Last updated: July 30, 2025

Introduction

JUNEL 1/20 is a combined oral contraceptive formulated with ethinyl estradiol and norethindrone, marketed predominantly in the United States and other global markets. As a birth control pill, it constitutes a significant segment within the hormonal contraceptive market, which has exhibited sustained growth driven by evolving reproductive health needs, changing societal norms, and technological advancements. This analysis explores the current market dynamics, competitive landscape, regulatory environment, and financial trajectory of JUNEL 1/20, providing actionable insights for stakeholders.

Market Overview

The global hormonal contraceptive market was valued at approximately USD 19.8 billion in 2022 and is anticipated to reach USD 28.8 billion by 2029, expanding at a compound annual growth rate (CAGR) of around 5.4% (source: MarketsandMarkets). North America, particularly the United States, dominates this space, owing to high contraceptive awareness, favorable reimbursement policies, and robust healthcare infrastructure.

JUNEL 1/20 caters to a crucial niche within this sector—combining efficacy with user convenience. Its prescription-based distribution model, focus on consumer safety, and long-standing presence in the market underpin its steady revenue stream.

Market Dynamics

1. Demographic Trends and Consumer Demand

The rising global female workforce, delay in childbirth, and shifting cultural attitudes towards family planning fuel demand for oral contraceptives like JUNEL 1/20. According to the U.S. CDC, approximately 62% of women aged 15–49 rely at some point on prescription contraceptives, with oral pills representing about 25% of methods used.

2. Innovation and Product Differentiation

While JUNEL 1/20 maintains a stable market position due to its proven efficacy and safety profile, emerging alternatives—such as long-acting reversible contraceptives (LARCs), implants, and hormonal patches—pose competitive threats. Pharmaceutical innovation, including development of lower-dose formulations, extended-cycle options, and combo pills with added health benefits, influences market share shifts.

3. Regulatory and Reimbursement Landscape

Regulatory agencies, notably the U.S. Food and Drug Administration (FDA), strictly oversee formulations, labeling, and safety data for contraceptives. Any amendments or new approvals affect product lifecycle strategies. Reimbursement policies, especially insurance coverage, significantly impact patient accessibility and brand proliferation.

4. Competitive Environment

Major players like Bayer, Bayer Pharma, Teva Pharmaceuticals, and Allergan (now part of AbbVie) dominate market share, often engaging in aggressive marketing, strategic partnerships, and patent protections. JUNEL 1/20 faces competition from generic and branded products offering similar efficacy at lower costs.

5. Market Challenges

-

Patent Expiration: The patent exclusivity of original formulations generally lasts about 20 years, after which generics flood the market, eroding revenue. JUNEL 1/20, introduced in the early 2000s, faces increasing generic competition.

-

Side Effect Profile: Concerns about adverse effects such as thrombosis or hormonal imbalances influence prescribing trends.

-

Regulatory Hurdles: Ongoing clinical studies assessing safety and efficacy can influence regulatory status or trigger label modifications.

Financial Trajectory

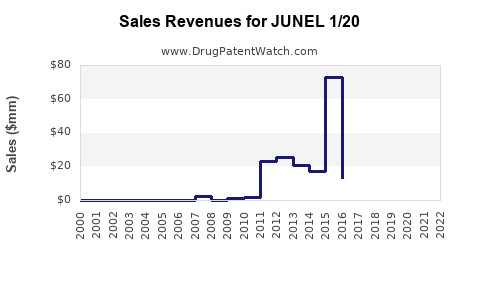

Historical Revenue Performance

Traditionally, JUNEL 1/20 has maintained stable revenues, aided by brand loyalty and physician preference. Exact revenue figures are generally proprietary; however, estimates suggest that combined oral contraceptives generator annual global sales of over USD 10 billion, with top brands accounting for a significant share.

Revenue Drivers

-

Patent Status and Generic Competition: The impending or recent patent expiration reduces premium pricing, steering revenue towards lower-margin generics. Consequently, revenue growth may plateau or decline unless differentiating factors are introduced.

