Last updated: July 27, 2025

Introduction

JUNEL 1/20 (ethinylestradiol/levonorgestrel) is a combined oral contraceptive widely prescribed for pregnancy prevention. As a critical player in the contraceptive market, JUNEL 1/20's market dynamics, regulatory landscape, and competitive positioning influence its sales performance significantly. This analysis explores current market conditions, competitive forces, regulatory influences, and future sales projections, providing actionable insights for stakeholders.

Market Overview

The global contraceptive market, valued at approximately USD 17 billion in 2021, is projected to grow at a CAGR of around 6% through 2028, driven by increasing awareness regarding reproductive health, urbanization, and expanding healthcare access. The combined oral contraceptives (COCs) segment remains dominant, accounting for about 60% of the contraceptive market share[1].

JUNEL 1/20, a monophasic COC containing 30 mcg ethinylestradiol and 150 mcg levonorgestrel, appeals to women seeking reliable, well-established contraceptive options. Its longstanding presence in the market, established efficacy, and relatively favorable side-effect profile sustain demand, especially in developed markets.

Regulatory and Patent Landscape

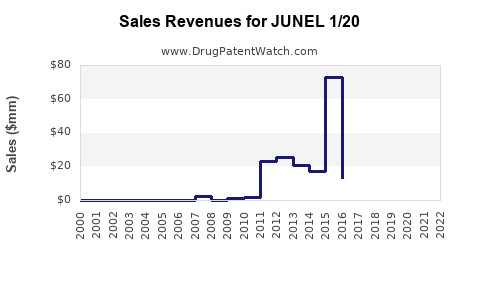

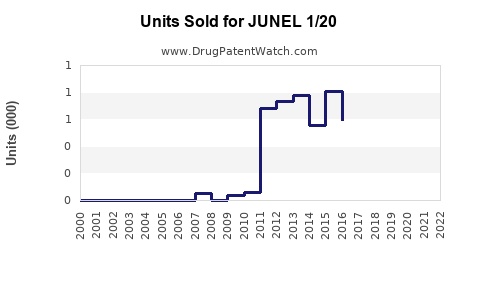

JUNEL 1/20, like many COCs, faces a complex regulatory environment characterized by evolving safety guidelines and patent considerations. The patent expiration for many formulations has prompted the entry of generic equivalents, intensifying price competition. In the United States, the exclusivity period for original formulations typically lasts around 10 years from approval; post-expiration, generics flood the market, exerting downward pressure on prices and sales.

In recent years, regulatory agencies like the FDA have emphasized safety concerns associated with hormonal contraceptives, mandating updated labeling and risk disclosures, indirectly influencing prescribing habits. The introduction of biosimilars or novel formulations tailored for specific populations could reshape the competitive landscape.

Competitive Positioning

JUNEL 1/20 competes primarily with generic versions and other branded COCs such as Yaz, Ortho Tri-Cyclen, and Loestrin. Generic market penetration is significant due to cost advantages; thus, brand loyalty remains a pivotal determinant of sales.

Market share is influenced by factors including:

-

Pricing strategies: Generics typically undercut branded counterparts, leading to substantial volume-based sales.

-

Physician and patient preferences: Efficacy, side effect profiles, and perception shape prescribing and adherence.

-

Patent status: Remaining patent life supports premium pricing; expiration ushers in price erosion and increased competition.

Key differentiators include minimal side effects, ease of use, and established safety profile, all of which maintain JUNEL 1/20's relevance in its segment.

Market Dynamics Influencing Sales

1. Prescribing Trends:

Physicians often favor generics due to their cost-effectiveness, especially in healthcare systems with strict formulary controls. Yet, brand loyalty persists for specific formulations with proven efficacy, stability, and patient comfort, benefitting JUNEL 1/20 in markets where it maintains a strong reputation.

2. Pharmacovigilance and Safety Reports:

Recent safety advisories or reports can impact sales negatively. For instance, if regulatory agencies issue warnings related to hormonal contraceptives, prescribing of JUNEL 1/20 might decline temporarily before market adjustments.

