austedo Drug Patent Profile

✉ Email this page to a colleague

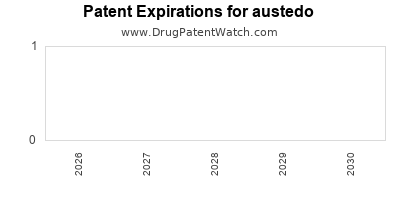

Which patents cover Austedo, and when can generic versions of Austedo launch?

Austedo is a drug marketed by Teva Branded Pharm and Teva and is included in two NDAs. There are fifteen patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and thirty patent family members in thirty-four countries.

The generic ingredient in AUSTEDO is deutetrabenazine. One supplier is listed for this compound. Additional details are available on the deutetrabenazine profile page.

DrugPatentWatch® Generic Entry Outlook for Austedo

Austedo was eligible for patent challenges on April 3, 2021.

There has been one patent litigation case involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for austedo?

- What are the global sales for austedo?

- What is Average Wholesale Price for austedo?

Summary for austedo

| International Patents: | 130 |

| US Patents: | 14 |

| Applicants: | 2 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 12 |

| Clinical Trials: | 4 |

| Patent Applications: | 18 |

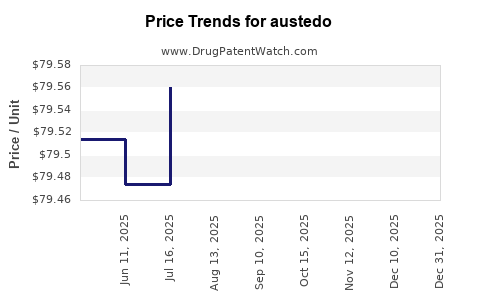

| Drug Prices: | Drug price information for austedo |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for austedo |

| What excipients (inactive ingredients) are in austedo? | austedo excipients list |

| DailyMed Link: | austedo at DailyMed |

Recent Clinical Trials for austedo

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Vanderbilt University Medical Center | Phase 2/Phase 3 |

| Teva Branded Pharmaceutical Products R&D, Inc. | Phase 2/Phase 3 |

| Fundacion Huntington Puerto Rico | Phase 1 |

Paragraph IV (Patent) Challenges for AUSTEDO

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| AUSTEDO | Tablets | deutetrabenazine | 6 mg, 9 mg and 12 mg | 208082 | 2 | 2021-04-05 |

US Patents and Regulatory Information for austedo

austedo is protected by fourteen US patents.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Teva | AUSTEDO XR | deutetrabenazine | TABLET, EXTENDED RELEASE;ORAL | 216354-008 | Jul 1, 2024 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Teva | AUSTEDO XR | deutetrabenazine | TABLET, EXTENDED RELEASE;ORAL | 216354-004 | May 29, 2024 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Teva Branded Pharm | AUSTEDO | deutetrabenazine | TABLET;ORAL | 208082-003 | Apr 3, 2017 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Teva Branded Pharm | AUSTEDO | deutetrabenazine | TABLET;ORAL | 208082-003 | Apr 3, 2017 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Teva | AUSTEDO XR | deutetrabenazine | TABLET, EXTENDED RELEASE;ORAL | 216354-003 | Feb 17, 2023 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Teva | AUSTEDO XR | deutetrabenazine | TABLET, EXTENDED RELEASE;ORAL | 216354-005 | May 29, 2024 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for austedo

When does loss-of-exclusivity occur for austedo?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 13318182

Patent: Formulations pharmacokinetics of deuterated benzoquinoline inhibitors of vesicular monoamine transporter 2

Estimated Expiration: ⤷ Get Started Free

Patent: 18222896

Patent: Formulations pharmacokinetics of deuterated benzoquinoline inhibitors of vesicular monoamine transporter 2

Estimated Expiration: ⤷ Get Started Free

Patent: 20205297

Patent: Formulations pharmacokinetics of deuterated benzoquinoline inhibitors of vesicular monoamine transporter 2

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2015005894

Patent: composição farmacêutica

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 83641

Patent: PHARMACOCINETIQUES DE FORMULATIONS D'INHIBITEURS DE BENZOQUINOLINE DEUTERE DU TRANSPORTEUR 2 DE MONOAMINE VESICULAIRE (FORMULATIONS PHARMACOKINETICS OF DEUTERATED BENZOQUINOLINE INHIBITORS OF VESICULAR MONOAMINE TRANSPORTER 2)

