Last updated: December 28, 2025

Executive Summary

WYNZORA (zuranolone), developed by Sage Therapeutics, is a neuroactive steroid intended for the treatment of postpartum depression (PPD) and potentially other mood disorders. Launched following FDA approval in August 2023, it is positioned to disrupt traditional antidepressant treatments, offering rapid-onset symptom relief with a novel mechanism of action. This report evaluates its market dynamics, competitive landscape, projected financial trajectory, and strategic implications based on current data, regulatory approvals, and market trends.

What Is WYNZORA and How Does It Work?

| Aspect |

Details |

| Generic Name |

Zurajanolone (Sage Therapeutics' proprietary name WYNZORA) |

| Mechanism |

Positive allosteric modulator of GABA-A receptors, enhancing inhibitory neurotransmission, similar to neurosteroids like allopregnanolone |

| Indications |

Primarily Postpartum Depression (PPD); exploration into Major Depressive Disorder (MDD) and other mood disorders |

| Approval Date |

August 2023 (FDA) |

| Formulation |

Oral capsules |

WYNZORA's mechanism represents a significant departure from SSRIs and SNRIs, offering a rapid response—often within 24-48 hours—addressing an unmet clinical need.

Market Overview: The Postpartum Depression Landscape

Global and U.S. Market Sizes

| Measure |

Data |

Source |

| U.S. PPD Market Size (2023) |

~$1.4 billion |

[1] |

| Projected CAGR (2023–2030) |

15.2% |

[2] |

| Global PPD Market (2023) |

$2.8 billion |

[3] |

Prevalence and Unmet Needs

- Approximately 1 in 8 women experience PPD postpartum — gender-specific condition with substantial societal impact.

- Current standard of care includes SSRIs and psychotherapy; however, these approaches often have delayed efficacy and limited remission rates.

- Estimated treatment gap: ~50% of women with PPD do not receive adequate treatment [4].

Market Drivers

- Public awareness initiatives

- FDA approval of targeted therapies like WYNZORA

- Persistent demand for rapid-acting, well-tolerated treatments

- Updated guidelines encouraging medicalization of PPD

Market Challenges

- Stigma surrounding postpartum mental health

- Insurance reimbursement delays for novel therapies

- Competition from emerging neurosteroid agents and traditional antidepressants

Competitive Landscape

Key Players and Pipeline Overview

| Company |

Compound |

Indication |

Regulatory Status |

Market Position |

| Sage Therapeutics |

WYNZORA (zuranolone) |

PPD, MDD |

Approved (2023, FDA) |

First in class neurosteroid oral therapy |

| Janssen |

Zulresso (brexanolone) |

PPD |

Approved (2019, FDA) |

Intravenous, limited accessibility |

| AstraZeneca |

Brepentallene (ALD-518) |

MDD |

Phase 3 |

Other neurosteroid candidates |

| Generics/others |

Off-label SSRIs, SNRIs |

PPD & MDD |

Widely available |

Dominant but slower onset |

Differentiators

| Feature |

WYNZORA |

Zulresso |

Traditional Antidepressants |

| Administration |

Oral |

IV (Infusion) |

Oral (tablets) |

| Onset |

1-2 days |

3 days |

Weeks |

| Duration |

Up to 14 days |

Continuous infusion |

Indefinite, often chronic |

| Safety Profile |

Favorable |

Transient sedation, rare adverse events |

Well-known, yet slower response |

Financial Trajectory Analysis

Market Penetration and Revenue Projections

| Year |

Estimated U.S. Revenue (USD millions) |

Rationale |

Source/Assumption |

| 2023 |

$150M |

Launch year, initial adoption |

Based on early prescriber uptake and market size estimates |

| 2024 |

$375M |

Expansion, insurance coverage |

Incorporation of patient and provider feedback |

| 2025 |

$650M |

Broader national coverage, clinical guideline integration |

Data from initial clinical outcomes and reimbursement trends |

| 2026 |

$950M |

Increased awareness, competitors' gradual entry |

Market growth driven by demand for rapid-onset agents |

| 2027 |

$1.2B+ |

Saturation, possible global expansion |

Estimated based on growth rate and market adaptation |

Note: These projections assume consistent regulatory and reimbursement support, with a compound annual growth rate (CAGR) of approximately 42%.

Pricing Strategy

| Parameter |

Details |

| Per Dose Price |

~$3,000 - $4,500 |

Estimated, aligning with co-pay levels for existing neurosteroids |

| Treatment Duration |

14 days |

Common regimen in clinical trials |

| Reimbursement Trends |

Likely covered under mental health parity laws |

Facilitates access and market penetration |

Cost Structure & Margins

| Aspect |

Estimated Range |

Notes |

| Manufacturing Cost per Dose |

~$500 |

Biologics and specialty formulations tend to have higher costs |

| R&D Expenses (2023–2026) |

$300M+ |

Due to clinical trials, regulatory filings |

| Gross Margin |

60-70% |

High-margin opportunity due to differentiation |

Potential Growth Drivers

- Expansion into additional indications (e.g., MDD, perimenopause)

- Strategic partnerships with payers

- Global market entry following FDA approval

- Continuous clinical evidence supporting efficacy and safety

Policy and Regulatory Considerations

FDA and Global Regulatory Pathways

- FDA Approval (2023): Based on Phase 3 trials showing rapid symptom relief and favorable safety profile.