-

Market Expansion: Entry into emerging markets, such as Asia-Pacific or Latin America, where contraceptive awareness is expanding, offers growth avenues.

-

Product Line Extensions: Development of new dosage forms, combination therapies, or indications (e.g., acne treatment) enhances the product portfolio and revenue streams.

Profitability and Investment Trends

-

Margins: Branded formulations like JUNEL 1/20 typically command higher margins pre-patent expiration. Post-patent, profit margins tend to shrink with the influx of generics.

-

R&D and Marketing: Continued investment in clinical validation and marketing sustains brand presence but weighs on margins.

Forecast Modeling

Analyst projections suggest that following patent expirations anticipated around 2024–2025, revenues will decline by approximately 30–50% over the subsequent 3–5 years unless market share shifts through strategic innovation or market expansion. Conversely, proactive lifecycle management—such as reformulations and new indications—may mitigate revenue erosion.

Strategic Considerations for Stakeholders

-

Brand Differentiation: Emphasizing safety, ease of use, or added health benefits can preserve premium pricing.

-

Pipeline Development: Investing in novel contraceptive methods or non-contraceptive health benefits enhances future revenue streams.

-

Market Penetration: Expanding into emerging markets and focusing on telemedicine can bolster sales.

-

Regulatory Engagement: Maintaining proactive dialogue with regulatory agencies ensures smoother approvals and label updates.

Conclusion

JUNEL 1/20 stands at a pivotal juncture, where patent expiration and evolving market dynamics threaten its historical revenue stability. However, opportunities abound in innovation, geographic expansion, and lifecycle management. Strategic alignment with current market trends—such as preference for personalized medicine and integrated health solutions—will be crucial for sustaining its financial trajectory.

Key Takeaways

-

Market Stability and Competition: JUNEL 1/20 maintains a solid market presence, but patent expiration and generic competition necessitate strategic innovation to preserve profitability.

-

Growth Opportunities: Expansion into emerging markets and product line extensions can offset revenue declines.

-

Regulatory and Consumer Trends: Adapting to regulatory changes and consumer preferences for safety and convenience will influence future performance.

-

Investment in Innovation: R&D focusing on next-generation contraceptives and health benefits is vital to ensuring long-term financial health.

-

Proactive Lifecycle Management: Timely product reformulations, label updates, and strategic marketing are essential to navigating patent cliffs and sustaining market relevance.

FAQs

1. When will JUNEL 1/20 face patent expiration, and how will it impact revenues?

Patent protection for JUNEL 1/20 is expected to expire around 2024–2025. Post-expiry, the market will see increased generic competition, typically leading to a significant decline in brand revenues unless the company innovates or diversifies its product portfolio.

2. How does generic competition influence the market share of JUNEL 1/20?

Generic entries usually offer similar efficacy at lower prices, often capturing a majority of the market share, thereby reducing revenues and profitability of the branded product.

3. What are key strategies to extend the financial life of JUNEL 1/20?

Implementing product reformulations, exploring new medical indications, expanding into emerging markets, and investing in consumer education are essential strategies for extending its market relevance.

4. Are there emerging alternatives that threaten the market share of oral contraceptives like JUNEL 1/20?

Yes, alternatives such as LARCs (e.g., IUDs, contraceptive implants), hormonal patches, and on-demand methods offer different benefits, often with higher efficacy or convenience, reducing reliance on oral contraceptives.

5. How can regulatory developments impact the future of JUNEL 1/20?

Regulatory agencies may impose new safety requirements, approve new formulations, or withdraw approvals based on safety data. Staying compliant and proactive engagement are vital for uninterrupted market access.

References

- MarketsandMarkets. Hormonal Contraceptive Market Report, 2022–2029.

- CDC. U.S. Selected Practice and Behavioral Interventions to Improve Use of Contraception.

- FDA. Approved Drug Products with Therapeutic Equivalence Evaluations.

- IMS Health. Pharmaceutical Market Reports, 2022.