ZYDELIG Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Zydelig, and what generic alternatives are available?

Zydelig is a drug marketed by Gilead Sciences Inc and is included in one NDA. There are eight patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and eleven patent family members in forty countries.

The generic ingredient in ZYDELIG is idelalisib. There are two drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the idelalisib profile page.

DrugPatentWatch® Generic Entry Outlook for Zydelig

Zydelig was eligible for patent challenges on July 23, 2018.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be September 2, 2033. This may change due to patent challenges or generic licensing.

There has been one patent litigation case involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for ZYDELIG?

- What are the global sales for ZYDELIG?

- What is Average Wholesale Price for ZYDELIG?

Summary for ZYDELIG

| International Patents: | 111 |

| US Patents: | 8 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 84 |

| Clinical Trials: | 13 |

| Patent Applications: | 4,862 |

| Drug Prices: | Drug price information for ZYDELIG |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for ZYDELIG |

| What excipients (inactive ingredients) are in ZYDELIG? | ZYDELIG excipients list |

| DailyMed Link: | ZYDELIG at DailyMed |

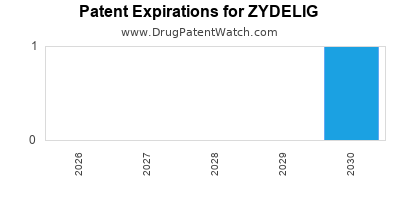

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for ZYDELIG

Generic Entry Date for ZYDELIG*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for ZYDELIG

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Loxo Oncology, Inc. | Phase 3 |

| Prospect Creek Foundation | Phase 1 |

| Oregon Health and Science University | Phase 1 |

Pharmacology for ZYDELIG

| Drug Class | Kinase Inhibitor |

| Mechanism of Action | Cytochrome P450 3A Inhibitors Kinase Inhibitors |

Paragraph IV (Patent) Challenges for ZYDELIG

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| ZYDELIG | Tablets | idelalisib | 100 mg and 150 mg | 205858 | 1 | 2022-03-23 |

US Patents and Regulatory Information for ZYDELIG

ZYDELIG is protected by nine US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of ZYDELIG is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Gilead Sciences Inc | ZYDELIG | idelalisib | TABLET;ORAL | 205858-001 | Jul 23, 2014 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Gilead Sciences Inc | ZYDELIG | idelalisib | TABLET;ORAL | 205858-002 | Jul 23, 2014 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Gilead Sciences Inc | ZYDELIG | idelalisib | TABLET;ORAL | 205858-001 | Jul 23, 2014 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Gilead Sciences Inc | ZYDELIG | idelalisib | TABLET;ORAL | 205858-002 | Jul 23, 2014 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for ZYDELIG

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Gilead Sciences Inc | ZYDELIG | idelalisib | TABLET;ORAL | 205858-001 | Jul 23, 2014 | ⤷ Get Started Free | ⤷ Get Started Free |

| Gilead Sciences Inc | ZYDELIG | idelalisib | TABLET;ORAL | 205858-002 | Jul 23, 2014 | ⤷ Get Started Free | ⤷ Get Started Free |

| Gilead Sciences Inc | ZYDELIG | idelalisib | TABLET;ORAL | 205858-001 | Jul 23, 2014 | ⤷ Get Started Free | ⤷ Get Started Free |

| Gilead Sciences Inc | ZYDELIG | idelalisib | TABLET;ORAL | 205858-002 | Jul 23, 2014 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

EU/EMA Drug Approvals for ZYDELIG

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Gilead Sciences Ireland UC | Zydelig | idelalisib | EMEA/H/C/003843Zydelig is indicated in combination with an anti‑CD20 monoclonal antibody (rituximab or ofatumumab) for the treatment of adult patients with chronic lymphocytic leukaemia (CLL):who have received at least one prior therapy, oras first line treatment in the presence of 17p deletion or TP53 mutation in patients who are not eligible for any other therapies.Zydelig is indicated as monotherapy for the treatment of adult patients with follicular lymphoma (FL) that is refractory to two prior lines of treatment. | Authorised | no | no | no | 2014-09-18 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for ZYDELIG

When does loss-of-exclusivity occur for ZYDELIG?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 0253

Patent: FORMAS POLIMORFICAS DE (S)-2-(1-(9H-PURIN-6-ILAMINO)PROPIL)-5-FLUOR-3-FENILQUINAZOLIN-4(3H)-ONA

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 13203620

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2014021935

Patent: formas polimórficas de (s)-2(l-(9h-purin-6-ilamino)propil)-5-fluoro-3-fenilquinazolina-4(3h)ona

