VOQUEZNA Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Voquezna, and what generic alternatives are available?

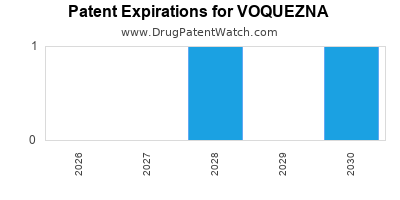

Voquezna is a drug marketed by Phathom and is included in three NDAs. There are two patents protecting this drug.

This drug has one hundred and three patent family members in forty-three countries.

The generic ingredient in VOQUEZNA is amoxicillin; clarithromycin; vonoprazan fumarate. There are forty-six drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the amoxicillin; clarithromycin; vonoprazan fumarate profile page.

DrugPatentWatch® Generic Entry Outlook for Voquezna

Voquezna will be eligible for patent challenges on May 3, 2026. This date may extended up to six months if a pediatric exclusivity extension is applied to the drug's patents.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be May 3, 2032. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for VOQUEZNA?

- What are the global sales for VOQUEZNA?

- What is Average Wholesale Price for VOQUEZNA?

Summary for VOQUEZNA

| International Patents: | 103 |

| US Patents: | 2 |

| Applicants: | 1 |

| NDAs: | 3 |

| Finished Product Suppliers / Packagers: | 1 |

| Clinical Trials: | 1 |

| Patent Applications: | 86 |

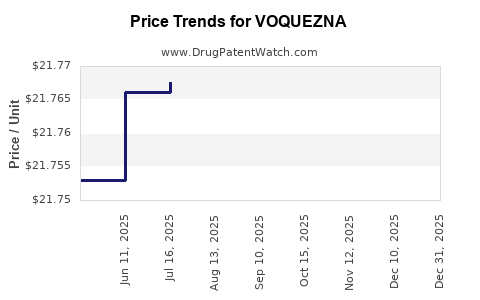

| Drug Prices: | Drug price information for VOQUEZNA |

| What excipients (inactive ingredients) are in VOQUEZNA? | VOQUEZNA excipients list |

| DailyMed Link: | VOQUEZNA at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for VOQUEZNA

Generic Entry Date for VOQUEZNA*:

Constraining patent/regulatory exclusivity:

GENERATING ANTIBIOTIC INCENTIVES NOW NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for VOQUEZNA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Humanis Saglk Anonim Sirketi | PHASE1 |

US Patents and Regulatory Information for VOQUEZNA

VOQUEZNA is protected by two US patents and four FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of VOQUEZNA is ⤷ Get Started Free.

This potential generic entry date is based on GENERATING ANTIBIOTIC INCENTIVES NOW.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

International Patents for VOQUEZNA

When does loss-of-exclusivity occur for VOQUEZNA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 2842

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 09277443

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0916689

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 32243

Estimated Expiration: ⤷ Get Started Free

Patent: 36400

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 11000170

Estimated Expiration: ⤷ Get Started Free

Patent: 13000224

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2164581

Estimated Expiration: ⤷ Get Started Free

Patent: 2743330

Estimated Expiration: ⤷ Get Started Free

Patent: 4784180

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 90638

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 110110

Estimated Expiration: ⤷ Get Started Free

Dominican Republic

Patent: 011000033

Estimated Expiration: ⤷ Get Started Free

Patent: 013000172

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 11010855

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 1170272

Estimated Expiration: ⤷ Get Started Free

Patent: 1201451

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 09985

Estimated Expiration: ⤷ Get Started Free

Patent: 64833

Estimated Expiration: ⤷ Get Started Free

Georgia, Republic of

Patent: 0146122

Estimated Expiration: ⤷ Get Started Free

Patent: 0146166

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 95356

Estimated Expiration: ⤷ Get Started Free

Patent: 93363

Estimated Expiration: ⤷ Get Started Free

Patent: 11529445

Estimated Expiration: ⤷ Get Started Free

Patent: 13047239

Patent: PHARMACEUTICAL COMPOSITION

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 6305

Patent: PHARMACEUTICAL COMPOSITION

Estimated Expiration: ⤷ Get Started Free

Patent: 9461

Patent: PHARMACEUTICAL COMPOSITION

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 11000757

Patent: COMPOSICION FARMACEUTICA. (PHARMACEUTICAL COMPOSITION.)

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 556

Patent: تركيب صيدلاني

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 1344

Patent: Stabilized pharmaceutical composition comprising a nonpeptidic active agent

Estimated Expiration: ⤷ Get Started Free

Patent: 2592

Patent: Light irradiation resistant pharmaceutical composition

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 110591

Patent: COMPOSICION FARMACEUTICA ESTABILIZADA A BASE DE UN COMPUESTO NO PEPTIDICO

Estimated Expiration: ⤷ Get Started Free

Patent: 140977

Patent: COMPOSICION FARMACEUTICA ESTABILIZADA A BASE DE UN COMPUESTO NO PEPTIDICO

Estimated Expiration: ⤷ Get Started Free

Patent: 141585

Patent: COMPOSICION FARMACEUTICA ESTABILIZADA A BASE DE UN COMPUESTO NO PETIDICO

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 6685

Patent: PHARMACEUTICAL COMPOSITION

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1101198

Patent: PHARMACEUTICAL COMPOSITION

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 110042334

Patent: PHARMACEUTICAL COMPOSITION

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 60962

Estimated Expiration: ⤷ Get Started Free

Patent: 69592

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 1010992

Patent: Pharmaceutical composition

Estimated Expiration: ⤷ Get Started Free

Patent: 1431552

Patent: Pharmaceutical composition

Estimated Expiration: ⤷ Get Started Free

Tunisia

Patent: 11000030

Patent: PHARACEUTICAL COMPOSITION

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 3332

Patent: ФАРМАЦЕВТИЧЕСКАЯ КОМПОЗИЦИЯ, КОТОРАЯ СОДЕРЖИТ НЕПЕПТИДНЫЙ АКТИВНЫЙ АГЕНТ С ПЕРВИЧНОЙ ИЛИ ВТОРИЧНОЙ АМИНОГРУППОЙ;ФАРМАЦЕВТИЧНА КОМПОЗИЦІЯ, ЩО МІСТИТЬ НЕПЕПТИДНИЙ АКТИВНИЙ АГЕНТ З ПЕРВИННОЮ АБО ВТОРИННОЮ АМІНОГРУПОЮ (PHARMACEUTICAL COMPOSITION CONTAINING A NONPEPTIDIC ACTIVE AGENT HAVING A PRIMARY OR SECONDARY AMINO GROUP)

Estimated Expiration: ⤷ Get Started Free

Uruguay

Patent: 008

Patent: COMPOSICIÓN FARMACÉUTICA

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering VOQUEZNA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Canada | 2732243 | ⤷ Get Started Free | |

| South Korea | 20110042334 | PHARMACEUTICAL COMPOSITION | ⤷ Get Started Free |

| South Korea | 101115857 | ⤷ Get Started Free | |

| Croatia | P20120792 | ⤷ Get Started Free | |

| Eurasian Patent Organization | 201170272 | ⤷ Get Started Free | |

| Taiwan | 201431552 | Pharmaceutical composition | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Market Dynamics and Financial Trajectory for VOQUEZNA

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.