Last updated: July 30, 2025

Introduction

Vincristine sulfate PFS (Premixed Formulation) remains a cornerstone in pediatric and adult chemotherapy regimens, primarily for hematologic malignancies such as leukemia, lymphoma, and solid tumors. As of 2023, this antineoplastic agent sustains a vital role despite emerging targeted therapies. The evolving landscape of oncology treatment, regulatory considerations, pricing pressures, and manufacturing advancements directly influence its market dynamics and financial trajectory.

Market Overview

Vincristine sulfate was first isolated in the 1960s and has been commercially available in various formulations. The current PFS version consolidates the drug into a ready-to-use format, enabling easier administration and reducing preparation errors. Market participants include both branded and generic manufacturers, with key players globally spanning the United States, Europe, and emerging markets in Asia.

The global oncology drug market value exceeds USD 150 billion, with Vincristine constituting a modest segment due to its niche application. However, it remains indispensable within combination chemotherapy protocols, underpinning its persistent market presence.

Market Drivers

1. Unwavering Therapeutic Necessity

Vincristine is classified as a critical medicine by the World Health Organization (WHO) and remains a standard component in leukemia and lymphoma treatment protocols worldwide. Its efficacy, especially in pediatric populations, sustains high clinical reliance.

2. Increasing Global Cancer Incidence

The rising global cancer burden, projected to reach over 28 million new cases annually by 2040 [1], directly boosts demand for established chemotherapies including vincristine sulfate. The expanding prevalence in emerging markets further catalyzes regional consumption.

3. Initiatives for Pediatric Oncology Access

Global health initiatives aim to improve childhood cancer outcomes. Programs such as WHO's Global Initiative for Childhood Cancer support increased access to chemotherapy agents, indirectly elevating demand for vincristine PFS.

4. Shift Toward Pre-mixed Formulations

The transition from lyophilized powders to PFS formulations enhances safety, stability, and ease of use, prompting manufacturers to phase out older formats. This acceptance supports ongoing sales and procurement stability.

5. Resistance to Targeted Therapies

While targeted therapies and immuno-oncology agents flourish, resistance patterns and high costs sustain the continued relevance of traditional chemotherapies like vincristine, especially in low-resource settings.

Market Challenges

1. Competition From Generics

The expiration of patents and market entry of generic formulations have led to price erosion, constraining profit margins. Multiple manufacturers now offer vincristine sulfate PFS, intensifying price competition.

2. Regulatory and Quality Assurance Hurdles

Stringent regulatory standards, especially for injectable chemotherapeutic agents, impose barriers to market entry and manufacturing scalability. Supply chain complexities, including cold chain logistics, threaten access.

3. Emerging Therapies and Precision Oncology

The advent of targeted therapies and monoclonal antibodies diminishes the relative reliance on chemotherapy agents in certain indications, gradually shrinking the market segment for vincristine in some regions.

4. Ethical and Safety Concerns

Vincristine's neurotoxicity and narrow therapeutic index necessitate careful handling and administration, influencing procurement policies and institutional preferences.

Financial Trajectory

1. Revenue Trends

Market analysis projects stable but modest revenue streams for vincristine sulfate PFS over the next five years. The global demand is expected to grow at a compound annual growth rate (CAGR) of approximately 2-3%, primarily driven by emerging markets and expanding pediatric oncology programs.

2. Pricing Dynamics

Pricing remains under pressure due to widespread generic availability. In developed markets, healthcare providers leverage competitive bidding and cost-containment strategies, reducing reimbursement rates. Nevertheless, premium formulations with enhanced safety profiles command higher margins.

3. Manufacturing and Supply Chain Economics

Manufacturers are investing in scalable, compliant production facilities to meet demand and adhere to quality standards mandated by agencies like the FDA and EMA. These investments optimize cost efficiencies, supporting competitive pricing and margin preservation.

4. Regional Market Variations

North America and Europe collectively account for approximately 50-60% of global sales, with mature pricing and procurement systems. Conversely, Asia-Pacific, Latin America, and Africa offer growth opportunities due to rising healthcare investments and cancer prevalence, though market penetration can be challenged by logistical and regulatory factors.

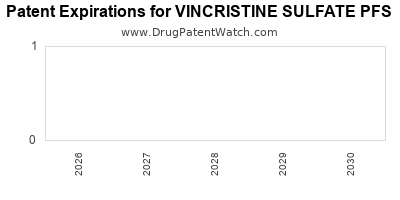

5. Patent and Regulatory Landscape

While most patents for vincristine formulations have expired, regulatory exclusivities in certain regions or for specific delivery systems may influence market exclusivity periods and pricing strategies.

Future Outlook

1. Market Consolidation and Portfolio Diversification

Major pharmaceutical companies are integrating vincristine into broader oncology portfolios, offering combination packs and branded regimens. This strategy enhances lifecycle management and sustains revenues.

2. Innovative Delivery Systems

Research into sustained-release formulations and targeted delivery mechanisms aims to improve safety profiles and efficacy, potentially commanding premium prices and expanding indications.

3. Scaling in Emerging Markets

Growing healthcare infrastructure and government initiatives foster increased procurement in Asia, Africa, and Latin America, offering long-term growth avenues despite market fragmentation.

4. Regulatory and Policy Impact

Global regulatory harmonization and inclusion in essential medicines lists will continue to favor stabilized supply and predictable demand trajectories.

Key Takeaways

- Vincristine sulfate PFS remains a vital chemotherapeutic agent, with demand driven by global cancer incidence, especially in pediatric oncology.

- Market growth is modest (~2-3% CAGR), pressured by generic competition, but steady due to essential clinical role.

- Price erosion necessitates innovation in formulations and strategic portfolio management for manufacturers.

- Expansion efforts in emerging markets, coupled with global health initiatives, support long-term growth prospects.

- Regulatory compliance, manufacturing efficiency, and safety enhancements will be critical to sustaining profitability and market share.

FAQs

1. How does the expiration of patents affect the vincristine sulfate PFS market?

Patent expirations lead to the entry of generic manufacturers, increasing competition and exerting downward pressure on prices. While this reduces profit margins for branded versions, it expands overall market accessibility.

2. What are the primary indications driving vincristine sulfate PFS demand?

The predominant indications include acute lymphoblastic leukemia (ALL), Hodgkin lymphoma, non-Hodgkin lymphoma, and certain solid tumors, especially in pediatric populations.

3. How are emerging therapies impacting vincristine's market share?

Targeted therapies and immunotherapies are gradually replacing some chemotherapy regimens, potentially reducing vincristine's share in certain indications but maintaining its role in combination therapies and resource-limited settings.

4. What are the key considerations for manufacturers in ensuring supply chain stability?

Compliance with regulatory standards, maintaining high-quality manufacturing, cold chain logistics, and securing reliable raw material sourcing are essential to prevent shortages and ensure steady supply.

5. What is the outlook for pricing strategies in the coming years?

Price pressures will persist due to generic competition; thus, manufacturers focusing on innovative formulations, differentiated offerings, and regional market adaptation can sustain margins and growth.

Sources

[1] World Health Organization. Global Cancer Observatory. 2022.