Last updated: July 29, 2025

Introduction

ZYLOPRIM, the brand name for allopurinol, is one of the earliest and most established medications used primarily to treat gout and hyperuricemia. Since its launch in 1966, it has played a pivotal role in managing conditions associated with elevated uric acid levels. As the pharmaceutical landscape evolves with newer therapies and increasing healthcare demands, analyzing the current market dynamics and projected financial trajectories for ZYLOPRIM reveals vital insights for stakeholders.

Market Overview

Historical Market Position and Usage

Allopurinol, marketed under ZYLOPRIM by companies such as Novartis, has historically dominated the gout management space due to its proven efficacy and long-term safety profile. It remains a first-line therapy for gout prophylaxis, especially in patients with recurrent attacks or renal impairment. Its widespread use is anchored in its well-characterized pharmacodynamics, cost-effectiveness, and extensive clinical documentation.

Current Market Size and Growth Drivers

The global gout treatment market, valued at approximately USD 1.8 billion in 2022, is anticipated to grow at a compound annual growth rate (CAGR) of around 4-5% through 2027. This growth stems from several factors:

-

Increasing Prevalence of Gout: The rising incidence of gout correlates with lifestyle factors such as obesity, diet, and aging populations. The CDC reports gout affects over 8 million Americans, with similar trends worldwide.

-

Enhanced Diagnosis Rates: Advances in diagnostic criteria and increased awareness lead to earlier and more frequent diagnosis, expanding the patient base.

-

Rigid Treatment Guidelines: Clinical protocols favor urate-lowering therapies like allopurinol for long-term management, bolstering ongoing demand.

-

Chronic Disease Management Focus: The shift toward managing chronic conditions rather than episodic treatment sustains sales longevity.

Competitive Landscape

While ZYLOPRIM remains a key player, newer agents like febuxostat (Uloric) and pegloticase offer alternative mechanisms, especially in cases where allopurinol is contraindicated or poorly tolerated. Nevertheless, allopurinol's established safety profile and lower cost sustain its market relevance, particularly in developing economies and cost-conscious healthcare systems.

Market Dynamics Influencing ZYLOPRIM

Patent and Regulatory Environment

ZYLOPRIM's patent protection has long expired, opening the market to generic competitors. This transition significantly impacts pricing and market share, emphasizing the importance of cost advantage and formulary preferences. Reimbursement policies further influence its accessibility; many healthcare systems favor generic allopurinol due to its affordability.

Pricing Trends

Over the last decade, the price of ZYLOPRIM has declined by approximately 70%–80% owing to generic proliferation. This price erosion enhances affordability but constrains profit margins for manufacturers. The shift has reinforced ZYLOPRIM's status as an essential, low-cost therapy.

Emerging Therapies and Market Challenges

Despite its entrenched position, ZYLOPRIM faces challenges from:

-

Novel Uric Acid-Lowering Agents: Febuxostat, with a different mechanism and fewer drug interactions, appeals to specific patient populations. However, concerns about cardiovascular safety have tempered enthusiasm.

-

Biologicals and Biotech Advances: The development of targeted biologics for gout management is in early phases, potentially disrupting traditional therapies.

-

Patient Preferences and Treatment Adherence: Side effect profiles, such as hypersensitivity reactions linked to allopurinol, influence prescribing patterns, especially in patients with comorbidities.

Global Market Penetration

While ZYLOPRIM enjoys high penetration in mature markets like North America and Europe, its presence in emerging markets is driven by generics availability and local manufacturing. Growing healthcare infrastructure and increasing awareness support market expansion in Asia-Pacific regions.

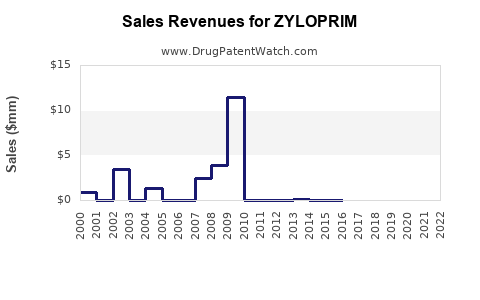

Financial Trajectory and Future Outlook

Revenue Projections

Given the market maturity and generic competition, ZYLOPRIM's revenue trajectory is expected to decline modestly but steadily over the next five years, with an estimated CAGR of approximately -1% to -2%. This decline reflects price erosion and shrinking market share as newer therapies gain prominence.

