ZITUVIMET Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Zituvimet, and what generic alternatives are available?

Zituvimet is a drug marketed by Zydus Lifesciences and is included in two NDAs.

The generic ingredient in ZITUVIMET is metformin hydrochloride; sitagliptin. There are forty-nine drug master file entries for this compound. Three suppliers are listed for this compound. Additional details are available on the metformin hydrochloride; sitagliptin profile page.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for ZITUVIMET?

- What are the global sales for ZITUVIMET?

- What is Average Wholesale Price for ZITUVIMET?

Summary for ZITUVIMET

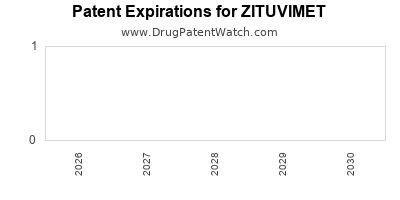

| US Patents: | 0 |

| Applicants: | 1 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 2 |

| Drug Prices: | Drug price information for ZITUVIMET |

| What excipients (inactive ingredients) are in ZITUVIMET? | ZITUVIMET excipients list |

| DailyMed Link: | ZITUVIMET at DailyMed |

Pharmacology for ZITUVIMET

| Drug Class | Biguanide Dipeptidyl Peptidase 4 Inhibitor |

| Mechanism of Action | Dipeptidyl Peptidase 4 Inhibitors |

US Patents and Regulatory Information for ZITUVIMET

EU/EMA Drug Approvals for ZITUVIMET

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Merck Sharp & Dohme B.V. | Ristfor | sitagliptin, metformin hydrochloride | EMEA/H/C/001235For patients with type-2 diabetes mellitus:Ristfor is indicated as an adjunct to diet and exercise to improve glycaemic control in patients inadequately controlled on their maximal tolerated dose of metformin alone or those already being treated with the combination of sitagliptin and metformin.Ristfor is indicated in combination with a sulphonylurea (i.e. triple combination therapy) as an adjunct to diet and exercise in patients inadequately controlled on their maximal tolerated dose of metformin and a sulphonylurea.Ristfor is indicated as triple combination therapy with a peroxisome proliferator-activated-receptor-gamma (PPARγ) agonist (i.e. a thiazolidinedione) as an adjunct to diet and exercise in patients inadequately controlled on their maximal tolerated dose of metformin and a PPARγ agonist.Ristfor is also indicated as add-on to insulin (i.e. triple combination therapy) as an adjunct to diet and exercise to improve glycaemic control in patients when stable dose of insulin and metformin alone do not provide adequate glycaemic control. | Authorised | no | no | no | 2010-03-15 | |

| Accord Healthcare S.L.U. | Sitagliptin / Metformin hydrochloride Accord | sitagliptin, metformin hydrochloride | EMEA/H/C/005850For adult patients with type 2 diabetes mellitus:It is indicated as an adjunct to diet and exercise to improve glycaemic control in patients inadequately controlled on their maximal tolerated dose of metformin alone or those already being treated with the combination of sitagliptin and metformin.It is indicated in combination with a sulphonylurea (i.e., triple combination therapy) as an adjunct to diet and exercise in patients inadequately controlled on their maximal tolerated dose of metformin and a sulphonylurea.It is indicated as triple combination therapy with a peroxisome proliferator-activated receptor gamma (PPARγ) agonist (i.e., a thiazolidinedione) as an adjunct to diet and exercise in patients inadequately controlled on their maximal tolerated dose of metformin and a PPARγ agonist.It is also indicated as add-on to insulin (i.e., triple combination therapy) as an adjunct to diet and exercise to improve glycaemic control in patients when stable dose of insulin and metformin alone do not provide adequate glycaemic control. | Authorised | yes | no | no | 2022-07-22 | |

| Sun Pharmaceutical Industries Europe B.V. | Sitagliptin / Metformin hydrochloride Sun | sitagliptin, metformin hydrochloride | EMEA/H/C/005778For adult patients with type 2 diabetes mellitus:Sitagliptin/Metformin hydrochloride SUN is indicated as an adjunct to diet and exercise to improve glycaemic control in patients inadequately controlled on their maximal tolerated dose of metformin alone or those already being treated with the combination of sitagliptin and metformin.Sitagliptin/Metformin hydrochloride SUN is indicated in combination with a sulphonylurea (i.e., triple combination therapy) as an adjunct to diet and exercise in patients inadequately controlled on their maximal tolerated dose of metformin and a sulphonylurea.Sitagliptin/Metformin hydrochloride SUN is indicated as triple combination therapy with a peroxisome proliferator-activated receptor gamma (PPARγ) agonist (i.e., a thiazolidinedione) as an adjunct to diet and exercise in patients inadequately controlled on their maximal tolerated dose of metformin and a PPARγ agonist.Sitagliptin/Metformin hydrochloride SUN is also indicated as add-on to insulin (i.e., triple combination therapy) as an adjunct to diet and exercise to improve glycaemic control in patients when stable dose of insulin and metformin alone do not provide adequate glycaemic control. | Authorised | yes | no | no | 2023-03-31 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

Market Dynamics and Financial Trajectory for ZITUVIMET

More… ↓