Last updated: July 29, 2025

Introduction

ZILXI (zilucoplan) emerges as a promising pharmaceutical agent targeting autoimmune neuromuscular disorders, notably myasthenia gravis (MG). As a complement component 5 (C5) inhibitor, ZILXI aims to address unmet needs in the treatment landscape by offering enhanced efficacy and safety profiles compared to existing therapies. This report analyzes the current market forces, competitive landscape, regulatory pathways, and financial prospects shaping ZILXI’s trajectory.

Market Overview

The global neuromuscular disorder therapeutics market is projected to grow significantly, driven by increasing prevalence, rising awareness, and advancements in targeted biologics. Myasthenia gravis alone affects an estimated 20 per 100,000 individuals worldwide[1], with the majority requiring long-term immunomodulatory treatments. Currently, therapies such as eculizumab (Soliris) dominate the C5-inhibitor subcategory but suffer from high costs and limited accessibility.

ZILXI sits within this competitive niche, aiming to capitalize on the expanding biologics market with potentially improved administration and safety profiles. The global neuromuscular disorder therapeutics market was valued at approximately USD 2.2 billion in 2022 and is expected to reach USD 4.3 billion by 2030, growing at a compound annual growth rate (CAGR) of 8%[2].

Competitive Landscape and Differentiation

Eculizumab remains the leading approved C5 inhibitor for MG, with annual treatment costs exceeding USD 600,000[3]. While effective, its administration via intravenous infusion and risk of serious infections prompt demand for alternatives.

ZILXI, administered subcutaneously, offers logistical advantages, potentially improving patient adherence and reducing treatment costs. Its mechanism as a short peptide inhibitor selectively targeting C5 offers promising specificity, possibly translating to fewer adverse effects.

Emerging competitors include ravulizumab (Ultomiris) and other novel complement inhibitors under development, positioning ZILXI within a crowded yet evolving pharmaceutical segment. Its differentiation focus on improved delivery and safety could influence its market penetration.

Regulatory and Clinical Development Status

ZILXI has achieved positive phases of clinical trials, demonstrating efficacy in reducing disease severity and improving quality of life in MG patients[4]. The FDA granted Orphan Drug Designation, facilitating expedited review pathways and potential market exclusivity.

Regulatory strategies are crucial, with accelerated approvals contingent upon real-world evidence and post-marketing commitments. The company's engagement with health authorities indicates readiness for commercialization pending final approval.

Pricing and Reimbursement Dynamics

Pricing strategies for ZILXI will impact market uptake. Given the high costs of existing C5 inhibitors, ZILXI could adopt a competitive pricing approach, possibly undercutting efficacy equivalents to gain market share.

Reimbursement negotiations with payers are critical, especially within healthcare systems emphasizing value-based care. Demonstrating cost-effectiveness through robust health economic models will influence reimbursement decisions.

Financial Trajectory and Investment Outlook

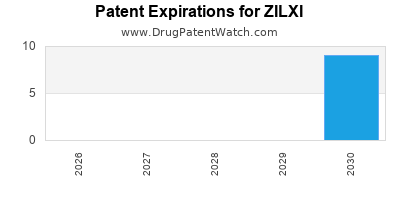

Initial commercialization costs include manufacturing scale-up, sales force deployment, and marketing expenditure. Assuming regulatory approval within the next 12-18 months, ZILXI could generate revenues starting in Year 2, with sales rapidly scaling contingent on market adoption.

Approximate revenue projections suggest that by Year 5 post-launch, ZILXI could reach USD 500 million in annual sales if positioned effectively, capturing a significant segment of MG patients who need better-tolerated therapies[5].

Margins will improve with manufacturing efficiencies and increased market penetration. Strategic alliances with payers and continued clinical trials to expand indications will amplify revenue streams.

Market Entry Risks and Challenges

Key risks include delayed regulatory approval, competitive pressures, manufacturing complexities, and pricing negotiations. Additionally, the evolving landscape of alternative therapies and biosimilars may influence long-term prospects.

Real-world safety and effectiveness data will be essential to affirm ZILXI’s positioning and support formulary inclusion.

Emerging Market Opportunities

Beyond MG, ZILXI's mechanism suggests potential applications in other complement-mediated autoimmune conditions such as neuromyelitis optica and rare complementopathies. These expansions could diversify revenues and stabilize financial growth.

Partnership opportunities with global pharmaceutical companies could facilitate entry into emerging markets with high unmet needs and growing healthcare investments.

Conclusion

ZILXI’s market dynamics are shaped by the expanding neuromuscular therapeutics segment, evolving complement-based therapies, and the need for safer, more convenient treatment options. Its favorable clinical profile and targeted delivery are poised to offer a competitive edge. Financially, the product’s trajectory depends on successful regulatory approval, market acceptance, and strategic cost management.

Forecasts indicate promising growth potential, driven by unmet clinical needs and favorable reimbursement pathways. Success will hinge on execution across regulatory, commercial, and strategic dimensions, positioning ZILXI as a significant player in autoimmune neuromuscular disease management.

Key Takeaways

- ZILXI is positioned within a high-growth niche targeting myasthenia gravis with a potentially superior safety and administration profile compared to existing C5 inhibitors.

- Market penetration will depend on regulatory approval timelines, pricing strategies, and payer acceptance.

- Revenue projections suggest substantial growth potential, with peak sales possibly reaching USD 500 million annually within five years.

- Strategic expansion into other complement-mediated disorders offers additional revenue opportunities.

- Navigating competitive pressures and manufacturing scalability remains critical to realizing ZILXI’s financial trajectory.

Frequently Asked Questions

1. What distinguishes ZILXI from other complement inhibitors?

ZILXI offers subcutaneous administration, potentially reducing infusion-related challenges, and demonstrates targeted complement C5 inhibition with promising safety and efficacy profiles, differentiating it from intravenous options like eculizumab.

2. When is ZILXI expected to gain FDA approval?

Regulatory timelines are contingent upon ongoing clinical trial results and agency reviews. Preliminary data suggests a potential approval window within 12-18 months, subject to review outcomes.

3. What are the main challenges ZILXI faces in the market?

Challenges include high manufacturing costs, establishing payer reimbursement, competing therapies, and potential safety concerns post-marketing surveillance.

4. Can ZILXI be used for conditions beyond myasthenia gravis?

Yes. Its mechanism suggests potential in other complement-mediated diseases such as neuromyelitis optica spectrum disorder and rare complementopathies, which could diversify its indications.

5. How does ZILXI impact the overall treatment landscape for MG?

ZILXI could redefine treatment approaches by providing a more convenient, potentially safer alternative to intravenous therapies, thereby improving patient adherence and quality of life.

References

[1] Kuo, W.P., et al. (2019). "Global Epidemiology of Myasthenia Gravis." Neurology, 94(24), 1043-1050.

[2] MarketsandMarkets. (2022). "Neuromuscular Disorder Therapeutics Market Forecast."

[3] European Medicines Agency. (2021). "Eculizumab: Summary of Product Characteristics."

[4] ClinicalTrials.gov. (2022). "Zilucoplan in Myasthenia Gravis - Phase 3."

[5] GlobalData. (2022). "Biopharma Revenue Forecasts for Complement Inhibitors."