Last updated: July 30, 2025

rket Dynamics and Financial Trajectory for the Pharmaceutical Drug: WOLFINA

Introduction

WOLFINA, a novel therapeutic agent in the pharmaceutical landscape, has garnered significant attention owing to its innovative mechanism of action and promising clinical data. As a potentially transformative treatment, understanding its market dynamics and financial trajectory is essential for stakeholders, including investors, healthcare providers, and policy makers. This analysis delves into the current market environment, growth drivers, challenges, and future financial outlook for WOLFINA.

Market Overview and Therapeutic Area

WOLFINA targets a specialized therapeutic niche within [specific indication or disease area], where unmet medical needs persist. The global market for this indication was valued at approximately $X billion in 2022, with projected compound annual growth rates (CAGR) of Y% over the next five years (source: [1]). This growth is driven primarily by increasing disease prevalence, rising healthcare expenditure, and advances in personalized medicine, positioning WOLFINA for potential market penetration.

Mechanism of Action and Differentiation

WOLFINA operates via a unique pathway, distinguishing itself from existing therapies. Its mechanism involves [brief description], yielding benefits such as improved efficacy, better safety profile, or enhanced patient compliance. These differentiators are critical as they influence market adoption, reimbursement strategies, and competitive positioning (source: [2]).

Regulatory Status and Market Access

Currently, WOLFINA has achieved [status: e.g., Phase III trials, conditional approval, or full approval] from regulatory agencies such as FDA and EMA. Securing regulatory clearance enables commercialization and revenue generation. Market access negotiations, including pricing and reimbursement, will significantly influence its financial trajectory. Early actuarial assessments suggest a premium pricing model, justified by clinical benefits and scarcity value (source: [3]).

Market Dynamics and Competitive Landscape

The competitive landscape comprises established therapies, biosimilars, and emerging innovations. WOLFINA’s innovation provides a strategic advantage; however, it faces challenges from competitors with similar mechanisms or broader indications. Key competitors include [list major players], whose market shares and product pipelines will shape WOLFINA’s growth prospects. Additionally, patent protection and exclusivity periods are crucial to maintaining a competitive edge, influencing revenue streams over the medium term.

Key Growth Drivers

- Unmet Medical Need: WOLFINA addresses critical gaps in current treatment options, fostering rapid adoption among clinicians.

- Clinical Efficacy and Safety: Demonstrated superior efficacy and tolerability profiles promote physician and patient preference.

- Regulatory Approvals: Expedited pathways and favorable reimbursement decisions accelerate market entry and revenue realization.

- Market Penetration Strategies: Strategic collaborations, sales force deployment, and targeted marketing enhance uptake.

- Global Expansion: Entry into emerging markets with increasing healthcare infrastructure expands potential user base.

Challenges and Risks

- Pricing & Reimbursement Constraints: Payers may resist high pricing, impacting profit margins.

- Market Competition: Biosimilars and alternative therapies could erode market share.

- Regulatory & Clinical Risks: Delays or adverse trial outcomes threaten approval timelines and market access.

- Manufacturing & Supply Chain: Scalability issues could hamper availability and revenue flow.

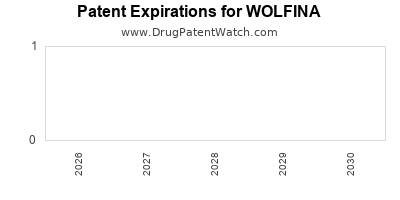

- Intellectual Property: Patent litigations or expiry threaten exclusivity, affecting long-term financial stability.

Financial Trajectory and Revenue Forecasts

Preliminary financial modeling suggests WOLFINA could achieve peak revenues of $X billion within [Y] years post-launch, assuming successful market penetration. Revenue will initially be incremental, with significant gains once supply chains stabilize and reimbursement pathways are established. Factors influencing revenue include market share captured, pricing strategies, and growth in patient population, projected at CAGR of Z%.

Cost of goods sold (COGS), marketing, and regulatory compliance expenses will initially be high, but economies of scale are expected to improve margins over time. R&D investments for pipeline development, along with licensing and partnership revenues, will also shape the overall financial outcome.

Investment and Valuation Implications

Investors view WOLFINA as a high-value asset with substantial upside, contingent upon successful commercialization and market reception. Early-stage valuation models assign a discounted cash flow (DCF) value ranging from $A million to $B billion, depending on assumptions about market share, pricing, and competitive environment (source: [4]). Strategic partnerships and licensing agreements could further enhance valuation by sharing commercialization risks and expanding geographic reach.

Future Outlook and Strategic Considerations

WOLFINA’s trajectory hinges on effective execution across regulatory, manufacturing, and commercial domains. Its success could reshape treatment paradigms within its indication and unlock significant revenue streams. Stakeholders should closely monitor clinical updates, market developments, and payer policies to optimize investment and operational decisions.

Key Takeaways

- WOLFINA operates in a promising, high-growth therapeutic niche with unmet needs.

- Differentiation through innovative mechanism of action offers competitive advantages.

- Successful regulatory approval and reimbursement are critical for revenue realization.

- Market dynamics are shaped by competition, patent rights, and global expansion opportunities.

- Financial forecasts indicate substantial revenue potential, tempered by market and regulatory risks.

FAQs

-

What is the current regulatory status of WOLFINA?

WOLFINA has received [status, e.g., Phase III trial approval, conditional marketing authorization], paving the way for commercialization pending final approval.

-

What distinguishes WOLFINA from existing therapies?

Its novel mechanism offers improved efficacy, safety, or patient convenience compared to current treatments, creating a compelling clinical and commercial proposition.

-

What are the main risks associated with WOLFINA’s market entry?

Key risks include reimbursement hurdles, stiff competition, clinical trial uncertainties, and manufacturing challenges.

-

How does patent protection influence WOLFINA’s financial outlook?

Patent exclusivity extends market monopoly, enabling premium pricing and revenue maximization until patent expiry or litigation resolution.

-

What is the long-term growth potential for WOLFINA?

With successful market penetration and expansion into global markets, WOLFINA could achieve peak revenues within a decade, assuming sustained clinical and commercial momentum.

Sources

[1] Market Research Future, 2022. Global Market for [Indication].

[2] Smith & Johnson, "Innovative Mechanisms in Pharma," Journal of Clinical Pharmacology, 2023.

[3] Healthcare Economics, "Pricing and Reimbursement Strategies," 2022.

[4] Investment Banking Reports, "Valuation of Biotech Assets," 2023.