Share This Page

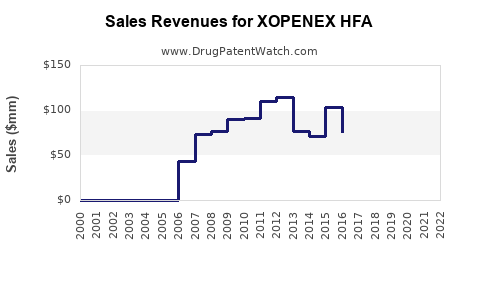

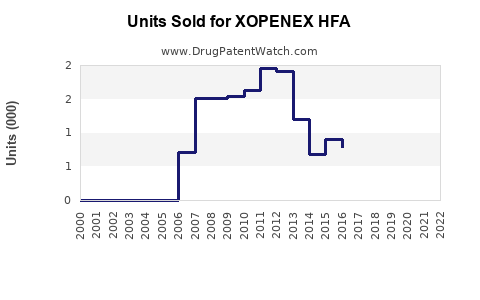

Drug Sales Trends for XOPENEX HFA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for XOPENEX HFA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| XOPENEX HFA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| XOPENEX HFA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| XOPENEX HFA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| XOPENEX HFA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| XOPENEX HFA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| XOPENEX HFA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for XOPENEX HFA

Introduction

XOPENEX HFA (levalbuterol inhalation aerosol) is a prescription medication used primarily for the treatment of bronchospasm associated with chronic obstructive pulmonary disease (COPD) and asthma. As the inhaled bronchodilator, it delivers levalbuterol—a pure enantiomer of albuterol—offering targeted relief with a potentially reduced side-effect profile. Given its positioning within the respiratory therapeutics market, understanding its market dynamics and future sales potential necessitates a comprehensive analysis of current trends, competitive landscape, regulatory influences, and epidemiological factors.

Market Overview

The global respiratory drug market is vast, driven by increasing prevalence of COPD and asthma, aging populations, and a rising emphasis on inhalation therapies for respiratory conditions. The segment encompassing nebulized and inhaler bronchodilators, which includes XOPENEX HFA, is poised for sustained growth.

Market Size and Trends:

In 2022, the global respiratory drugs market was valued at approximately USD 42 billion, expected to expand at a Compound Annual Growth Rate (CAGR) of around 4% through 2030 [1]. Within this, the inhaled bronchodilators segment accounts for roughly 45%, signifying robust demand. The legacy of albuterol and levalbuterol remains strong due to their proven efficacy and safety profiles.

Key Drivers:

- Rising prevalence of COPD and asthma globally

- Greater adoption of inhaled therapy over oral or injectable routes

- Innovations in inhaler technology and drug delivery systems

- Increasing awareness and diagnosis rates

Challenges:

- Patent expirations of key competitors (e.g., Ventolin)

- Competition from alternative inhaler devices and combination therapies

- Cost pressures and insurance reimbursement issues

Product Positioning and Competitive Landscape

XOPENEX HFA faces competition mainly from established inhaled beta-agonists, chiefly:

- Ventolin HFA (albuterol) — Market leader with extensive brand recognition

- ProAir HFA (albuterol) — Competitive alternative with broad prescribing footprint

- Striverdi Respimat (olodaterol) — A long-acting bronchodilator targeting COPD

- Combination therapies (ICS/LABA inhalers) such as Advair and Symbicort

XOPENEX’s unique selling proposition hinges on its pharmacologic purity—delivering only levalbuterol—which can translate into fewer side effects like jitteriness or tachycardia associated with racemic albuterol. Despite this, market penetration remains moderate, constrained by brand switching inertia, formulary access barriers, and entrenched prescribing habits.

Regulatory and Patent Status:

XOPENEX HFA benefits from patent protections extending into the mid-2020s, securing exclusive market rights. Pending biosimilar or generic entries could influence future pricing and sales, especially as patents expire.

Epidemiological and Demographic Factors

The growth outlook of XOPENEX HFA correlates strongly with disease prevalence. Key epidemiological insights include:

- Global COPD prevalence: Estimated at 200 million cases worldwide, projected to rise due to smoking, pollution, and aging [2].

- Asthma prevalence: Approximately 300 million globally, with rising incidence in developing countries [3].

- Age demographics: Elderly populations exhibit higher disease burden, increasing demand for inhaled therapies.

The expansion of healthcare infrastructure, particularly in emerging markets, supports increased access and adoption.

Market Penetration Strategies

For XOPENEX HFA to accelerate market share, strategies include:

- Physician Engagement: Education highlighting its safety advantages and efficacy.

- Formulary Negotiations: Ensuring inclusion in insurance plans and hospital formularies.

