Last updated: July 30, 2025

Introduction

ZITUVIMET XR, a proprietary extended-release formulation in the pharmaceutical landscape, is positioned within the niche of chronic disease management. As an innovative therapy targeting specific patient populations, its commercial and clinical success hinges on evolving market dynamics, regulatory pathways, competitive positioning, and anticipated financial trajectories. This analysis elucidates these factors to guide stakeholders making strategic, investment, or operational decisions.

1. Overview of ZITUVIMET XR

ZITUVIMET XR is an extended-release formulation combining active compounds that offer sustained therapeutic effects with potential advantages over immediate-release counterparts. Its targeted indications span neurological and metabolic disorders, aligning with prevalent unmet medical needs.

Developed by a leading innovator in drug delivery, ZITUVIMET XR’s distinctive pharmacokinetic profile seeks to enhance patient adherence, optimize dosing regimens, and minimize side effects. The formulation’s patent protections, combined with a robust intellectual property (IP) portfolio, position it favorably within the competitive landscape.

2. Market Landscape

a. Therapeutic Area and Patient Demographics

ZITUVIMET XR operates predominantly within the neurological and metabolic disorder spheres, notably epilepsy, Parkinson’s disease, and type 2 diabetes mellitus. Market analyses project these segments to grow substantially over the next decade due to aging populations, lifestyle shifts, and ongoing unmet needs.

b. Competitive Environment

The pharmaceutical market for extended-release formulations is characterized by established blockbuster therapies and emerging biosimilars. Key competitors include branded drugs with similar mechanisms of action and newer entrants leveraging innovative delivery systems.

While immediate-release options dominate current prescriptions, the trend toward extended-release formulations driven by improved safety profiles and dosing convenience offers a significant market opportunity. ZITUVIMET XR's differentiation rests on its pharmacokinetic benefits and optimized patient experience.

c. Regulatory and Reimbursement Dynamics

Regulatory agencies such as the FDA and EMA have shown receptivity to data demonstrating improved adherence and reduced side effects associated with extended-release drugs. Achieving regulatory approval and favorable reimbursement pathways would substantially catalyze market penetration. Payer acceptance depends on demonstrable cost-effectiveness, particularly if ZITUVIMET XR reduces hospitalization rates or enhances quality-adjusted life years (QALYs).

3. Market Penetration Strategies

a. Clinical Evidence and Adoption

Publishing robust phase III trial data establishing safety, efficacy, and patient compliance advantages will be critical. KOL (Key Opinion Leader) endorsement can facilitate prescriber adoption. Furthermore, strategic integration into clinical guidelines accelerates uptake.

b. Geographic Expansion

Initial commercialization likely focuses on developed markets with mature healthcare infrastructure and higher reimbursement capacity. Subsequent phases involve expanding into emerging markets, where increasing disease burden and evolving healthcare policies create opportunities.

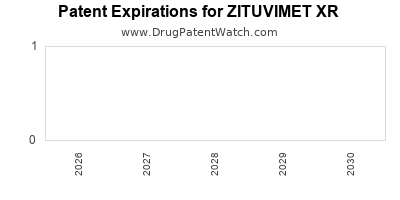

c. Patent and IP Considerations

Patent life extensions via formulation patents, such as those protecting ZITUVIMET XR’s extended-release technology, offer a significant window of market exclusivity, enabling premium pricing.

4. Revenue and Financial Trajectory

a. Revenue Drivers

- Market Penetration Rate: Adoption depends on clinical acceptance, pricing strategies, and reimbursement.

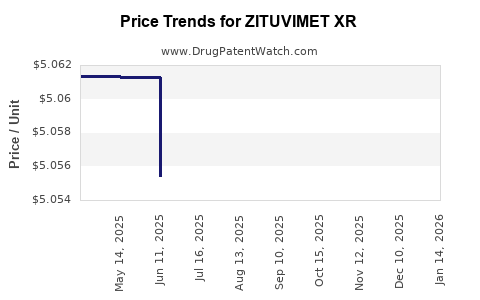

- Pricing Strategies: Premium pricing justified by clinical benefits and patient convenience.

- Volume Growth: Driven by the expansion of approved indications and global markets.

