ella Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Ella, and what generic alternatives are available?

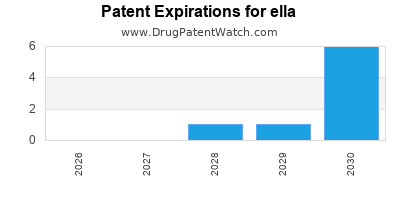

Ella is a drug marketed by Lab Hra Pharma and is included in one NDA. There are eight patents protecting this drug and one Paragraph IV challenge.

This drug has sixty-five patent family members in twenty-eight countries.

The generic ingredient in ELLA is ulipristal acetate. There are six drug master file entries for this compound. Three suppliers are listed for this compound. Additional details are available on the ulipristal acetate profile page.

DrugPatentWatch® Generic Entry Outlook for Ella

Ella was eligible for patent challenges on August 13, 2014.

There has been one patent litigation case involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for ella?

- What are the global sales for ella?

- What is Average Wholesale Price for ella?

Summary for ella

| International Patents: | 65 |

| US Patents: | 8 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 3 |

| Raw Ingredient (Bulk) Api Vendors: | 70 |

| Patent Applications: | 1,041 |

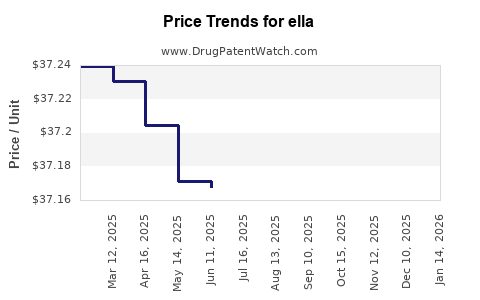

| Drug Prices: | Drug price information for ella |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for ella |

| What excipients (inactive ingredients) are in ella? | ella excipients list |

| DailyMed Link: | ella at DailyMed |

Pharmacology for ella

| Drug Class | Progesterone Agonist/Antagonist |

| Mechanism of Action | Selective Progesterone Receptor Modulators |

Paragraph IV (Patent) Challenges for ELLA

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| ELLA | Tablets | ulipristal acetate | 30 mg | 022474 | 1 | 2014-08-13 |

US Patents and Regulatory Information for ella

ella is protected by eight US patents.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Lab Hra Pharma | ELLA | ulipristal acetate | TABLET;ORAL | 022474-001 | Aug 13, 2010 | AB | RX | Yes | Yes | 8,426,392 | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Lab Hra Pharma | ELLA | ulipristal acetate | TABLET;ORAL | 022474-001 | Aug 13, 2010 | AB | RX | Yes | Yes | 9,844,510 | ⤷ Get Started Free | Y | ⤷ Get Started Free | ||

| Lab Hra Pharma | ELLA | ulipristal acetate | TABLET;ORAL | 022474-001 | Aug 13, 2010 | AB | RX | Yes | Yes | 10,159,681 | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Lab Hra Pharma | ELLA | ulipristal acetate | TABLET;ORAL | 022474-001 | Aug 13, 2010 | AB | RX | Yes | Yes | 8,512,745 | ⤷ Get Started Free | Y | ⤷ Get Started Free | ||

| Lab Hra Pharma | ELLA | ulipristal acetate | TABLET;ORAL | 022474-001 | Aug 13, 2010 | AB | RX | Yes | Yes | 8,962,603 | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Lab Hra Pharma | ELLA | ulipristal acetate | TABLET;ORAL | 022474-001 | Aug 13, 2010 | AB | RX | Yes | Yes | 9,283,233 | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Lab Hra Pharma | ELLA | ulipristal acetate | TABLET;ORAL | 022474-001 | Aug 13, 2010 | AB | RX | Yes | Yes | 8,735,380 | ⤷ Get Started Free | Y | ⤷ Get Started Free | ||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for ella

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Laboratoire HRA Pharma | ellaOne | ulipristal acetate | EMEA/H/C/001027Emergency contraception within 120 hours (five days) of unprotected sexual intercourse or contraceptive failure. | Authorised | no | no | no | 2009-05-15 | |

| Gedeon Richter Plc. | Ulipristal Acetate Gedeon Richter | ulipristal acetate | EMEA/H/C/005017Ulipristal acetate is indicated for one treatment course of pre-operative treatment of moderate to severe symptoms of uterine fibroids in adult women of reproductive age.Ulipristal acetate is indicated for intermittent treatment of moderate to severe symptoms of uterine fibroids in adult women of reproductive age who are not eligible for surgery. | Withdrawn | no | no | no | 2018-08-27 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for ella

When does loss-of-exclusivity occur for ella?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 09326084

Patent: Ulipristal acetate tablets

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0922796

Patent: COMPRIMIDO FARMACÊUTICO PARA ADMINISTRAÇÃO POR VIA ORAL E MÉTODO DE FABRICAÇÃO DO MESMO

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 45084

Patent: COMPRIMES D'ULIPRISTAL ACETATE (ULIPRISTAL ACETATE TABLETS)

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2245173

Patent: Ulipristal acetate tablets

Estimated Expiration: ⤷ Get Started Free

Patent: 5267168

Patent: Ulipristal Acetate Tablets

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 00186

Patent: TABLETAS DE ACETATO DE ULIPRISTAL

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0161262

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 18099

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 65800

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 65800

Patent: COMPRIMÉS D'ULIPRISTAL ACÉTATE (ULIPRISTAL ACETATE TABLETS)

Estimated Expiration: ⤷ Get Started Free

Patent: 03445

Patent: COMPRIMÉS D'ACÉTATE D'ULIPRISTAL (ULIPRISTAL ACETATE TABLETS)

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 32134

Patent: 烏利司他醋酸片 (ULIPRISTAL ACETATE TABLETS)

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 30762

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 3247

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 84502

Estimated Expiration: ⤷ Get Started Free

Patent: 51727

Estimated Expiration: ⤷ Get Started Free

Patent: 12511041

Estimated Expiration: ⤷ Get Started Free

Patent: 15107994

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 65800

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 3358

Estimated Expiration: ⤷ Get Started Free

Patent: 11006106

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 3498

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 65800

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 65800

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 92853

Estimated Expiration: ⤷ Get Started Free

Patent: 11127989

Estimated Expiration: ⤷ Get Started Free

San Marino

Patent: 01600372

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 209

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 65800

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1104137

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1733533

Estimated Expiration: ⤷ Get Started Free

Patent: 110097936

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 96554

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 1863

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering ella around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Canada | 2757496 | ⤷ Get Started Free | |

| Japan | 2016188232 | オンデマンド避妊方法 (METHOD FOR ON-DEMAND CONTRACEPTION) | ⤷ Get Started Free |

| Japan | 5951480 | ⤷ Get Started Free | |

| Ukraine | 101863 | ТАБЛЕТКИ НА ОСНОВЕ УЛИПРИСТАЛА АЦЕТАТА;ТАБЛЕТКИ НА ОСНОВІ УЛІПРИСТАЛУ АЦЕТАТУ (ULIPRISTAL ACETATE TABLETS) | ⤷ Get Started Free |

| Montenegro | 02548 | POSTUPAK ZA KONTRACEPCIJU PO POTREBI (METHOD FOR ON-DEMAND CONTRACEPTION) | ⤷ Get Started Free |

| San Marino | T201600399 | ⤷ Get Started Free | |

| Colombia | 6400186 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Market Dynamics and Financial Trajectory for the Pharmaceutical Drug: ELLA

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.