Strategic Opportunities

To sustain revenue streams, pharma companies may focus on:

-

Formulation Innovations: Fixed-dose combinations or extended-release formulations enhancing adherence.

-

Market Expansion: Targeting underpenetrated geographical areas with favorable regulatory environments.

-

Patient Management Programs: Enhancing compliance and safety through digital adherence tools and monitoring.

-

Lifecycle Management: Developing new dosing regimens or indications, such as prophylactic use in cancer patients with tumor lysis syndrome.

Risks and Mitigation Strategies

Key risks include:

-

Competitive Substitution: Uptake of alternative treatments, especially febuxostat and biologics, could further dilute ZYLOPRIM's market.

-

Safety and Tolerability Concerns: Risks such as hypersensitivity reactions necessitate vigilant monitoring and may influence prescribing patterns.

-

Regulatory Changes: Potential restrictions or changes in reimbursement policies could impact profitability.

To mitigate these risks, strategic investments in post-marketing safety data, cost-effectiveness analysis, and patient-centric formulations are vital.

Conclusion

ZYLOPRIM's market dynamics are characterized by its status as a cost-effective, well-established urate-lowering therapy amidst increasing competition from newer agents. Its financial trajectory is gradually declining, shaped by patent expirations, generics proliferation, and evolving treatment paradigms. Nonetheless, its enduring clinical utility and low-cost profile ensure it remains a cornerstone in gout management, especially within resource-limited settings.

Key Takeaways

-

The global gout treatment market is expanding steadily, primarily driven by rising prevalence and increased diagnosis rates, securing ongoing demand for ZYLOPRIM.

-

Patent expiry and generic entry have significantly reduced ZYLOPRIM prices, constraining revenue growth but maintaining its affordability and widespread use.

-

Emerging therapies pose competitive challenges, but ZYLOPRIM’s safety profile and cost-effectiveness sustain its relevance.

-

Future growth opportunities hinge on formulation innovations, geographical expansion, and potential new indications.

-

Stakeholders should monitor safety profiles, regulatory shifts, and competitor innovations to adapt strategies and optimize long-term value.

FAQs

1. How does ZYLOPRIM compare to newer urate-lowering agents in terms of efficacy?

Allopurinol (ZYLOPRIM) remains highly effective when dosed appropriately, with extensive clinical data supporting its use. Newer agents like febuxostat may offer benefits in specific populations, such as those with allopurinol hypersensitivity, but efficacy differences are generally marginal.

2. What are the primary safety concerns associated with ZYLOPRIM?

The most notable safety concern is hypersensitivity reactions, including Stevens-Johnson syndrome and toxic epidermal necrolysis, especially in patients with renal impairment or those with specific genetic predispositions (e.g., HLA-B*5801 allele).

3. How do regulatory policies influence ZYLOPRIM’s market trajectory?

Regulatory decisions impacting safety labeling, reimbursement policies favoring generics, and approvals for new indications directly affect market access and pricing, thereby shaping financial outcomes.

4. Are there ongoing lifecycle management initiatives for ZYLOPRIM?

Yes. Companies are exploring combination therapies, dosing optimizations, and new formulations to enhance adherence and safety profiles, aiming to extend ZYLOPRIM’s market relevance.

5. What is the outlook for ZYLOPRIM in emerging markets?

In emerging markets, ZYLOPRIM benefits from generic availability and affordability, suggesting stable demand. However, growth depends on expanding healthcare infrastructure, awareness, and regulatory support.

Sources:

[1] GlobalData Healthcare. "Gout Treatment Market Analysis," 2023.

[2] CDC. "Gout Statistics," 2022.

[3] Novartis Annual Report, 2022.

[4] IQVIA. "Pharmaceutical Market Overview," 2023.

[5] FDA Drug Safety Communications, 2021.