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 64305

Patent: FORMES POLYMORPHES DE L'ACIDE -2-(1-(9H-PURINE-6-YLAMINO)PROPYL)-5-FLUORO-3-PHENYLQUINAZOLIN-4(3H)-ONE (POLYMORPHIC FORMS OF (S)-2-(1-(9H-PURIN-6-YLAMINO)PROPYL)-5-FLUORO-3-PHENYLQUINAZOLIN-4(3H)-ONE)

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 14002358

Patent: Formas polimorficas de (s)-2-(1-(9h-purin-6-ilamino)propil)-5-fluoro-3-fenilquinazolin-4(3h)-ona; metodos de preparacion; composiciones farmaceuticas que las comprenden y uso en el tratamiento del cancer.

Estimated Expiration: ⤷ Get Started Free

China

Patent: 4334560

Patent: Polymorphic forms of (S)-2-(1-(9H-purin-6-ylamino)propyl)-5-fluoro-3-phenylquinazolin-4(3H)-one

Estimated Expiration: ⤷ Get Started Free

Patent: 6146506

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 71131

Patent: Formas polimórficas de (s)-2-(1-(9h-purin-6-ilamino)propil)-5-fluor-3-fenilquinazolin-4(3h)-ona

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 140460

Patent: FORMAS POLIMÓRFICAS DE (S)-2-(1-(9H-PURIN-6-ILAMINO)PROPIL)-5-FLUORO-3-FENILQUINAZOLIN-4(3H)-ONA

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 14020478

Patent: FORMAS POLIMÓRFICAS DE (S)-2-(1-(9H-PURIN-6-ILAMINO)PROPIL)-5-FLUORO-3-FENILQUINAZOLIN-4(3H)-ONA

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 5407

Patent: ПОЛИМОРФНАЯ ФОРМА I (S)-2-(1-(9H-ПУРИН-6-ИЛАМИНО)ПРОПИЛ)-5-ФТОР-3-ФЕНИЛХИНАЗОЛИН-4(3H)-ОНА (POLYMORPHIC FORM I OF (S)-2-(1-(9H-PURIN-6-YLAMINO)PROPYL)-5-FLUORO-3-PHENYLQUINAZOLIN-4(3H)-ONE)

Estimated Expiration: ⤷ Get Started Free

Patent: 1491473

Patent: ПОЛИМОРФНЫЕ ФОРМЫ (S)-2-(1-(9H-ПУРИН-6-ИЛАМИНО)ПРОПИЛ)-5-ФТОР-3-ФЕНИЛХИНАЗОЛИН-4(3H)-ОНА

Estimated Expiration: ⤷ Get Started Free

Patent: 1690461

Patent: ПОЛИМОРФНЫЕ ФОРМЫ (S)-2-(1-(9H-ПУРИН-6-ИЛАМИНО)ПРОПИЛ)-5-ФТОР-3-ФЕНИЛХИНАЗОЛИН-4(3H)-ОНА

Estimated Expiration: ⤷ Get Started Free

Patent: 1691327

Patent: ПОЛИМОРФНЫЕ ФОРМЫ (S)-2-(1-(9H-ПУРИН-6-ИЛАМИНО)ПРОПИЛ)-5-ФТОР-3-ФЕНИЛХИНАЗОЛИН-4(3H)-ОНА

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 34241

Patent: FORMES POLYMORPHES DE LA (S)-2-(1-(9H-PURINE-6-YLAMINO)PROPYL)-5-FLUORO-3-PHÉNYLQUINAZOLIN-4(3H)-ONE (POLYMORPHIC FORMS OF (S)-2-(1-(9H-PURIN-6-YLAMINO)PROPYL)-5-FLUORO-3-PHENYLQUINAZOLIN-4(3H)-ONE)

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 06345

Estimated Expiration: ⤷ Get Started Free

India

Patent: 05DEN2014

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 15509537

Patent: (S)−2−(1−(9H−プリン−6−イルアミノ)プロピル)−5−フルオロ−3−フェニルキナゾリン−4(3H)−オンの多形性形態

Estimated Expiration: ⤷ Get Started Free

Patent: 16104823

Patent: (S)−2−(1−(9H−プリン−6−イルアミノ)プロピル)−5−フルオロ−3−フェニルキナゾリン−4(3H)−オンの多形性形態 (POLYMORPHIC FORM OF (S)-2-(1-(9H-PURIN-6-YLAMINO)PROPYL)-5-FLUORO-3-PHENYL-QUINAZOLINE-4(3H)-ONE)

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 14010656

Patent: FORMAS POLIMORFICAS DE (S)-2-(1-(9H-PURIN-6-ILAMINO)PROPIL)-5-FLUO RO-3-FENILQUINAZOLIN-4(3H)-ONA. (POLYMORPHIC FORMS OF (S)-2-(1-(9H-PURIN-6-YLAMINO)PROPYL)- 5-FLUORO-3-PHENYLQUINAZOLIN-4(3H)-ONE.)

