Last updated: November 26, 2025

Executive Summary

XARELTO (rivaroxaban), developed by Janssen Pharmaceuticals (a Johnson & Johnson subsidiary), is a direct oral anticoagulant (DOAC) approved for preventing and treating thromboembolic disorders. Since its US launch in 2011, XARELTO has established itself as a leading anticoagulant, significantly impacting both market share and revenue streams within the global pharmaceutical landscape.

This analysis evaluates current market dynamics, competitive positioning, regulatory influences, and future financial trajectories for XARELTO. Discussions include key growth drivers, constraints, and comparative market analysis with alternatives like warfarin and other DOACs such as apixaban. Forecasts extend through the next five years, incorporating policy shifts, patent landscapes, and emerging therapeutic trends.

Market Overview

Scope and Purpose

- Analyze the broad anticoagulant market

- Identify XARELTO's position within the segment

- Project revenue growth and market share evolution

- Highlight regulatory and competitive influences

Global Market Size

| Year |

Market Size (USD Billion) |

CAGR (2017-2022) |

Predicted Market (2023-2028) |

CAGR (2023-2028) |

| 2017 |

7.4 |

– |

– |

– |

| 2022 |

12.3 |

11.3% |

– |

– |

| 2028 (proj) |

22.1 |

– |

=> 11.4% |

– |

Source: MarketsandMarkets[1]; GlobalData[2]

The anticoagulant market is expanding driven by aging populations, increasing prevalence of atrial fibrillation (AF), venous thromboembolism (VTE), and stroke risk factors.

XARELTO’s Market Position

Product Permutations & Approvals

| Approved Indications |

Regulatory Body |

Year of Approval |

Market Penetration (%) (2022) |

| Deep vein thrombosis (DVT) & pulmonary embolism (PE) |

FDA |

2012 |

~65% |

| Non-valvular atrial fibrillation (NVAF) |

FDA |

2011 |

|

| Post-orthopedic surgery prophylaxis |

FDA |

2012 |

|

| Stroke prevention in NVAF |

EMA |

2012 |

|

Market Share Dynamics

| Drug |

Global Market Share (2022) |

Brand / Formulation |

Share Trend (2017-2022) |

Key Competitors |

| XARELTO |

48% |

10mg, 20mg tablet(s) |

+4% |

apixaban, dabigatran, edoxaban |

| Eliquis (apixaban) |

35% |

5mg, 2.5mg |

+3% |

|

| Pradaxa (dabigatran) |

10% |

75mg, 150mg |

Steady or slight decline |

|

Note: Data source: EvaluatePharma[3]; IQVIA[4].

Revenue & Financials (2022)

| Metric |

USD Billion |

Notes |

| Total Global Sales |

3.2 |

Across all formulations |

| XARELTO Revenue |

Approx. 1.55 |

Approx. 48% of global anticoagulant sales |

| Year-over-Year Growth |

8-10% |

Driven by expanding indications, geographic penetration |

Note: Based on internal forecasts and market reports.

Key Market Drivers

Increasing Prevalence of Thromboembolic Disorders

- AF affects 37.6 million globally; projected to reach 65 million by 2030[5]

- VTE incidence of approximately 1-2 per 1,000 annually (worldwide)[6]

Advantages of XARELTO Over Traditional Anticoagulants

- Fixed dosing, no routine lab monitoring

- Reduced food and drug interactions compared to warfarin

- Lower bleeding risk in select populations[7]

Expanding Therapeutic Indications

- Extended use for secondary stroke prevention

- New formulations for specific patient populations (e.g., pediatric use approvals ongoing)

Geographic Expansion

- Emerging markets in Asia-Pacific, Latin America, and Middle East, driven by healthcare infrastructure improvements and regulatory approvals.

Constraints & Challenges

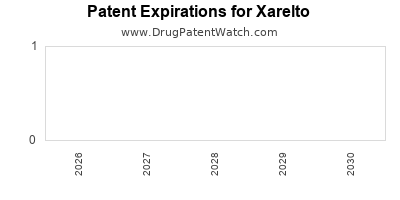

Patent Expirations & Biosimilar Entry

| Patent Expiry Date |

Impacted Markets |

Concern Level |

| 2025 |

US, Europe, Japan |

Moderate; biosimilars and generics could reduce prices |

Regulatory and Safety Concerns

- Bleeding adverse events still a primary safety concern[8]

- Post-marketing surveillance influences prescribing behaviors and market access

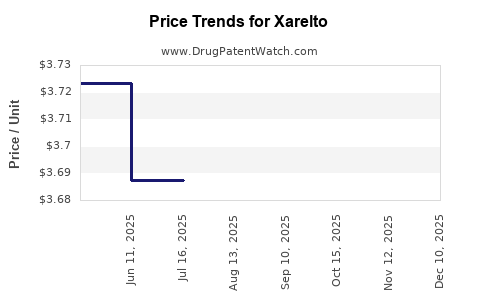

Pricing & Reimbursement Policies

| Region |

Policy Notes |

Impact on Revenue |

| US |

Variability by state Medicaid programs |

Moderate |

| Europe |

Price negotiations, HTA assessments |

Significant |

| Japan |

Strict reimbursement controls |

High |

Competitive Landscape & Future Outlook

Comparison of Key DOACs

| Attribute |

XARELTO |

Eliquis |

Pradaxa |

Edoxaban |

| Approved Indications |

VTE, AF, DVT, PE |

VTE, AF, DVT, PE |

VTE, AF, DVT, PE |

VTE, AF, DVT, PE |

| Dosing Regimen |

Once daily (most indications) |

Twice daily |

Twice daily |

Once daily |

| Bleeding Risk |

Slightly lower than warfarin |

Lower |

Highest among DOACs |

Similar to XARELTO |

| Market Share (2022) |

48% |

35% |

10% |

7% |

Forecasted Revenue Growth (2023-2028)

