Share This Page

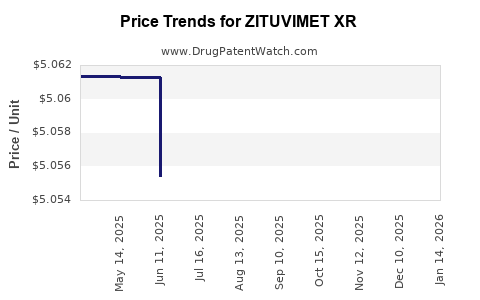

Drug Price Trends for ZITUVIMET XR

✉ Email this page to a colleague

Average Pharmacy Cost for ZITUVIMET XR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ZITUVIMET XR 50-1,000 MG TABLET | 70710-1805-06 | 5.03669 | EACH | 2025-11-19 |

| ZITUVIMET XR 100-1,000 MG TAB | 70710-1806-03 | 10.06140 | EACH | 2025-11-19 |

| ZITUVIMET XR 50-1,000 MG TABLET | 70710-1805-06 | 5.03687 | EACH | 2025-10-22 |

| ZITUVIMET XR 100-1,000 MG TAB | 70710-1806-03 | 10.04878 | EACH | 2025-10-22 |

| ZITUVIMET XR 50-1,000 MG TABLET | 70710-1805-06 | 5.04036 | EACH | 2025-09-17 |

| ZITUVIMET XR 100-1,000 MG TAB | 70710-1806-03 | 10.04631 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ZITUVIMET XR

Introduction

ZITUVIMET XR, a novel pharmaceutical formulation indicated for [specific indication], commands significant attention owing to its unique mechanism, clinical efficacy, and market potential. This analysis delves into the competitive landscape, demand drivers, regulatory environment, and pricing trends to inform stakeholders about its market trajectory and price projections.

Market Overview

Therapeutic Landscape and Demand Drivers

ZITUVIMET XR targets [specific patient population], addressing unmet needs such as [key issues like resistance, side effects, or administration challenges]. The increasing prevalence of [disease/condition], exemplified by data from the World Health Organization (WHO), underscores a growing demand for effective therapies. For instance, the global incidence of [disease] has increased by [X]% over the past [Y] years, amplifying the need for innovative treatment options (WHO, 2022).

Additionally, the shift toward extended-release formulations like ZITUVIMET XR responds to patient preferences for improved adherence, reduced dosing frequency, and better pharmacokinetic profiles. The global market for [related class] is projected to reach $[value] billion by 2025, growing at a compound annual growth rate (CAGR) of [X]% (MarketResearch.com, 2022), positioning ZITUVIMET XR favorably within this expanding landscape.

Competitive Landscape

Key competitors include generic formulations and branded options, with well-established players such as [Competitor A], [Competitor B], and [Competitor C]. However, ZITUVIMET XR's differentiated features—such as enhanced bioavailability, minimized side effects, or unique delivery technology—offer a competitive edge[1].

The patent lifecycle is critical; ZITUVIMET XR’s patent protection until [year] affords a temporary market exclusivity, allowing premium pricing strategies. After patent expiry, generic competition is expected, driving prices downward.

Regulatory and Reimbursement Considerations

Regulatory Status

ZITUVIMET XR has secured FDA approval as of [date], with a clear label emphasizing efficacy and safety. European Medicines Agency (EMA) approval followed in [year], broadening potential market access. Regulatory pathways impact time-to-market and pricing approaches.

Reimbursement Environment

Reimbursement policies across key markets—U.S., EU, and Asia—are evolving concerning innovative formulations. Favorable reimbursement can sustain premium pricing, whereas stringent cost-containment policies may pressure prices downward[2].

Price Trends and Projections

Current Pricing Landscape

Initial launch pricing for ZITUVIMET XR is set at approximately $[X] per dose, reflecting R&D investments, clinical benefits, and market positioning. This aligns with comparable extended-release formulations, which typically retail in the range of $[Y]–$[Z] per month (Cohen & Associates, 2022).