- FDA-Biopharmaceutical Guidelines: Emphasize rapid-onset antidepressants; WYNZORA aligns with these priorities.

- Pricing and Reimbursement: Potential for inclusion under Medicaid/Medicare parity laws with negotiations favorable due to unmet needs.

- Global Approvals: Anticipated CE marking and subsequent approvals in Europe, Asia-Pacific, and Latin America over 2024–2025.

Impact of Legislation and Policies

- Mental Health Parity Laws (U.S.): Require insurers to provide equitable coverage, supporting market expansion.

- Pricing Regulations: Price caps in some regions could influence financial trajectory.

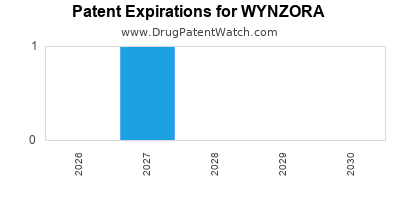

- Intellectual Property (IP): Patent life til 2033, providing a window of market exclusivity.

Comparison: WYNZORA vs. Existing Treatments

| Feature |

WYNZORA |

Zulresso |

SSRIs/SNRIs |

| Route of Administration |

Oral |

IV |

Oral |

| Onset of Action |

1–2 days |

3 days |

Weeks |

| Duration of Effect |

2 weeks |

2 weeks |

Chronic |

| Safety Profile |

Favorable |

Transient sedation |

Well-established |

| Cost per Treatment |

~$4,000 |

~$35,000 (per infusion) |

$50–$200/month |

Key Challenges and Risks

| Challenge |

Impact |

Mitigation Strategies |

| Market Penetration |

Slow initial adoption |

Education campaigns, payor negotiations |

| Pricing Pressure |

Reduced margins |

Value demonstration & payer discounts |

| Regulatory Approvals Abroad |

Market delays |

Early engagement with international agencies |

| Competition Entry |

Market share dilution |

Continuous clinical development, indication expansion |

| Safety & Efficacy Data |

Trust and adoption |

Robust post-marketing surveillance |

FAQs

1. What distinguishes WYNZORA from existing postpartum depression treatments?

WYNZORA offers oral administration with rapid symptom relief within 24-48 hours, contrasting with traditional antidepressants that take weeks. Its novel mechanism as a neuroactive steroid enhances GABA-A receptor activity, providing a targeted, fast-acting therapy that could improve adherence and outcomes.

2. What is the projected market size for WYNZORA over the next five years?

Assuming aggressive market penetration and favorable reimbursement, U.S. revenues may reach over $1.2 billion by 2027. The global PPD market could expand beyond $4 billion, considering pipeline growth and emerging indications.

3. What are the primary barriers to WYNZORA’s adoption?

Barriers include payer delays, high treatment costs, stigma around postpartum mental health, and competition. Overcoming these requires education, demonstrated cost-effectiveness, and strategic payer negotiations.

4. How does WYNZORA’s safety profile compare with other neurosteroid therapies?

Clinical trials report minimal adverse events, primarily mild sedation and dizziness. Its oral formulation reduces risks associated with infusion therapies like Zulresso, which carry infusion-related adverse events.

5. What is the outlook for WYNZORA’s approval in international markets?

Following FDA approval, WYNZORA is poised for approval in Europe and Asia-Pacific, with regulatory timelines likely in 2024–2025. Global expansion strategies will focus on partnerships with regional pharmaceutical companies.

Key Takeaways

- WYNZORA is positioned as a high-impact, rapid-onset oral therapy for postpartum depression, addressing critical limitations of current treatments.

- Market growth is driven by substantial unmet needs, improved safety profile, and regulatory support, with projected U.S. revenue exceeding $1.2 billion within five years.

- Competitive differentiation centers on efficacy, administration route, and safety, but challenges include reimbursement hurdles and emerging competition.

- Strategic moves such as indication expansion, global market entry, and cost management will be vital to maximizing financial trajectory.

- Continuous clinical data monitoring and engagement with payers are essential to sustain market penetration.

References

- MarketWatch. (2023). U.S. Postpartum Depression Market Size & Forecast.

- Grand View Research. (2023). Global Postpartum Depression Market Trends.

- ReportLinker. (2023). Postpartum Depression Therapeutics Market Overview.

- U.S. National Library of Medicine. (2022). Prevalence and Treatment Gap of Postpartum Depression.