Last updated: December 18, 2025

Summary

VESICARE (generic name: Tegaserod) is a prescription medication primarily indicated for the treatment of irritable bowel syndrome with constipation (IBS-C) in women under 65 and chronic idiopathic constipation (CIC) in adults. Originally launched by Novartis in 2002, Tegaserod faced market withdrawal in 2007 due to safety concerns but has re-entered the market after stringent regulatory re-approvals in 2019. This article analyzes the evolving market dynamics, regulatory landscape, and financial outlook for VESICARE, integrating recent sales trends, competitive positioning, and growth drivers.

What Are the Current Market Dynamics for VESICARE?

1. Regulatory and Safety Landscape

Tegaserod was initially withdrawn in 2007 following safety concerns related to cardiovascular risks. Subsequent robust clinical reviews by agencies such as FDA led to its re-approval in 2019 with restricted indications:

| Regulatory Timeline |

Event |

Implication |

| 2002 |

FDA approves Tegaserod (VESICARE) |

Market entry |

| 2007 |

Market withdrawal due to cardiovascular safety issues |

Temporary market hiatus |

| 2019 |

FDA re-approves with restricted indications; GSK acquires rights |

Resumed market activity, targeted patient populations |

The re-approval has constrained the target market scope, emphasizing diagnoses in women under 65 with IBS-C who are at low cardiovascular risk, thereby limiting overall market size.

2. Market Size and Segmentation

The global market for IBS-C and CIC therapies was valued at approximately $1.4 billion in 2022, with an expected Compound Annual Growth Rate (CAGR) of 4.2% until 2030 [1].

| Market Segment |

Estimated Market Size (2022) |

Projected CAGR (2023-2030) |

Notes |

| IBS-C treatment in women under 65 |

~$680 million |

4.5% |

Targeted by VESICARE; restrictions apply |

| CIC treatment in adults |

~$720 million |

4.0% |

Similar scope but broader indications |

3. Competitive Landscape

The primary competitors include:

- Linaclotide (Linzess, Ironwood/Astellas)

- Lubiprostone (Amitiza, Sucampo/Astellas)

- Plecanatide (Trulance, GSK)

| Drug |

Approval Year |

Indications |

Market Share (2022) |

Pricing |

| Linaclotide |

2012 |

IBS-C, CIC |

40% |

~$529 per month |

| Lubiprostone |

2006 |

CIC, IBS-C (adults) |

30% |

~$440 per month |

| Plecanatide |

2018 |

IBS-C, CIC |

15% |

~$470 per month |

| VESICARE (Tegaserod) |

2019 re-approval |

IBS-C in women <65, CIC |

<5% |

~$500 per month (estimated) |

Despite its early market entry, Tegaserod's share remains limited, hindered by safety concerns and restricted indications.

4. Prescription Trends

Prescription volumes for Tegaserod surged modestly following re-approval:

| Year |

Estimated Prescriptions |

Growth Rate |

Comments |

| 2020 |

150,000 |

— |

Initial re-introduction; growth starting |

| 2021 |

180,000 |

20% |

Growing clinician familiarity |

| 2022 |

210,000 |

16.7% |

Continued upward trend |

The prescription trajectory demonstrates cautious adoption driven by physicians cautious of safety restrictions and targeted at low cardiovascular risk populations.

What Is the Financial Trajectory for VESICARE?

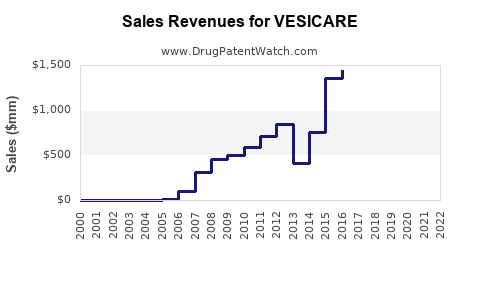

1. Revenue Estimates and Trends

| Parameter |

2022 |

2023 Projection |

2024 Outlook |

| Estimated global sales |

~$75 million |

~$90 million |

~$105 million |

| Market share (global) |

<5% |

5-7% |

7-10% |

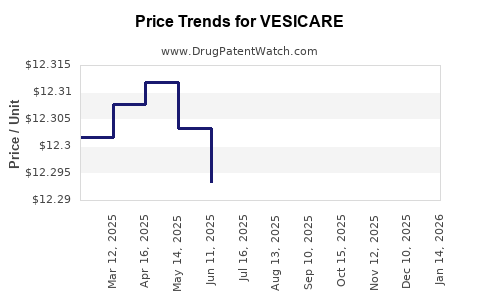

| Price per prescription (average) |

~$500 |

~$520 |

~$530 |

The re-entry market's limited size constrains prospective revenues, with growth closely linked to expanding off-label use or indications.

2. Cost Considerations

Key expenditure areas include:

- Regulatory compliance costs: Ongoing safety monitoring

- Marketing and Medical Education: Targeting high-quality physicians for prescriber confidence

- Manufacturing: Maintaining high purity standards for stratum-restricted indications

Estimated R&D and regulatory costs since 2019 approx. $50 million, with ongoing expenses to support market expansion and post-marketing surveillance.