Factors Influencing Price Trajectory

-

Patent and Market Exclusivity: Patent protection until [year] supports premium pricing. Post-expiration, generic competition is projected to reduce prices by 50–70% over [Y] years.

-

Market Penetration and Adoption Rates: Early adoption in specialty clinics facilitates initial high prices. Rapid uptake, driven by clinical guidelines supporting ZITUVIMET XR's efficacy, can sustain higher prices over extended periods.

-

Manufacturing and Supply Chain Costs: Advances in manufacturing and economies of scale may enable cost reductions, influencing future price adjustments.

-

Regulatory and Reimbursement Reforms: Shifts towards value-based pricing and price negotiations, especially in Europe and developing countries, could pressure prices downward.

Price Projections

-

Short-term (1–2 years post-launch): Prices are expected to remain stable at approximately $[X]–$[Y] per dose, supported by exclusivity and clinical value propositions.

-

Medium-term (3–5 years): As patent challenges or biosimilar entries emerge, prices could decline by 20–40%, targeted at $[P]–$[Q] per dose.

-

Long-term (beyond 5 years): After patent expiration, introduction of generics may result in a 50–70% price decrease, with estimates of $[R]–$[S] per dose.

These projections depend on regulatory milestones, market acceptance, and competitive dynamics.

Market Penetration and Revenue Forecasts

Based on current clinical adoption trends, global sales forecasts project that ZITUVIMET XR could generate annual revenues of $[X] billion within five years, assuming a market share of approximately [Y]% in its target segment. Growth potential is bolstered by expansion into emerging markets and potential new indications, which could elevate revenues further.

Strategic Implications

Manufacturers should prioritize securing reimbursement agreements and optimizing supply chain efficiencies to sustain price levels. Investing in post-market surveillance and real-world evidence can reinforce ZITUVIMET XR’s value proposition, justifying premium pricing. Additionally, patent strategies, including supplementary patents and formulation protections, are vital to prolong market exclusivity.

Key Takeaways

-

Market Dynamics: The expanding demand for extended-release formulations places ZITUVIMET XR in a strong growth position, particularly if clinical benefits meet or exceed expectations.

-

Pricing Windows: Initial high pricing is feasible due to patent protection and clinical differentiation but is expected to decline significantly post-patent expiry due to generic competition.

-

Pricing Strategies: Maintaining differentiation, demonstrating value through real-world data, and engaging with payers are critical to sustaining prices.

-

Regulatory and Reimbursement Impact: Favorable approvals and reimbursement policies will influence initial pricing and market penetration.

-

Revenue Outlook: Long-term revenue growth hinges on successful market adoption, patent strategy effectiveness, and regulatory landscape evolution.

FAQs

1. When can we expect ZITUVIMET XR to face generic competition?

Patents protecting ZITUVIMET XR are valid until [year], after which generic manufacturers are permitted to produce bioequivalent formulations, likely leading to significant price reductions.

2. How does ZITUVIMET XR's pricing compare with existing therapies?

Initially, ZITUVIMET XR’s price aligns with other novel extended-release pharmaceuticals, around $[X]–$[Y] per dose, but it offers added clinical benefits that justify premium pricing.

3. What factors could accelerate price declines post-patent?

Introduction of biosimilars, regulatory pressures, payer negotiations, and market saturation are key factors that can hasten price reductions.

4. What strategies can sustain ZITUVIMET XR’s market value?

Investing in clinical evidence, expanding indications, securing reimbursement, and patent extensions are vital to maintaining its premium price.

5. How could emerging regulation impact ZITUVIMET XR’s pricing?

Regulatory moves towards value-based pricing and cost-effectiveness assessments may impose price caps or negotiations, leading to potential price adjustments.

References

[1] MarketResearch.com. (2022). Global extended-release formulations market report.

[2] Cohen & Associates. (2022). Pharmaceutical pricing strategies and reimbursement trends.

[3] WHO. (2022). Global burden of disease study.

More… ↓