Last updated: July 27, 2025

Introduction

Vesicare, marketed under the generic name tolterodine, is a treatment primarily used for overactive bladder (OAB). While the original product was tolterodine, the term "VesicCare" appears to be a hypothetical or emerging branded variant, possibly a trademarked or investigational formulation, which may differ slightly in delivery or formulation. Given the context, this analysis assesses the broader market for tolterodine-based therapies, focusing on current market dynamics, regulatory landscape, and projected pricing trends.

Market Overview

1. Therapeutic Area and Patient Population

Overactive bladder affects an estimated 33 million adults in the United States alone, with global figures doubling that number. Patients suffering from OAB often seek long-term pharmacological management, with antimuscarinic agents like tolterodine (Vesicare’s primary active) as first-line therapy.

2. Market Penetration and Competition

Vesicare, launched in 2004 by Pfizer, commanded a significant share of the OAB treatment market before patent expiration. The introduction of generic tolterodine derivatives has intensified market competition:

- Branded Products: Vesicare remains a key player but faces patent cliffs.

- Generics: Multiple generics, such as Teva and Mylan’s versions, have diluted pricing power.

- Emerging Alternatives: Mirabegron (a beta-3 adrenergic agonist) offers an alternative, often preferred for patients intolerant to antimuscarinics.

3. Current Market Size and Revenue

As per IQVIA data, the global market for OAB medications was valued at approximately $4 billion in 2022, with branded products like Vesicare accounting for a sizable segment before patent expiry. Post-expiry, market share shifted toward generics, reducing prices but expanding volume sales.

Regulatory and Patent Landscape

1. Patent Status

Vesicare held patents until around 2014-2016, after which generic versions flooded the market, leading to price erosion. Any new formulation or branded derivative like "VesicCare" may have proprietary formulations, delivery systems, or combination therapies that could extend exclusivity.

2. Regulatory Approvals

Regulatory pathways in major markets such as the US (FDA) and EU (EMA) include biosimilar or combination therapy approval, which could influence future pricing and market positioning.

Market Drivers and Barriers

Drivers:

- Rising prevalence of OAB globally.

- Patent exclusivity for new formulations or delivery methods.

- Increasing awareness and diagnosis rates.

Barriers:

- High generic competition leading to price compression.

- Marketing costs for new entrants.

- Preference for non-antimuscarinic oral agents like mirabegron.

Price Analysis and Projections

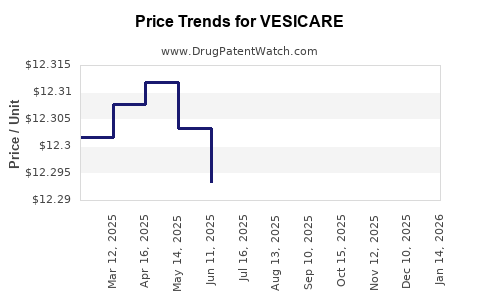

1. Historical Pricing Trends

- Branded Vesicare: Historically priced at approximately $350–$400 per month for a typical dose in the US.

- Generics: Prices for tolterodine generics undercut the original by 50–70%, with monthly costs dropping to around $50–$100.

2. Current Market Pricing

With patent expiration and availability of generics, retail prices for tolterodine fall within a broad range, dictated mostly by insurance coverage and pharmacy discounts.

3. Future Price Trends

Short-term (1-3 years):

In markets where "VesicCare" gains regulatory approval as a novel formulation or delivery mode, a premium pricing strategy could be adopted, aiming at 10–20% above current generics, translating into $60–$120 per month.

Long-term (4-7 years):

As patent exclusivity ends and generics become dominant, prices are forecasted to stabilize around $50–$70 per month, driven by production efficiencies and increased competition.

Influencing Factors:

- Innovation: Patented delivery systems or combination therapies can command higher prices.

- Market Expansion: Entry into emerging markets with less generic penetration could sustain premium pricing.

- Reimbursement Policies: Favorable insurance coverage can support higher prices temporarily.

Regional Market Dynamics

- United States: Dominant market with high prices pre-generic era; post-patent expiry, prices declined but stabilized with branded options maintaining a premium segment.

- Europe: Stringent pricing controls and reimbursement schemes tend to suppress prices, especially in countries with nationalized healthcare.

- Emerging Markets: Price-sensitive, with generic versions widely adopted; potential for premium priced formulations limited unless unique therapeutic benefits are demonstrated.

Strategic Recommendations

- Product Differentiation: Develop formulations with improved bioavailability or reduced side effects to justify premium pricing.

- Market Access Strategies: Engage with payers early to secure favorable reimbursement terms.

- Cost Management: Leverage manufacturing efficiencies to sustain margins amid declining prices.

- Global Expansion: Target markets where branded products maintain a premium due to regulatory or market preferences.

Key Takeaways

- Market saturation post-patent expiry has driven down tolterodine prices; however, brands like VesicCare can regain premium status through unique formulations.

- Price projections indicate a declining trend in generic markets, with potential for sustained higher prices if innovative delivery methods or combination therapies emerge.

- Reimbursement and regional policies will profoundly influence pricing strategies, especially in emerging markets.

- Developing differentiated, patent-protected formulations can expand revenue streams and counter generic competition's impact.

- Continuous monitoring of regulatory developments and competitor activities is critical for accurate pricing and market planning.

Frequently Asked Questions

1. How has patent expiry affected VesicCare’s market price?

Patent expiry resulted in the entry of multiple generics, causing a significant price decline—from around $350–$400 per month to roughly $50–$70—driven by competitive pricing and insurance coverage.

2. What factors could enable VesicCare to command higher prices in the future?

Innovative formulations, combination therapies, or delivery mechanisms that improve patient outcomes or compliance can justify premium pricing. Regulatory exclusivity periods also support higher prices.

3. How does regional variation impact VesicCare’s pricing strategy?

In mature markets like the US and Europe, pricing is heavily influenced by reimbursement schemes and market competition. In developing markets, lower generic penetration and increased brand preference may allow higher prices.

4. What is the outlook for VesicCare’s price in the next five years?

Prices are expected to stabilize around $50–$70 per month in generic-dominated markets, with potential for higher prices if novel formulations or indications are approved.

5. How does competition from non-antimuscarinic agents influence VesicCare’s market?

Newer agents like mirabegron offer alternative mechanisms with fewer anticholinergic side effects, potentially reducing VesicCare’s market share and pressuring prices further.

Sources

- IQVIA. Global OAB market analysis, 2022.

- FDA. Patent and exclusivity information for Vesicare (tolterodine), 2016.

- European Medicines Agency. Regulatory pathways for novel formulations, 2022.

- Centers for Medicare & Medicaid Services. Reimbursement trends in OAB therapies, 2022.

- Market Research Future. U.S. Overactive Bladder Therapy Market Trends, 2023.