XTORO Drug Patent Profile

✉ Email this page to a colleague

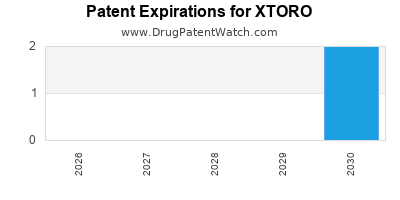

When do Xtoro patents expire, and what generic alternatives are available?

Xtoro is a drug marketed by Fonseca Biosciences and is included in one NDA. There are four patents protecting this drug.

This drug has forty-two patent family members in eighteen countries.

The generic ingredient in XTORO is finafloxacin. Additional details are available on the finafloxacin profile page.

DrugPatentWatch® Generic Entry Outlook for Xtoro

Xtoro was eligible for patent challenges on December 17, 2018.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be July 2, 2030. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for XTORO?

- What are the global sales for XTORO?

- What is Average Wholesale Price for XTORO?

Summary for XTORO

| International Patents: | 42 |

| US Patents: | 4 |

| Applicants: | 1 |

| NDAs: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 44 |

| DailyMed Link: | XTORO at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for XTORO

Generic Entry Date for XTORO*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

SUSPENSION/DROPS;OTIC |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

US Patents and Regulatory Information for XTORO

XTORO is protected by four US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of XTORO is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fonseca Biosciences | XTORO | finafloxacin | SUSPENSION/DROPS;OTIC | 206307-001 | Dec 17, 2014 | DISCN | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Fonseca Biosciences | XTORO | finafloxacin | SUSPENSION/DROPS;OTIC | 206307-001 | Dec 17, 2014 | DISCN | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Fonseca Biosciences | XTORO | finafloxacin | SUSPENSION/DROPS;OTIC | 206307-001 | Dec 17, 2014 | DISCN | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Fonseca Biosciences | XTORO | finafloxacin | SUSPENSION/DROPS;OTIC | 206307-001 | Dec 17, 2014 | DISCN | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for XTORO

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Fonseca Biosciences | XTORO | finafloxacin | SUSPENSION/DROPS;OTIC | 206307-001 | Dec 17, 2014 | ⤷ Get Started Free | ⤷ Get Started Free |

| Fonseca Biosciences | XTORO | finafloxacin | SUSPENSION/DROPS;OTIC | 206307-001 | Dec 17, 2014 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for XTORO

When does loss-of-exclusivity occur for XTORO?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 7372

Patent: COMPOSICIONES Y METODOS PARA TRATAR INFECCIONES OFTALMICAS OTICAS O NASALES

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 10266120

Patent: Compositions comprising finafloxacin and methods for treating ophthalmic, otic, or nasal infections

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 1016257

Patent: composições compreendendo finafloxacino e métodos para tratar infecções oftálmicas, ópticas ou nasais

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 65852

Patent: COMPOSITIONS COMPRENANT DE LA FINAFLOXACINE ET METHODES DE TRAITEMENT D'INFECTIONS OPHTALMIQUES, OTIQUES OU NASALES (COMPOSITIONS COMPRISING FINAFLOXACIN AND METHODS FOR TREATING OPHTHALMIC, OTIC, OR NASAL INFECTIONS)

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 11003327

Patent: Composicion farmaceutica que comprende finafloxacina y un agente antiinflamatorio; uso en el tratamiento de infecciones oftalmicas, oticas o nasales.

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2470139

Patent: Compositions comprising finafloxacin and methods for treating ophthalmic, otic, or nasal infections

Estimated Expiration: ⤷ Get Started Free

Patent: 5687111

Patent: 用于治疗眼、耳或鼻感染的包含非那沙星的组合物和方法 (Compositions and methods for treating ophthalmic, otic, or nasal infections)

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 48587

Patent: COMPOSITIONS COMPRENANT DE LA FINAFLOXACINE ET MÉTHODES DE TRAITEMENT D'INFECTIONS OPHTALMIQUES, OTIQUES OU NASALES (COMPOSITIONS COMPRISING FINAFLOXACIN AND METHODS FOR TREATING OPHTHALMIC, OTIC, OR NASAL INFECTIONS)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 84012

Estimated Expiration: ⤷ Get Started Free

Patent: 12532115

Estimated Expiration: ⤷ Get Started Free

Patent: 15134827

Patent: 眼、耳または鼻の感染症を処置するためのフィナフロキサシンを含む組成物および方法 (COMPOSITIONS COMPRISING FINAFLOXACIN AND METHODS FOR TREATING OPHTHALMIC, OTIC, OR NASAL INFECTIONS)

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 12000136

Patent: COMPOSICIONES QUE COMPRENDEN FINAFLOXACINA Y METODOS PARA TRATAR INFECCIONES OFTALMICAS, OTICAS, O NASALES. (COMPOSITIONS COMPRISING FINAFLOXACIN AND METHODS FOR TREATING OPHTHALMIC, OTIC, OR NASAL INFECTIONS.)