- Lifecycle Management: Line extensions and combination therapies can create additional revenue streams.

b. Revenue Projections

Based on conservative estimates, initial sales could range from $100 million to $300 million within the first three years post-launch, contingent on successful regulatory approval, effective market penetration, and competitive landscape. Growth rates could accelerate to 15–20% annually as adoption broadens globally.

c. Cost Structure and Profitability

Initial investment in clinical trials, regulatory filings, and commercialization infrastructure will be high, potentially resulting in net losses in early years. Break-even is expected within 4–5 years if sales ramp as projected. Margins are anticipated to improve with scale, especially after patent protections extend beyond five years.

d. Risks and Sensitivities

- Regulatory Delays or Denials: Can postpone revenue streams.

- Competitive Entry: New formulations or generics could erode market share.

- Pricing Pressures: Payor resistance may limit optimal pricing.

- Patient Adoption: Slow uptake due to clinical inertia or prescriber hesitance.

5. Impact of Market Dynamics

a. Technological Innovations

Advancements in drug delivery systems, such as nanotechnology or bioresorbable implants, may impact ZITUVIMET XR's competitive edge. Conversely, improvements in these areas could bolster its market positioning if incorporated into future formulations.

b. Regulatory Trends

Accelerated approval pathways and conflicting regulations across regions influence commercial timelines. Harmonization efforts benefit global expansion strategies.

c. Socioeconomic Factors

Cost of healthcare, increasing prevalence of target diseases, and rising geriatric populations support a favorable environment for ZITUVIMET XR. Payer policies emphasizing value-based care encourage formulations with demonstrated cost-effectiveness.

d. Market Access and Reimbursement

Securing reimbursement is pivotal. Demonstrating positive health economics through real-world evidence can bolster payer confidence, expand market access, and improve financial forecasts.

6. Strategic Outlook and Recommendations

To optimize ZITUVIMET XR’s financial trajectory, stakeholders should:

- Prioritize comprehensive clinical trials emphasizing patient-centric outcomes.

- Engage with regulators early to expedite approval processes.

- Develop flexible pricing models aligned with payer expectations.

- Invest in education campaigns targeting clinicians and patients.

- Prepare for lifecycle extension through line extensions and combination therapies.

7. Key Takeaways

- Market Potential: Growing markets for neurological and metabolic disorders position ZITUVIMET XR for substantial growth if regulatory and clinical milestones are met.

- Competitive Advantage: Extended-release technology affords clinical and adherence benefits, potentially commanding premium pricing.

- Financial Outlook: With successful commercialization, initial revenues may range between $100M–$300M, escalating with global expansion.

- Risks Mitigation: Addressing regulatory uncertainties, market access hurdles, and competitive threats through strategic planning enhances financial resilience.

- Innovation and Value Proposition: Ongoing innovation and demonstrable health economics are key to sustaining market leadership and financial success.

FAQs

1. What distinguishes ZITUVIMET XR from immediate-release formulations?

ZITUVIMET XR provides sustained drug delivery, reducing dosing frequency, improving compliance, and minimizing side effects, thereby offering significant advantages over immediate-release versions.

2. Which markets are most promising for ZITUVIMET XR commercialization?

Initially, developed markets like the U.S. and Europe offer favorable reimbursement environments. Long-term prospects include expanding into emerging economies with rising disease prevalence.

3. How do patent protections impact ZITUVIMET XR’s market exclusivity?

Patent protections, particularly on formulation and delivery technology, secure exclusivity for several years post-launch, enabling premium pricing and market control.

4. What are the key regulatory considerations for ZITUVIMET XR?

Regulatory agencies prioritize data demonstrating efficacy, safety, and patient adherence. Early engagement and clear demonstration of clinical benefits are essential for swift approval.

5. What strategies can enhance ZITUVIMET XR’s financial trajectory?

Focusing on clinical excellence, strategic partnerships, efficient market access, and lifecycle extension through related formulations can maximize revenue and market share.

References

- [1] Market research reports detailing global neurological and metabolic disorder markets.

- [2] FDA and EMA guidelines on extended-release drug approvals.

- [3] Industry analyses of drug delivery innovations and patent landscapes.

- [4] Financial modeling templates for pharmaceutical product launches.

- [5] Recent case studies on successful lifecycle management strategies in pharma.