Property Landscape

The regulatory environment profoundly impacts JUNEL 1.5/30's market trajectory. As a generic, JUNEL benefits from established regulatory pathways, with approvals based on bioequivalence to the innovator. Patent expirations have historically facilitated market access by multiple manufacturers.

However, patent protections on the original formulation have expired, and generic manufacturers utilize this to introduce cost-effective versions. Currently, no significant patent barriers restrict JUNEL 1.5/30's manufacturing or distribution, allowing competitive pricing strategies that appeal to both insurers and consumers.

Regulatory developments focusing on safety and labeling—particularly in jurisdictions like the European Union and the U.S.—may influence the drug’s marketability but are unlikely to limit its current market position given its long-standing approval profile.

Competitive Landscape

JUNEL 1.5/30 faces competition from both branded and generic oral contraceptives, notably Triphasic and Monophasic formulations with varying estrogen-progestin ratios. Major players include Teva, Mylan, and Sandoz, all of which produce similar levonorgestrel-ethinylestradiol combinations.

Market share is influenced by factors such as pricing, prescriber preferences, side effect profiles, and patient packaging. Generic versions often have a cost advantage, leading to increased penetration in price-sensitive markets. As regulatory pathways streamline, new entrants with innovative delivery methods or formulations may challenge JUNEL’s market stability.

Consumer Trends and Prescriber Behavior

Consumer preferences currently favor oral contraceptives with established safety profiles. The contraceptive counseling trend emphasizes personalized medicine, where factors such as BMI, age, and comorbidities influence prescription patterns. JUNEL 1.5/30's low-dose estrogen profile aligns with safety concerns over thromboembolic risks associated with higher estrogen doses [3].

Moreover, a shift towards long-acting reversible contraceptives (LARCs)—e.g., intrauterine devices (IUDs) and implants—might temper growth prospects for oral formulations. Nonetheless, for women prioritizing flexibility and non-invasiveness, JUNEL remains a first-line choice, especially in regions with robust healthcare delivery.

Pricing Strategies and Reimbursement Policies

Pricing dynamics significantly influence the financial trajectory of JUNEL 1.5/30. Generics are therefore priced lower than branded counterparts, leading to greater adoption in cost-conscious healthcare settings. In high-income countries, reimbursement policies favor cost-effective generics, bolstering market volume.

In developing markets, government subsidies and insurance coverage further stimulate demand. Pharmacoeconomic studies demonstrating the cost-benefit ratio of generic oral contraceptives support favorable reimbursement policies, reinforcing JUNEL 1.5/30’s market position.

Emerging Trends and Innovation Opportunities

The contraceptive landscape is witnessing innovation in delivery systems—transdermal patches, vaginal rings, and injectables—aiming to improve compliance and extend duration of action. JUNEL’s market share may see competition from these modalities over the coming decade.

However, ongoing research into novel formulations with reduced hormone doses or targeted delivery mechanisms could enhance JUNEL’s appeal. Companies exploring bioadhesive patches or digital health integration could also recalibrate competitive dynamics.

Additionally, increasing focus on contraception for specific populations, such as adolescents and women with certain health conditions, opens new market segments. Tailored formulations or co-diagnosis management may foster niche growth opportunities for JUNEL.

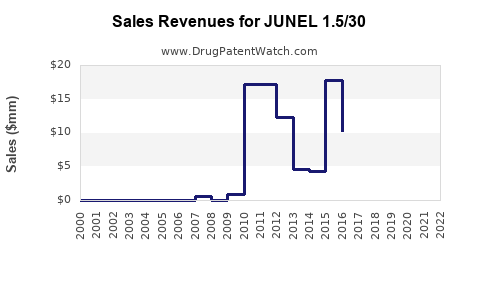

Financial Trajectory and Market Projections

JUNEL 1.5/30’s revenue trajectory will hinge on several factors:

- Market Penetration: In mature markets, growth is primarily volume-driven, supported by demographic expansion and policies promoting family planning.

- Pricing Strategy: Maintaining competitive pricing amid generic proliferation is crucial to sustain market share.

- Regulatory Environment: Streamlined approvals and minimal barriers support consistent availability.

- Competitive Innovation: The emergence of new contraceptive methods might marginalize oral pills unless differentiated through safety, cost, or convenience.

Current estimates suggest a compounded annual growth in revenues of approximately 2-3% over the next five years in developed markets, with higher growth potential (4-5%) in emerging regions due to demographic trends and increasing healthcare coverage [4].

Major pharmaceutical companies investing in manufacturing efficiencies and marketing efforts will influence this trajectory. Market segmentation insights indicate sustained steady demand, but growth may plateau as the contraceptive industry diversifies.

Regulatory and Market Risks

Risks include regulatory delays, patent litigations, and safety concerns resulting in labeling restrictions. The long-term safety scrutiny over hormonal formulations necessitates continuous post-marketing surveillance.

Market risks are also linked to global health policies discouraging hormone-based contraceptives or advocating for alternative methods, which might impact JUNEL’s market volume.

Key Takeaways

- Sustained Demand for Established Products: JUNEL 1.5/30 maintains a stable market position owing to its proven efficacy, safety, and cost-effectiveness, especially in emerging markets.

- Competitive Price Advantage: As a generic, it benefits from lower manufacturing costs and reimbursement policies favoring cost-effective options.

- Market Growth in Emerging Economies: Demographic shifts and expanding healthcare infrastructure support a double-digit growth rate in these regions.

- Innovation and Competition: Advancements in contraceptive technology and shifting consumer preferences pose challenges, necessitating strategic differentiation.

- Regulatory Stability: No immediate patent threats or regulatory hurdles are anticipated, providing a clear path for continued market presence.

FAQs

1. What factors influence the market growth of JUNEL 1.5/30?

Market growth hinges on demographic expansion, healthcare access, regulatory approvals, competitive pricing, and consumer preference shifts toward oral contraceptives.

2. How does patent expiration impact JUNEL 1.5/30’s market position?

Patent expirations open the market to generic manufacturers, increasing competition but also enabling price reductions that boost accessibility and volume.

3. Are there safety concerns affecting JUNEL 1.5/30 sales?

While hormonal contraceptives carry certain risks (e.g., thromboembolism), the low-dose estrogen formulation of JUNEL generally maintains a favorable safety profile, aligned with current clinical guidelines.

4. How might emerging contraceptive technologies influence JUNEL’s future?

Innovations like long-acting reversible methods and digital health integration could shift consumer preferences, pressing JUNEL to adapt through formulation improvements or marketing strategies.

5. What are the key markets for JUNEL 1.5/30 in the coming years?

Emerging markets in Asia-Pacific, Latin America, and Africa are critical growth regions, driven by demographic trends and expanding healthcare infrastructure, while North America and Europe will continue stable demand based on healthcare policies and consumer choice.

References

- Market Research Future. "Global Contraceptive Market Analysis." 2022.

- WHO. "Reproductive Health and Family Planning in Developing Countries." 2021.

- American College of Obstetricians and Gynecologists. "Hormonal Contraception and Thromboembolism." 2020.

- IQVIA. "The Future of Women's Health: Contraception Market Outlook." 2022.