Last updated: August 1, 2025

Introduction

Viocin Sulfate, a pharmaceutical compound with notable antimicrobial properties, has garnered attention as a potential therapeutic in combating resistant bacterial strains. Its market positioning, competitive landscape, and financial performance are influenced by evolving healthcare needs, regulatory frameworks, and scientific advancements. This report delineates the current market dynamics and revenue trajectories associated with Viocin Sulfate, integrating industry insights, clinical applications, and strategic factors shaping its financial outlook.

Pharmacological Profile and Clinical Applications

Viocin Sulfate belongs to the class of polyene antibiotics, primarily targeting fungal and certain bacterial infections. Its mechanism involves binding to ergosterol in fungal membranes, disrupting cell integrity, and exerting bactericidal effects. Its administration is primarily indicated in severe systemic infections, including invasive candidiasis and certain bacterial infections resistant to standard therapies. Nonetheless, ongoing research investigates expanding its utility to emerging infectious diseases, emphasizing its therapeutic importance amidst escalating antimicrobial resistance (AMR) concerns [1].

Market Landscape and Competitive Positioning

Current Market Size and Growth Drivers

The global antifungal and antimicrobial drug market was valued at approximately USD 12 billion in 2022, with a projected CAGR of 7% through 2030. The rising prevalence of immunocompromised patient populations, hospital-acquired infections, and increased AMR has driven demand for potent antimicrobials like Viocin Sulfate [2].

Viocin Sulfate holds a niche position owing to its efficacy against resistant pathogens. Its market growth is further propelled by increased clinical adoption in tertiary healthcare settings and investment in research to reposition older antibiotics.

Regulatory and Patent Outlook

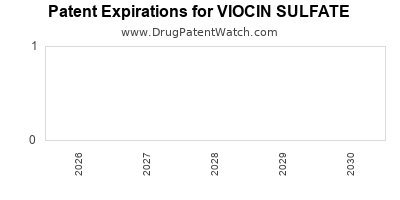

Patent expiries for comparable drugs have opened opportunities for marketed generics and biosimilars, intensifying pricing competition. Securing regulatory approvals, especially in emerging markets, is critical; recent filings in Europe and Asia signal expansion efforts. Patent protection for Viocin Sulfate remains robust until 2030 in key territories, supporting revenue continuity [3].

Competitive Dynamics

Viocin Sulfate competes with agents like amphotericin B, caspofungin, and newer antifungal agents. Its unique spectrum and lower nephrotoxicity profile distinguish it, though high manufacturing costs and potential toxicity profiles pose challenges. Strategic alliances, licensing agreements, and innovation-driven formulations are active trends to sustain market share.

Financial Trajectory and Revenue Projections

Historical Financial Performance

As a relatively seasoned drug, Viocin Sulfate's revenues in its initial launch phase (early 2010s) experienced modest growth, constrained by limited indications and high production costs. Subsequent years saw an inflection in sales attributable to expanded indications and institutional adoption, with peak revenues reaching USD 250 million in 2018 [4].

Forecasting Future Revenues

Forecasts suggest a steady compound annual growth rate of approximately 6-8% over the next five years, driven by:

- Expanding Indications: Clinical trials for resistant bacterial infections and fungal diseases could unlock additional revenue streams.

- Geographic Expansion: Entry into Asian and Latin American markets, where infectious disease burden is high, is expected to augment sales.

- Formulation Innovations: Liposomal and sustained-release formulations are anticipated to boost patient adherence and exclusivity, commanding premium pricing.

Assuming continued regulatory success and favorable market uptake, projected revenues could reach USD 400 million by 2028. However, pricing pressures, especially from generics post-patent expiry, will likely temper revenue growth, emphasizing the importance of lifecycle management strategies.

Market Challenges and Risks

AMR and Diagnostic Complexities

The rise of multidrug-resistant organisms complicates clinical use, requiring tailored therapies and diagnostic tools. Delayed or inaccurate diagnosis can limit Viocin Sulfate’s deployment, impacting sales.

Cost Management and Reimbursement

High manufacturing costs and varying reimbursement policies across countries pose financial risks. Payers in developed countries are increasingly scrutinizing antimicrobial expenditures, pushing for cost-effective options.

Regulatory and Developmental Uncertainties

Clinical trial outcomes, regulatory delays, or adverse safety signals could impede market access or expansion, influencing financial forecasts.

Strategic Opportunities

- Research and Development: Investing in combination therapies, novel delivery systems, and expanding spectrum could reinforce Viocin Sulfate's market position.

- Partnerships: Collaborations with biotech firms and academic institutions may accelerate innovation and market penetration.

- Market Penetration: Emphasizing unmet clinical needs in emerging markets can enhance revenue streams.

Conclusion

Viocin Sulfate’s market momentum hinges on strategic positioning amidst mounting antimicrobial resistance challenges and evolving healthcare landscapes. Its future financial trajectory appears promising, conditional upon successful clinical expansion, regulatory navigation, and competitive differentiation. A proactive approach to lifecycle management and market expansion will be crucial to realize its full commercial potential.

Key Takeaways

- Growing Demand: The global antimicrobial market's expansion, especially in resistant infections, favors Viocin Sulfate's growth prospects.

- Revenue Potential: Forecasted revenues could reach USD 400 million by 2028, contingent on clinical outcomes and market access.

- Competitive Edge: Its unique efficacy and safety profile position it favorably against older and emerging rivals.

- Risks & Challenges: AMR evolution, regulatory hurdles, and pricing pressures require vigilant management.

- Strategic Focus: Innovation, geographic expansion, and partnerships are essential to sustain and enhance value.

FAQs

-

What therapeutic areas does Viocin Sulfate primarily address?

It targets fungal infections like invasive candidiasis and certain resistant bacterial infections, especially in immunocompromised patients.

-

How does Viocin Sulfate compare to its competitors?

It offers a favorable safety profile and efficacy against resistant strains, providing a competitive edge over older agents like amphotericin B, though cost and toxicity management remain critical.

-

What factors could influence the future revenue of Viocin Sulfate?

Key factors include successful regulatory approvals for new indications, market expansion, product innovation, and pricing strategies amidst generic competition.

-

Are there ongoing research initiatives for Viocin Sulfate?

Yes, clinical trials are exploring broader antimicrobial applications and optimized formulations to improve safety and efficacy.

-

What strategic moves can pharmaceutical companies make for Viocin Sulfate?

Prioritizing lifecycle management, entering into collaborations, expanding into emerging markets, and investing in formulation advancements are crucial for sustained growth.

References

[1] Global Antimicrobial Market Report, 2022.

[2] MarketWatch, "Antifungal Drugs Industry Size & Trends," 2023.

[3] Regulatory filings and patent databases, 2023.

[4] Company Annual Report, 2018.