Estimated Expiration: ⤷ Get Started Free

Moldova, Republic of

Patent: 140100

Patent: Forme polimorfe ale (S)-2-(1-(9H-purin-6-ilamino)propil)-5-fluoro-3-fenilchinazolin-4(3H)-onei;Forme polimorfe ale (S)-2-(1-(9H-purin-6-ilamino)propil)-5-fluoro-3-fenilchinazolin-4(3H)-onei (Polymorphic forms of (S)-2-(1-(9H-purin-6-ylamino)propyl)-5-fluoro-3-phenylquinazolin-4(3H)-one)

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 379

Patent: Formes polymorphes de l'acide -2-(1-(9h-purine-6-ylamino)propyl)-5-fluoro-3-phénylquinazolin-4(3h)-one

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 9684

Patent: Polymorphic forms of (s)-2-(1-(9h-purin-6-ylamino)propyl)-5-fluoro-3-phenylquinazolin-4(3h)-one

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 141792

Patent: FORMAS POLIMORFICAS DE (S)-2-(1-(9H-PURIN-6-ILAMINO)PROPIL)-5-FLUOR-3-FENILQUINAZOLIN-4(3H)-ONA

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 014501920

Patent: POLYMORPHIC FORMS OF (S)-2-(1-(9H-PURIN-6-YLAMINO)PROPYL)-5-FLUORO-3-PHENYLQUINAZOLIN-4(3H)-ONE

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 34241

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 34241

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 201405446P

Patent: POLYMORPHIC FORMS OF (S)-2-(1-(9H-PURIN-6-YLAMINO)PROPYL)-5-FLUORO-3-PHENYLQUINAZOLIN-4(3H)-ONE

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 34241

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1405870

Patent: POLYMORPHIC FORMS OF (S)-2-(1-(9H-PURIN-6-YLAMINO)-5-FLUORO-3-PHENYLQUINAZOLIN-4(3H)-ONE

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 140133590

Patent: POLYMORPHIC FORMS OF (S)-2-(1-(9H-PURIN-6-YLAMINO)PROPYL)-5-FLUORO-3-PHENYLQUINAZOLIN-4(3H)-ONE

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 48273

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 1350486

Patent: Polymorphic forms of (S)-2-(1-(9H-purin-6-ylamino)propyl)-5-fluoro-3-phenylquinazolin-4(3H)-one

Estimated Expiration: ⤷ Get Started Free

Uruguay

Patent: 656

Patent: POLIMORFOS DE (S)?2?(1?(9H?PURIN?6?ILAMINO)PROPIL)?5?FLUOR?3?FENILQUINAZOLIN?4(3H)?ONA, COMPOSICIÓN Y MÉTODO DE PREPARACIÓN

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering ZYDELIG around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Japan | 2015155436 | 血液学的な悪性疾患のための療法 (THERAPY FOR HEMATOLOGIC MALIGNANCY) | ⤷ Get Started Free |

| Australia | 2017200837 | Therapies for hematologic malignancies | ⤷ Get Started Free |

| Norway | 329136 | ⤷ Get Started Free | |

| China | 102271683 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for ZYDELIG

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1761540 | PA2017004 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: IDELALISIBAS ARBA FARMACINIU POZIURIU PRIIMTINA JO DRUSKA; REGISTRATION NO/DATE: EU/1/14/938 20140918 |

| 1761540 | 656 | Finland | ⤷ Get Started Free | |

| 1761540 | C20170009 00226 | Estonia | ⤷ Get Started Free | PRODUCT NAME: IDELALISIIB;REG NO/DATE: EU/1/14/938 19.09.2014 |

| 1761540 | CA 2017 00007 | Denmark | ⤷ Get Started Free | PRODUCT NAME: IDELALISIB; REG. NO/DATE: EU/1/14/938 20140924 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for ZYDELIG (Alectinib)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.