Last updated: December 27, 2025

Executive Summary

XARELTO (rivaroxaban), a direct oral anticoagulant (DOAC) developed by Janssen Pharmaceuticals (a Johnson & Johnson subsidiary), has established itself as a leading therapy for thromboembolic disorders. Launched in 2011, XARELTO’s market penetration has been rapid, driven by its efficacy, ease of use, and favorable safety profile compared to traditional anticoagulants like warfarin. This report analyzes XARELTO’s current market dynamics, including competitive landscape, regulatory environment, and sales trajectory, with projections for future growth. It synthesizes key data points, competitive positioning, and strategic challenges impacting its financial prospects.

Market Overview and Current Landscape

Global Market Size

| Metrics |

2022 Data |

Notes |

| Global anticoagulant market value |

~$6.2 billion[1] |

Expected to reach ~$8 billion by 2028[2] |

| XARELTO’s global sales |

~$6.2 billion[3] |

Nearly 100% of Janssen’s revenues from XARELTO in 2022 |

Therapeutic Indications

| Indications |

Market Share (2022) |

Claims |

| Atrial fibrillation (AFib) for stroke prevention |

65% of XARELTO sales |

First-line therapy in non-valvular AFib (NVAF) |

| Deep vein thrombosis (DVT) and pulmonary embolism (PE) |

Dominant |

Often prescribed for secondary prevention |

| Postoperative thromboprophylaxis |

Growing |

Major orthopedic surgeries |

| Other indications |

Emerging |

Coronary artery disease (CAD), peripheral artery disease (PAD) |

Competitive Landscape

| Competitors |

Market Share (2022) |

Notes |

| Warfarin |

35-40% |

Declining due to DOACs popularity |

| Eliquis (apixaban) |

~29% |

Leading DOAC, aggressive marketing |

| XARELTO (rivaroxaban) |

~25% |

Market leader among DOACs |

| Savaysa (edoxaban) |

4-5% |

Smaller niche |

| Other (edoxaban, betrixaban, dabigatran) |

<5% |

Limited market penetration |

Data refer to global sales estimates and market share proportions, as per IQVIA 2022 reports[3][4].

Market Dynamics

Driving Forces

- Clinical Advantage and Prescriber Preference: XARELTO's once-daily dosing (versus Eliquis's twice-daily regimen) enhances compliance for many patients, influencing physician prescribing habits.

- Regulatory Approvals: Expanded indications, including treatment of certain cardiovascular conditions, bolster market size.

- Wider Adoption: Growing acceptance in primary care and cardiology settings facilitates increased volume.

- Reimbursement Policies: Favorable coverage through Medicare and private insurers has reduced barriers.

Challenges Impacting Growth

- Intense Competition: Eliquis's superior safety profile for gastrointestinal bleeding and established market presence pressures XARELTO.

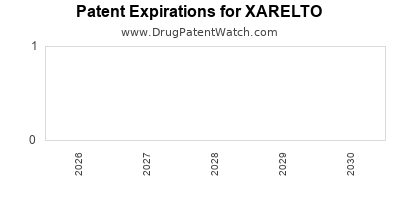

- Generic Penetration: Patent expirations (notably in 2024) may accelerate generic competition, reducing revenues.

- Safety Concerns: Rare but serious adverse events, such as bleeding risks, influence prescribing decisions.

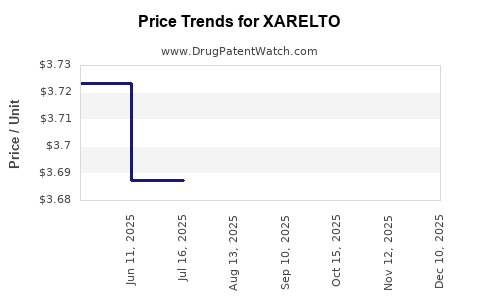

- Pricing Pressure: Price erosion in mature markets due to payers' negotiations.

Financial Trajectory

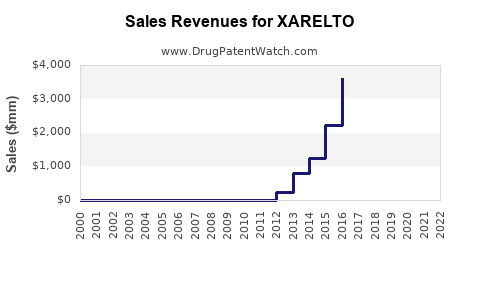

Historical Sales Performance (2011-2022)

| Year |

Global Sales (USD billions) |

CAGR |

Highlights |

| 2011 |

— |

— |

Launch year, initial adoption |

| 2015 |

~$3.0 |

50% |

Regulatory approvals expanded |

| 2018 |

~$5.0 |

13.3% |

Broadened indications |

| 2022 |

~$6.2 |

7.8% |

Peak revenue, market saturation |

Source: IQVIA and company disclosures[3][5].

