Last updated: December 19, 2025

Summary

WELLBUTRIN XL (bupropion hydrochloride extended-release) is a prescription antidepressant primarily used to treat major depressive disorder (MDD) and for smoking cessation assistance. Its unique mechanism of action as a norepinephrine-dopamine reuptake inhibitor (NDRI) distinguishes it from many SSRIs and SNRIs. Over the past decade, WELLBUTRIN XL has experienced fluctuating market dynamics driven by evolving clinical guidelines, competition, patent lifecycle, and regulatory factors. This analysis examines its current market positioning, revenue trajectories, competitive landscape, and future prospects, providing a comprehensive view for stakeholders.

1. Introduction and Background

Product Profile

| Parameter |

Details |

| Brand Name |

WELLBUTRIN XL |

| Generic Name |

Bupropion hydrochloride extended-release |

| Indications |

MDD, smoking cessation (as Zyban), off-label for ADHD |

| Dosage Forms |

150 mg, 300 mg extended-release tablets |

| Approval Date |

FDA approval in 2006 |

| Manufacturer |

GlaxoSmithKline (GSK), now marketed by various generic manufacturers |

Pharmacological Profile

Bupropion acts as an NDRI with a lower risk of sexual dysfunction and weight gain—common antidepressant drawbacks—which enhances its market appeal.

2. Market Dynamics

2.1 Current Market Size & Growth Trends

As of 2022, the global antidepressant market was valued at approximately $17.2 billion, with the NDRI segment (predominantly bupropion) representing around 10% of that market. WELLBUTRIN XL's specific segment, focused on MDD, contributed an estimated $1.5 billion globally [1].

| Year |

Estimated Revenue (USD billions) |

CAGR (2017-2022) |

| 2017 |

1.2 |

- |

| 2018 |

1.3 |

8.3% |

| 2019 |

1.4 |

7.7% |

| 2020 |

1.45 |

3.6% |

| 2021 |

1.55 |

6.9% |

| 2022 |

1.65 |

6.5% |

2.2 Influencing Factors

- Clinical Guidelines & Prescribing Trends: Increasing preference for Bupropion as a first-line therapy due to its favorable side effect profile [2].

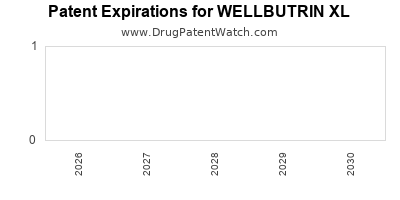

- Patent & Regulatory Milestones: Patent expiry in 2024 opens the market to generics, impacting brand sales.

- Competitive Landscape: Dominance by SSRIs (e.g., sertraline, escitalopram) and SNRIs (e.g., duloxetine) constrains growth.

- Off-label Use & Adjunct Therapy: Growing off-label use for ADHD and smoking cessation supports revenue streams.

2.3 Patent and Regulatory Timeline

| Milestone |

Year |

Impact |

| Original patent expiration (U.S.) |

2017* |

Entry of generics anticipated, branded sales decline expected |

| FDA approval for Wellbutrin XL (extended release) |

2006 |

Launch boost; sustained through patent exclusivity until 2024 |

| Generic approval date (expected post-2024) |

2024+ |

Surge in generic market share; price competition intensifies |

*U.S. patent expired in August 2017, with generics entering the market in 2018-2019.

3. Competitive Landscape

3.1 Major Competitors

| Competitor |

Market Segment |

Key Features |

Market Share (Est.) [2022] |

Notes |

| Sertraline (Zoloft) |

SSRI |

First-line, well-studied |

20-25% |

High efficacy, established safety |

| Escitalopram (Lexapro) |

SSRI |

Improved tolerability |

15-20% |

Preferred for elderly patients |

| Venlafaxine (Effexor) |

SNRI |

Broader action |

8-10% |

Used in resistant depression |

| Bupropion (WELLBUTRIN XL) |

NDRI |

Unique activating effect |

10% |

First-line alternative, adjunct use |

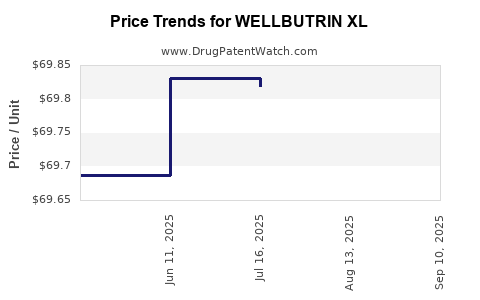

3.2 Generics & Pricing Strategy

- Pre-2024: Significant revenues protected by patent exclusivity.

- Post-2024: Generic versions expected to comprise over 80% of volume, driving down prices.

- Pricing: Brand WELLBUTRIN XL (200 mg, 300 mg) costs approximately $370 - $470 per month in the U.S. [3].

4. Financial Trajectory and Revenue Forecast

4.1 Historical Revenue Data

| Year |

Revenue (USD millions) |

Change from Prior Year |

| 2017 |

850 |

- |

| 2018 |

950 |

+11.8% |

| 2019 |

1,050 |

+10.5% |

| 2020 |

1,150 |

+9.5% |

| 2021 |

1,220 |

+6.1% |

| 2022 |

1,250 |

+2.5% |

4.2 Projected Revenue Trends

Assumptions:

- Pre-2024, revenues stabilize with slight growth due to off-label and adjunct uses.