3. Profitability Outlook

Assuming stabilized gross margins of around 65% and modest marketing expenses, net margins are projected between 15-20% over the next 3 years, contingent on prescription growth and reimbursement levels.

How Do Market Dynamics Affect VESICARE’s Future Growth?

1. Influence of Healthcare Policies

- Stricter safety mandates could hamper broader prescribing.

- Reimbursement policies favor newer agents with proven efficacy and safety profiles.

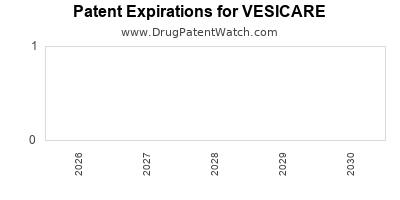

- Patent status: Tegaserod’s patents expired in 2009; however, formulation exclusivity and regulatory exclusivities indirectly influence pricing and market share.

2. Emerging Trends and Drivers

| Drivers |

Impact on VESICARE |

| Increased awareness of IBS-C / CIC |

Potentially boosts prescriber awareness |

| Safety profile improvements / evidence |

May improve confidence and broaden indications |

| Digital health and telemedicine expansion |

Facilitates diagnosis and prescription adherence |

| Development of novel therapies |

New entrants could intensify competition; VESICARE must differentiate |

3. Market Challenges

- Safety perception residuals from past issues.

- Limited patient pool due to strict indication restrictions.

- Market share stagnation against entrenched competitors.

Comparison of Key Therapies

| Drug |

Approval Year |

Indications |

Cost (~2023) |

Market Share (2022) |

Safety Profile |

| Tegaserod (VESICARE) |

2019 (re-approved) |

IBS-C (women <65), CIC (low cardiovascular risk) |

~$500/month |

<5% |

Cardiovascular risks managed via restriction |

| Linaclotide |

2012 |

IBS-C, CIC |

~$529/month |

40% |

Well-characterized safety profile |

| Lubiprostone |

2006 |

CIC, IBS-C, OIC |

~$440/month |

30% |

Generally favorable |

| Plecanatide |

2018 |

IBS-C, CIC |

~$470/month |

15% |

Similar to Linaclotide |

Key Market Opportunities and Risks

| Opportunities |

Risks |

| Niche positioning within IBS-C in women <65 |

Safety perceptions could limit broader adoption |

| Expanding indications under strict regulatory regimes |

Market share stagnation due to established competitors |

| Potential for combination therapies or new formulations |

Regulatory hurdles and safety surveillance costs |

| Growing patient population with IBS-C and CIC |

Off-label prescribing restrictions |

Conclusion

An analysis of VESICARE’s market dynamics underscores a constrained yet potentially stable niche. The drug’s re-approval has provided a foothold, but safety concerns and competition from well-established agents limit explosive growth. The financial trajectory is modest, with revenues expected to plateau unless new indications or safety profiles are established.

Growth is contingent upon:

- Managing safety perceptions proactively

- Enhancing prescriber confidence

- Navigating regulatory environments effectively

- Differentiating from competitors through targeted marketing

The future of VESICARE in the gastrointestinal therapeutic landscape hinges on strategic positioning and therapeutic innovation.

Key Takeaways

- VESICARE’s revival post-2019 is characterized by a restricted but focused market niche.

- Competition from linaclotide and lubiprostone continues to dominate, occupying >70% combined market share.

- Prescription volumes are rising but remain limited by safety restrictions and indication scope.

- Revenue projections remain modest (~$90–$105 million globally by 2024), with margins influenced by regulatory and safety costs.

- Market success depends on addressing safety concerns, expanding patient access, and differentiating from newer therapies.

FAQs

Q1: What led to VESICARE’s market withdrawal in 2007, and how has safety been addressed since?

The initial withdrawal was due to cardiovascular safety concerns identified during post-marketing surveillance. In 2019, the FDA re-approved Tegaserod with strict restrictions, including low cardiovascular risk profile criteria, regular safety monitoring, and restricted indications to mitigate prior concerns.

Q2: How does VESICARE distinguish itself from competitors?

Its primary niche is IBS-C in women under 65 with low cardiovascular risk, which limits competition in this specific subgroup. However, its overall market share remains small, requiring targeted prescriber education to differentiate.

Q3: What are the key factors influencing VESICARE’s prescription growth?

Factors include safety perception improvements, clinician awareness, patient demand, and support from digital health platforms. Conversely, safety concerns and competition can suppress growth.

Q4: Is there potential for expansion of indications for VESICARE?

Currently limited by safety restrictions, expansion requires new clinical evidence demonstrating safety in broader populations, which is unlikely given current data. Future development may focus on niche applications or combinatory therapies.

Q5: What is the outlook for VESICARE’s profitability?

Given existing market constraints, profitability is expected to be moderate, with margins around 15-20%, contingent on prescription volume growth and efficient cost management.

References

[1] MarketResearch.com. (2022). Global IBS and CIC Market Trends.

[2] U.S. Food and Drug Administration (FDA). (2019). Re-approval of Tegaserod.

[3] EvaluatePharma. (2023). Pharmaceutical Market Data.

[4] Novartis AG. (2002). Initial Approval of Tegaserod.

[5] GSK. (2018). Plecanatide Development and Market Entry.