- Patient Outreach: Targeted education and adherence programs.

- Expansion into Emerging Markets: Leveraging unmet needs and rising disease burden.

Sales Projections: 2023–2030

Forecasting sales involves integrating epidemiological data, competitive actions, regulatory pathways, and market adoption rates.

Assumptions:

- Continued patent exclusivity until mid-2020s, with generic competition possibly emerging afterward.

- Moderate market penetration growth facilitated by increased disease prevalence.

- An annual increase in unit sales driven by population aging and improved diagnosis.

2023–2025:

Sales are projected to stabilize, with modest growth (CAGR of 2-3%) as the product consolidates existing market share amid fierce competition.

2026–2030:

Post-patent expiry, sales could decline by 10-15% annually unless mitigated by new formulations, indications, or market expansion. However, if the product maintains clinical relevance and prescriber preference, a plateau or slight growth could ensue due to continued market penetration in emerging markets.

Sample Projection Summary:

| Year | Estimated Global Sales (USD Millions) | Notes |

|---|---|---|

| 2023 | 250 | Steady state with current market share |

| 2024 | 255 | Slight increase, new formulary adoptions |

| 2025 | 260 | Market stabilization |

| 2026 | 220 | Patent expiry, generic competition begins |

| 2027 | 195 | Market share erosion without new indications |

| 2028–2030 | 180–190 | Potential decline plateau or stabilization |

Note: These projections are indicative, subject to regulatory, market, and competitive developments.

Key Market Trends Influencing Future Sales

- Shift Towards Combination Therapies: As fixed-dose combination inhalers gain popularity, monotherapy products like XOPENEX HFA may see a decline unless repositioned for specific patient populations requiring monotherapy.

- Inhaler Technology Innovation: Development of more convenient, user-friendly inhalers may favor newer devices over traditional HFA formulations.

- Emerging Market Growth: Rapid growth in countries like China and India offers expanded opportunities, particularly if XOPENEX HFA gains regulatory approval and formulary access.

Regulatory Outlook and Impact

Regulatory authorities, including the FDA and EMA, continue to encourage innovative inhalation therapies with better safety profiles. The expiration of patents and the potential for biosimilar entries post-2025 could depress prices and sales volume unless the brand maintains its perceived clinical advantage.

Conclusion

XOPENEX HFA occupies a niche within the competitive inhaled bronchodilator market, with stable demand driven by the persistent prevalence of asthma and COPD. While current sales are strong, future growth hinges on strategic marketing, demonstrating clinical superiority, and expanding presence in emerging markets. Patent expiration and market commoditization present risks but also opportunities for repositioning or formulation innovation.

Key Takeaways

- Market stability: XOPENEX HFA benefits from a well-established position, bolstered by a favorable safety profile and targeted efficacy.

- Growth prospects: Limited growth expected pre-patent expiry; post-expiry, sales may decline unless countered by market expansion or innovation.

- Competitive dynamics: Strong competition from albuterol formulations and combination therapies requires strategic differentiation.

- Market expansion: Emerging markets present significant opportunities, contingent upon regulatory approvals and formulary inclusion.

- Innovation necessity: To sustain relevance, ongoing innovation in inhaler technology and potential new indications are critical.

FAQs

1. How does XOPENEX HFA differ from traditional albuterol inhalers?

XOPENEX HFA delivers pure levalbuterol, the active enantiomer of albuterol, which may result in fewer side effects and potentially better tolerability compared to racemic albuterol formulations.

2. What is the impact of patent expiration on XOPENEX HFA sales?

Patent expiry, expected in the mid-2020s, could lead to increased generic competition, driving down prices and potentially reducing sales volume unless the brand maintains a strong prescriber and patient base through differentiation.

3. Which markets present the most growth potential for XOPENEX HFA?

Emerging markets such as China, India, and Brazil offer substantial growth opportunities due to rising disease prevalence, improving healthcare infrastructure, and increasing access to inhaled therapies.

4. What strategies can manufacturer employ to maximize sales longevity?

Enhancing formulary access, increasing clinician and patient education, expanding indications, and developing more user-friendly inhaler devices can extend market relevance and sales.

5. How might future technological developments influence the inhaled respiratory drug market?

Advances in inhaler design, digital health integration, and novel formulations could challenge existing products but also open avenues for new growth if embraced effectively.

References

[1] MarketResearch.com. Global Respiratory Drugs Market Overview. 2022.

[2] World Health Organization. Chronic Obstructive Pulmonary Disease (COPD) Fact Sheet. 2023.

[3] Global Initiative for Asthma (GINA). Global Asthma Report. 2022.

More… ↓