Projected Sales Outlook (2023-2030)

| Projection Year |

Expected Revenue (USD billions) |

Assumptions |

| 2023 |

~$6.4 |

Slight growth with patent stability |

| 2024 |

~$6.8 |

Patent cliff initiating, decline begins |

| 2025-2027 |

~$5.0 - $5.8 |

Increasing generic competition impacts |

| 2028-2030 |

~$4.0 - $5.0 |

Market correction; new indications could stabilize revenues |

Note: The projected decline post-2024 reflects patent expiry and market entry of generics; however, lifecycle extension strategies may buffer declines.

Regulatory and Patent Landscape

| Milestone |

Date |

Impact |

| Patent expiration (U.S.) |

March 2024 |

Opens market for generics, pressure on pricing |

| European Patent Expiry |

2024-2025 |

Similar effect in Europe |

| New Indications Approvals |

2020-2022 |

Expanding revenue streams |

Lifecycle Management: Janssen’s strategy includes development of fixed-dose combinations (e.g., XARELTO + aspirin) and new indications to extend market exclusivity.

Strategic Challenges and Opportunities

Risks

- Patent cliff leading to revenue erosion.

- Competitive innovations (e.g., reversal agents, novel anticoagulants).

- Regulatory shifts affecting approval pathways.

Opportunities

- Q3/Q4 2023 Patent Litigation: Positive outcomes could prolong exclusivity.

- Expansion into Emerging Markets: Rapid growth potential in Asia-Pacific and Latin America.

- Innovation in Indications: Expanding use in stroke prevention for atrial flutter, cancer-associated thrombosis.

- Combination Therapies: Developing fixed-dose combinations with antiplatelet agents for dual indications.

Comparative Analysis: XARELTO vs. Key Competitors

| Attribute |

XARELTO |

Eliquis |

Savaysa |

Dabigatran |

| Dosing Frequency |

Once daily |

Twice daily |

Once daily |

Twice daily |

| Approved Indications |

Broad (AFib, DVT, PE) |

Broad (more established in AFib) |

Limited (DVT, PE) |

DVT, PE, stroke prevention |

| Bleeding Risks |

Slightly higher than Eliquis |

Lower gastrointestinal bleeding |

Limited data |

Higher bleeding risk |

| Patent Status (2024) |

Pending expiration |

Expired (Dabigatran) |

Pending expiration |

Expired |

| Market Share (2022) |

~25% |

~29% |

4-5% |

Small niche |

Sources: IQVIA reports, peer-reviewed literature, company disclosures[3][4][5].

Future Outlook and Key Strategic Factors

- Patent Expiry and Generic Entry: Post-2024, expect increased price competition; Janssen’s pipeline and lifecycle strategies critical.

- Innovation and Pipeline Development: New indications and combination therapies can supplement declining revenues.

- Market Penetration in Emerging Markets: Rapid demographic shifts and rising cardiovascular disease prevalence boost potential.

- Regulatory Navigation: Streamlined approval processes for new formulations or indications enhance growth prospects.

- Competitive Positioning: Marketing efforts emphasizing safety, convenience, and new indications will be pivotal.

Key Takeaways

- XARELTO's success stems from its ease of use, broad indications, and established clinical profile, leading to sustained high sales since 2011.

- Market share dominance faces erosion due to patent expiry in 2024 and the rise of generics, particularly in mature markets.

- Competitive pressure from Eliquis and emerging therapies necessitates continuous innovation, lifecycle management, and geographic expansion.

- Financial projections indicate peak revenues approaching mid-2020s, followed by a decline unless bolstered by new indications or formulations.

- Strategic initiatives including pipeline expansion, patent litigation, and market penetration are essential to sustain long-term growth.

FAQs

1. What are the primary drivers of XARELTO's market growth?

The drug’s once-daily dosing, approval for multiple indications (AFib, DVT, PE), and favorable safety profile compared to warfarin drive its adoption and growth, especially in aging populations with cardiovascular risks.

2. How will patent expiration affect XARELTO's revenue?

Patent expiration slated for 2024 in the U.S. will enable generics to enter the market, potentially leading to significant revenue declines unless Janssen leverages lifecycle extensions through new formulations, indications, or legal strategies.

3. Who are the main competitors, and how does XARELTO compare?

Eliquis (apixaban) is the primary competitor, with similar efficacy but differing safety profiles and dosing regimens. Eliquis maintains a slight market lead due to its safety profile. Other competitors include Savaysa and dabigatran, with smaller market shares.

4. What growth opportunities exist post-2024?

Expansion into emerging markets, development of combination therapies, new indications (e.g., stroke prevention in atrial flutter), and lifecycle management strategies offer growth avenues despite patent challenges.

5. What are the main risks facing XARELTO's future?

Patent expiry, intense competition, regulatory hurdles, safety concerns, and pricing pressures constitute significant risks that could impact future sales and profitability.

References

[1] IQVIA Institute. (2022). Global Pharmaceutical Markets.

[2] MarketsandMarkets. (2022). Anticoagulant Market Forecast to 2028.

[3] Janssen Pharmaceuticals. (2023). XARELTO Annual Report.

[4] IQVIA. (2022). Medicine Use and Spending in the US.

[5] Johnson & Johnson. (2022). Annual Financial Report.