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 70731

Patent: КОМПОЗИЦИИ, ВКЛЮЧАЮЩИЕ ФИНАФЛОКСАЦИИ, И СПОСОБЫ ЛЕЧЕНИЯ ОФТАЛЬМОЛОГИЧЕСКИХ, УШНЫХ ИЛИ НАЗАЛЬНЫХ ИНФЕКЦИЙ (FINAFLOXACIN-INCLUDING COMPOSITIONS, AND METHODS OF TREATING OPHTHALMOLOGICAL, AURAL AND NASAL INFECTIONS)

Estimated Expiration: ⤷ Get Started Free

Patent: 12103458

Patent: КОМПОЗИЦИИ, ВКЛЮЧАЮЩИЕ ФИНАФЛОКСАЦИИ, И СПОСОБЫ ЛЕЧЕНИЯ ОФТАЛЬМОЛОГИЧЕСКИХ, УШНЫХ ИЛИ НАЗАЛЬНЫХ ИНФЕКЦИЙ

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1109492

Patent: COMPOSITIONS COMPRISING FINAFLOXACIN AND METHODS FOR TREATING OPHTHALMIC,OTIC,OR NASAL INFECTIONS

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1541823

Estimated Expiration: ⤷ Get Started Free

Patent: 120114211

Patent: COMPOSITIONS AND METHODS FOR TREATING OPHTHALMIC, OTIC, OR NASAL INFECTIONS

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 94775

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 60181

Estimated Expiration: ⤷ Get Started Free

Patent: 1102395

Patent: Compositions and methods for treating ophthalmic, otic, or nasal infections

Estimated Expiration: ⤷ Get Started Free

Uruguay

Patent: 758

Patent: COMPOSICIONES Y MÉTODOS PARA EL TRATAMIENTO DE INFECCIONES ÓPTICAS, NASALES U OFTÁLMICAS

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering XTORO around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| China | 104869999 | Finafloxacin suspension compositions | ⤷ Get Started Free |

| South Korea | 20150090045 | 피나플록사신 현탁 조성물 (FINAFLOXACIN SUSPENSION COMPOSITIONS) | ⤷ Get Started Free |

| European Patent Office | 0946176 | UTILISATION DE DERIVES D'ACIDE 7-(2-OXY-5,8-DIAZABICYCLO 4.3.0]NON-8-YL)QUINOLEONE ET NAPHTYRIDONECARBOXYLIQUE POUR L'OBTENTION D'UN MEDICAMENT DESTINE AU TRAITEMENT D'INFECTIONS PAR HELICOBACTER PYLORI ET DES MALADIES GASTRO-DUODENALES QUI Y SONT ASSOCIEES (THE USE OF 7-(2-OXA-5,8-DIAZABICYCLO 4.3.0]NON-8-YL)-QUINOLONE CARBOXYLIC ACID AND NAPHTHYRIDON CARBOXYLIC ACID DERIVATIVES FOR MANUFACTURE OF A MEDICAMENT FOR THE TREATMENT OF HELICOBACTER PYLORI INFECTIONS AND ASSOCIATED GASTRODUODENAL DISEASES) | ⤷ Get Started Free |

| Slovakia | 14962000 | Použitie derivátov 7-(2-oxa-5,8-diazabicyklo[4.3.0] non-8-yl)- chinolónkarboxylovej a -naftyridónkarboxylovej kyseliny na výrobu liečiv na terapiu infekcií spôsobených Helicobacter pylori a ním asociovaných gastroduodenálnych ochorení a zlúčenina tohto typu (The use of 7-(2-oxa-5,8-diazabicyclo[4.3.0]non-8-yl)-quinolone carboxylic acid and naphthyridon carboxylic acid derivatives for the treatment of Helicobacter pylori infections and associated gastroduodenal diseases) | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Market Dynamics and Financial Trajectory for the Pharmaceutical Drug: XTORO

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.