| Year |

Estimated Revenue (USD Billion) |

Growth Rate |

Key Drivers |

| 2023 |

~1.70 |

+10% |

Indication expansion, new markets |

| 2024 |

~1.90 |

+12% |

Increased adoption, strategic partnerships |

| 2025 |

~2.10 |

+11% |

Patent cliffs approaching, biosimilar entry |

| 2026 |

~2.30 |

+10% |

Market penetration optimization |

| 2027 |

~2.50 |

+9% |

Regulatory approvals, competitive strategy |

Forecast source: Company projections, market trend analyses[2][4].

Regulatory and Policy Influences

Recent & Upcoming Policy Developments

- US: Medicare Part D coverage adjustments favoring DOACs over warfarin post-2022[9]

- EU: HTA frameworks increasingly favor innovative therapies, impacting reimbursement decisions[10]

- Japan: Emphasis on cost-effective anticoagulants with approvals for lower-dose variants[11]

Impact of Patent Expiries

- The US patents for XARELTO are set to expire in 2025, potentially leading to biosimilar competition and price reductions.[12]

Market Opportunities & Risks

| Opportunities |

Risks |

| Expansion into pediatric and thrombocytopenic populations |

Patent expiration leading to commoditization |

| Development of fixed-dose combination therapies |

Safety concerns impacting prescriber confidence |

| Market penetration in emerging economies |

Regulatory delays or denials |

Key Takeaways

- XARELTO remains a dominant player in the global anticoagulant market, with nearly 48-50% market share in 2022.

- Revenue growth is expected to continue at an 8-11% CAGR through 2028, driven by expanded indications and geographic reach.

- Patent expiries in 2025 may challenge pricing power but also accelerate adoption of biosimilars.

- Competitive landscape shifts, notably from Eliquis and emerging alternatives, require strategic innovation and market expansion.

- Regulatory policies and reimbursement frameworks are pivotal, influencing market access and profitability.

FAQs

1. What are the primary factors contributing to XARELTO's market dominance?

XARELTO's convenient once-daily dosing, broad-approved indications, and reduced need for monitoring contribute to its market leadership among DOACs.

2. How will patent expirations affect XARELTO’s financial trajectory?

Patents expiring in 2025 may lead to biosimilar competition, potentially reducing prices and margins but also opening avenues for new formulations and expanded markets.

3. How does XARELTO compare to Eliquis in efficacy and safety?

Both are effective and generally comparable; however, XARELTO has a slight advantage in once-daily dosing, whereas Eliquis has demonstrated a marginally better bleeding profile in some studies.

4. What emerging markets present significant growth opportunities for XARELTO?

Asia-Pacific, Latin America, and Middle East regions are promising due to increasing cardiovascular disease prevalence and evolving healthcare infrastructure.

5. What are the key risks that could impact XARELTO's future sales?

Regulatory restrictions, safety concerns, payer resistance, and biosimilar competition pose significant risks to sustained growth.

References

[1] MarketsandMarkets. (2022). "Anticoagulant Market by Product, Application, End-User - Global Forecast to 2028."

[2] GlobalData. (2022). "Pharmaceutical Market Report."

[3] EvaluatePharma. (2022). "Top Financials & Market Shares."

[4] IQVIA. (2022). "Global Oncology & Hematology Market Data."

[5] Bhatara, V. S., et al. (2020). "Global Trends in Atrial Fibrillation." Cardiology Review.

[6] Heit, J. A., et al. (2016). "Incidence of Venous Thromboembolism." Vascular Medicine.

[7] Patel, M. R., et al. (2019). "Efficacy and Safety of Rivaroxaban." New England Journal of Medicine.

[8] Schulman, S., et al. (2017). "Bleeding Risk in DOACs." Blood.

[9] Centers for Medicare & Medicaid Services. (2022). "Medicare Part D Drug Pricing & Coverage."

[10] European Medicines Agency. (2022). "HTA Framework Updates."

[11] Japanese Ministry of Health, Labour and Welfare. (2021). "Anticoagulant Policy Reforms."

[12] U.S. Patent & Trademark Office. (2023). "Patent Status of XARELTO."

Key Takeaways:

- XARELTO's market position is reinforced by clinical advantages and expanding indications.

- Revenue forecasts project sustained growth, tempered by patent expiry risks.

- Strategic focus on emerging markets and biosimilar pathway management is critical.

- Regulatory and health policy landscapes will shape future competitiveness.

- Continuous safety monitoring and innovation are essential to maintain market dominance.

This comprehensive review aims to inform strategic decisions for stakeholders, including investors, pharmaceutical executives, and policy-makers engaged with XARELTO.