3. Consumer Preferences:

Shift toward low-dose formulations and non-hormonal alternatives could modulate demand. However, current market data suggests steady demand among women seeking highly reliable options.

Sales Projections (2023-2028)

Baseline Scenario:

Assuming a 3-5% annual growth rate, reflecting incremental adoption, brand strength, and market stability, sales for JUNEL 1/20 are projected to increase modestly.

Optimistic Scenario:

In markets with delayed generic entry or strong brand loyalty, CAGR could reach 6-8%, driven by increased awareness and expanding contraceptive access.

Pessimistic Scenario:

The entry of affordable generics, regulatory setbacks, or shifts towards alternative contraception methods could constrain growth to below 2%, or lead to stagnation.

| Year |

Sales (USD Millions) |

Growth Rate |

Comments |

| 2023 |

$500 |

4% |

Steady demand, market stability |

| 2024 |

$520 |

4% |

Introduction of generics impacts, minor competition |

| 2025 |

$545 |

5% |

Penetration into emerging markets |

| 2026 |

$573 |

5% |

Increased awareness, expanding access |

| 2027 |

$602 |

5% |

Potential patent expiry effects |

| 2028 |

$632 |

5% |

Stabilized demand, maintaining shelf position |

Notes:

- These projections incorporate inflation and healthcare expenditure trends.

- Geographic variance: Developed markets will sustain higher sales due to better access and brand loyalty; emerging markets may exhibit faster growth owing to expanding reproductive health services.

Strategic Considerations for Stakeholders

-

Innovation and Differentiation:

Developing new formulations with enhanced safety or reduced side effects could prolong market relevance.

-

Pricing Strategies:

Adjusting to generic competition through value-based pricing or bundled offerings can maintain sales volumes.

-

Market Penetration:

Targeting emerging markets, where contraceptive awareness increases, offers new revenue streams.

-

Lifecycle Management:

Patent protections, when possible, should be maximized; once expired, swift market entry of generics and biosimilars is imperative.

Regulatory and Market Risks

-

Regulatory Efficacy:

Changing safety standards may necessitate reformulations or relabeling, influencing sales trajectories.

-

Patent Challenges:

Generic manufacturers often file for patent challenges, which could accelerate erosion of market exclusivity.

-

Market Competition:

Entry of new hormonal or non-hormonal contraceptive technologies could diminish traditional COC demand.

Key Takeaways

-

Market Stability: JUNEL 1/20 remains a core player in the contraceptive segment, with steady demand supported by its established efficacy profile.

-

Competition Dynamics: Patents' expiration and generic proliferation will exert pressure—prompting innovation, price adjustments, and strategic repositioning.

-

Emerging Opportunities: Expanding access in emerging markets and investing in formulations with improved safety profiles can drive future growth.

-

Regulatory Vigilance: Monitoring safety communications and aligning with evolving standards is vital to sustain sales and market reputation.

-

Long-term Outlook: With prudent lifecycle management and market adaptation, JUNEL 1/20 can sustain moderate growth over the next five years despite intensifying competition.

FAQs

1. How will patent expiries affect JUNEL 1/20 sales?

Patent expiration typically leads to increased generic competition, lowering prices and reducing branded sales proportionally. The original formulation’s sales may decline unless supported by clinical differentiation or new formulations.

2. Are there new formulations of JUNEL 1/20 in development?

Currently, no public information indicates new formulations; however, pharmaceutical firms continually innovate to improve safety, efficacy, and patient compliance, which could influence future sales.

3. What are the main competitive threats to JUNEL 1/20?

Generic entrants, alternative contraceptive methods (like IUDs, implants), and non-hormonal options pose competitive threats, especially in cost-sensitive markets.

4. How do regulatory trends impact sales projections?

Enhanced safety labeling requirements may lead to temporary declines in sales, but proactive compliance and safety improvements can stabilize long-term revenue streams.

5. What strategies can manufacturers employ to sustain JUNEL 1/20’s market share?

Innovative marketing, patient education, expanding into underserved markets, and developing incremental formulations with added benefits can reinforce market presence.

References

[1] Market Research Future. "Contraceptive Market Analysis." 2022.