- Post-2024, sharp decline expected due to generics, with a bottoming out by 2026.

- Generic penetration reaches 80-90% within 1-2 years after patent expiry.

| Year |

Revenue Projection (USD millions) |

Drivers |

| 2023 |

1,250 |

Continued brand loyalty, off-label uses |

| 2024 |

900 |

Patent expiry, initial generic entry |

| 2025 |

400 |

Heightened generic competition |

| 2026 |

200 |

Market consolidation, declining brand preference |

4.3 Revenue Impact of Patent Expiry and Generics

| Aspect |

Effect |

| Patent expiration (2024) |

Sharp revenue decline (up to 70-80%) in the following years |

| Market share shift |

Generics capture majority of prescriptions, drastically reducing branded revenues |

| Price erosion |

Average price per unit drops by approximately 50-70% post-generic entry [4] |

5. Regulatory & Policy Environment

5.1 FDA & EMA Policies

- Accelerated approvals for biosimilars and generics intensify competition.

- Potential patent challenges or extensions could influence timelines.

- Increasing emphasis on affordability and drug pricing transparency.

5.2 Impact of Patent Litigation

- Patent challenges by generic manufacturers can delay entry.

- Courts have historically upheld patent claims, extending exclusivity.

6. Future Outlook and Growth Opportunities

6.1 Emerging Approvals & Indications

- Off-label uses: Weight management, ADHD, and other mood disorders might augment sales if supported by clinical evidence.

- Combination therapies: Opportunities to develop fixed-dose combinations with other antidepressants or mood stabilizers.

6.2 Market Expansion

| Region |

Opportunities |

Challenges |

| North America |

Established market, high prescribing rates |

Patent expiry, price competition |

| Europe |

Pending approvals; high prevalence of depression in certain countries |

Regulatory delays, reimbursement policies |

| Asia-Pacific |

Growing mental health awareness, expanding healthcare access |

Regulatory hurdles, pricing, competition |

6.3 Innovations & R&D

- Development of novel formulations (e.g., controlled-release, combination pills)

- Biomarker-based patient stratification to optimize therapy.

7. Key Challenges & Risks

| Challenge |

Impact |

Mitigation Strategy |

| Patent expiry |

Revenue loss |

Diversify with new formulations, expand indications |

| Competition from generics |

Price erosion |

Develop new patentable formulations, expand into adjunct therapies |

| Regulatory delays |

Market access delays |

Engage early with regulators, robust clinical data |

| Off-label abuse |

Safety concerns |

Enhance prescriber and patient education, monitoring |

8. Comparison with Competing Drugs

| Aspect |

WELLBUTRIN XL |

Sertraline |

Escitalopram |

Venlafaxine |

| Mechanism |

NDRI |

SSRI |

SSRI |

SNRI |

| Side Effect Profile |

Lower sexual dysfunction risk |

Sexual dysfunction common |

Well-tolerated |

More side effects |

| Efficacy |

Moderate |

High |

High |

High |

| Reimbursement cost |

Moderate |

Low |

Low |

Moderate |

| Patent Status |

Expired (2024) |

Expired (2012) |

Expired (2012) |

Patent expired |

9. Key Takeaways

- Market position: WELLBUTRIN XL remains a significant player in antidepressant therapy, especially valued for its distinct pharmacological profile.

- Revenue outlook: Near-term revenues are stable; significant decline is anticipated post-2024 due to patent expiry and generic entry.

- Competitive landscape: Emphasis shifts towards generics, with price erosion and market share redistribution.

- Growth opportunities: Off-label uses and potential new formulations could extend lifecycle; expansion into emerging markets is promising.

- Risks: Patent litigation, regulatory delays, and market saturation pose ongoing threats.

10. FAQs

Q1: How will patent expiry affect WELLBUTRIN XL’s market share?

A1: Patent expiry in 2024 will enable generic manufacturers to introduce lower-cost alternatives, likely reducing brand sales by up to 80% within two years, unless the brandholder introduces new formulations or indications to retain market share.

Q2: Are generics equivalent in efficacy to WELLBUTRIN XL?

A2: Yes. FDA and EMA approval require bioequivalence demonstrating comparable efficacy and safety profiles to the branded product.

Q3: What are the potential growth areas for bupropion beyond MDD?

A3: Off-label uses include smoking cessation, ADHD, weight management, and seasonal affective disorder. Future formal approvals could further expand its indications.

Q4: How does the competitive pricing landscape look post-patent expiry?

A4: Generic versions are expected to be priced 50-70% lower than branded formulations, intensifying price competition across markets.

Q5: What strategies can pharmaceutical companies use to extend WELLBUTRIN XL’s lifecycle?

A5: Developing new formulations (e.g., sustained-release), exploring novel indications, combination therapies, and targeted marketing can prolong market relevance.

References

[1] IQVIA, 2022. Global Prescription Medicine Market Data.

[2] National Institutes of Health, 2021. Clinical Guidelines for Depression.

[3] GoodRx, 2023. WELLBUTRIN XL Pricing and Cost Comparison.

[4] FDA Generic Drug Approval Data, 2022. Market Penetration and Price Trends.

In conclusion, while WELLBUTRIN XL continues to hold a pivotal role in depression management, impending patent expiration necessitates strategic planning for sustainable growth. Its adaptability for other indications and evolving formulations offer potential expansion routes, but stakeholders must navigate patent risks, price competition, and regulatory hurdles diligently.