Estimated Expiration: ⤷ Get Started Free

Patent: 24804

Patent: PHARMACOCINETIQUES DE FORMULATIONS D'INHIBITEURS DE BENZOQUINOLINE DEUTERE DU TRANSPORTEUR 2 DE MONOAMINE VESICULAIRE (FORMULATIONS PHARMACOKINETICS OF DEUTERATED BENZOQUINOLINE INHIBITORS OF VESICULAR MONOAMINE TRANSPORTER 2)

Estimated Expiration: ⤷ Get Started Free

China

Patent: 4684555

Patent: Formulations pharmacokinetics of deuterated benzoquinoline inhibitors of vesicular monoamine transporter 2

Estimated Expiration: ⤷ Get Started Free

Patent: 1728971

Patent: D6-tetraphenylquinolizine solid oral dosage form, compound, and pharmaceutical composition, preparation method and treatment method thereof

Estimated Expiration: ⤷ Get Started Free

Patent: 6768882

Patent: 化合物、及其药物组合物及治疗方法 (Compounds, pharmaceutical compositions and methods of treatment thereof)

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 97615

Patent: PHARMACOCINÉTIQUES DE FORMULATIONS D'INHIBITEURS DE BENZOQUINOLINE DEUTÉRÉ DU TRANSPORTEUR 2 DE MONOAMINE VÉSICULAIRE (FORMULATIONS PHARMACOKINETICS OF DEUTERATED BENZOQUINOLINE INHIBITORS OF VESICULAR MONOAMINE TRANSPORTER 2)

Estimated Expiration: ⤷ Get Started Free

Patent: 45100

Patent: FORMULATIONS PHARMACOCINÉTIQUES D'INHIBITEURS DE BENZOQUINOLINE DEUTÉRÉS DU TRANSPORTEUR VÉSICULAIRE DE MONOAMINE 2 (FORMULATIONS PHARMACOKINETICS OF DEUTERATED BENZOQUINOLINE INHIBITORS OF VESICULAR MONOAMINE TRANSPORTER 2)

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 12232

Patent: 氘化苯並喹啉的囊泡單胺轉運體 抑制劑的配方藥代動力學 (FORMULATIONS PHARMACOKINETICS OF DEUTERATED BENZOQUINOLINE INHIBITORS OF VESICULAR MONOAMINE TRANSPORTER)

Estimated Expiration: ⤷ Get Started Free

India

Patent: 62DEN2015

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 62601

Estimated Expiration: ⤷ Get Started Free

Patent: 12420

Estimated Expiration: ⤷ Get Started Free

Patent: 15528516

Patent: 小胞モノアミン輸送体2の重水素化ベンゾキノリン阻害剤の製剤薬物動態

Estimated Expiration: ⤷ Get Started Free

Patent: 18162287

Patent: 小胞モノアミン輸送体2の重水素化ベンゾキノリン阻害剤の製剤薬物動態 (PHARMACOKINETICS OF DEUTERATED BENZOQUINOLINE INHIBITORS OF VESICULAR MONOAMINE TRANSPORTER 2)

Estimated Expiration: ⤷ Get Started Free

Patent: 19059784

Patent: 小胞モノアミン輸送体2の重水素化ベンゾキノリン阻害剤の製剤薬物動態 (PHARMACOKINETICS OF DEUTERATED BENZOQUINOLINE INHIBITORS OF VASCULAR MONOAMINE TRANSPORTER 2)

Estimated Expiration: ⤷ Get Started Free

Patent: 20189871

Patent: 小胞モノアミン輸送体2の重水素化ベンゾキノリン阻害剤の製剤薬物動態 (FORMULATION PHARMACOKINETICS OF DEUTERATED BENZOQUINOLINE INHIBITORS OF VESICULAR MONOAMINE TRANSPORTER 2)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 5372

Patent: Formulations pharmacokinetics of deuterated benzoquinoline inhibitors of vesicular monoamine transporter 2

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering austedo around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| South Korea | 102528845 | ⤷ Get Started Free | |

| Japan | 6932641 | ⤷ Get Started Free | |

| Eurasian Patent Organization | 201992168 | ⤷ Get Started Free | |

| Israel | 288712 | ⤷ Get Started Free | |

| Australia | 2020205297 | ⤷ Get Started Free | |

| Australia | 2021204740 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Market Dynamics and Financial Trajectory for Austedo (Deutetrabenazine)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.