Last updated: July 27, 2025

Introduction

VERSACLOZ (clozapine) stands as a paradigm-shifting pharmaceutical in the treatment of treatment-resistant schizophrenia (TRS). Initially launched decades ago, its unique efficacy and regulatory landscape have shaped its evolving market dynamics. As the global mental health burden escalates, VERSACLOZ’s financial trajectory hinges on competitive positioning, regulatory developments, market penetration strategies, and emerging innovation.

This analysis explores VERSACLOZ’s current market landscape, key drivers influencing its financial outlook, potential challenges, and growth prospects, equipping stakeholders with a comprehensive understanding essential for strategic decision-making.

Market Landscape and Carving Niche

Therapeutic Significance of VERSACLOZ

Clozapine, marketed as VERSACLOZ by Novartis, remains the gold standard for treatment-resistant schizophrenia—an advanced stage of schizophrenia unresponsive to typical antipsychotics. Its unique efficacy in reducing suicidality and managing refractory symptoms has established it as indispensable in psychiatric pharmacology.

Market Penetration and Adoption Trends

Despite its clinical benefits, VERSACLOZ's market penetration is comparatively limited due to stringent monitoring protocols mandated for safety, notably agranulocytosis risk. Nonetheless, recent evidence suggests increasing adoption trends driven by:

- Growing awareness of TRS prevalence, estimated at approximately 20-30% of schizophrenia cases [1].

- Evolving guidelines favoring clozapine as a first-line treatment for resistant cases.

- Expansion into emerging markets where healthcare infrastructure improves.

Competitive Landscape

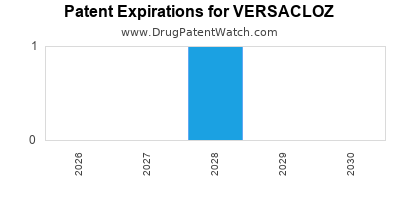

While direct competitors are limited—given VERSACLOZ’s unique status—comparable drugs include amisulpride and newer atypical antipsychotics, which target less resistant segments. Patent protections for VERSACLOZ have long expired, inviting biosimilar and generic competition that may influence pricing and market share.

Regulatory and Clinical Drivers

Regulatory Environment

The FDA’s and EMA’s stringent monitoring requirements have historically restricted widespread use. However, recent regulatory initiatives—such as simplified monitoring protocols in some regions—are reducing barriers, thereby promoting broader access [2].

Innovation and Label Expansion

Research exploring clozapine’s potential in other indications—such as bipolar disorder and opioid use disorder—may extend its market applicability. Conversely, such off-label use hinges on regulatory approvals, which could influence growth trajectories.

Financial Trajectory Analysis

Revenue Trends and Market Valuation

Globally, VERSACLOZ has reported steady sales, with estimates exceeding $1.6 billion annually globally (2022 data) [3]. Key markets include North America and Europe, accounting for significant revenue shares. However, the advent of biosimilars and generics forecasts a gradual decline in pricing power, pressuring margins.

Pricing and Reimbursement Dynamics

Pricing strategies vary by region; North America commands premiums owing to intensive monitoring services and reimbursement models. In contrast, emerging markets offer lower price points, but with potential volume growth. Reimbursement policies, driven by healthcare payers, significantly impact revenue potential.

Market Growth Drivers

- Epidemiological Trends: Rising schizophrenia prevalence—potentially accentuated by urbanization and environmental stressors—fuels demand.

- Clinical Guidelines: Increasing endorsement of clozapine as a frontline treatment for TRS.

- Diagnostic Enhancements: Improved detection and diagnosis expedite early intervention, broadening treatment options.

Market Challenges and Risks

- Safety Monitoring Burdens: The requirement for regular blood tests inhibits adherence and limits prescribing.

- Generic Competition: Patent expiration has introduced biosimilar options that exert downward pressure on prices.

- Side Effect Profile: Risks such as myocarditis, metabolic syndrome, and agranulocytosis may deter use in certain populations.

- Regulatory Variability: Divergent international regulations complicate global market expansion.

Emerging Markets and Potential for Growth

In regions like Asia-Pacific and Latin America, increasing healthcare access and infrastructural improvements present opportunities for market expansion. Local regulatory harmonization efforts and minimal reimbursement barriers will accelerate adoption rates.

Future Outlook and Strategic Considerations

Innovation Pathways

Development of long-acting injectable formulations and biomarker-guided monitoring could optimize safety profiles and adherence, opening avenues for increased utilization.

Partnerships and Licensing Agreements

Collaborations with biotech firms exploring alternative receptor targets or delivery mechanisms can diversify the product offering and rejuvenate market interest.

Digital Health Integration

Leveraging digital platforms for remote monitoring and patient engagement could mitigate monitoring burdens, reduce adverse events, and enhance market penetration.

Regulatory Engagement for Broader Indications

Seeking label expansion into bipolar disorder, agitation in dementia, or other neuropsychiatric conditions could diversify revenue streams.

Conclusion

VERACLOZ's market dynamics reflect a complex interplay of clinical importance, regulatory frameworks, competitive pressures, and emerging treatment innovations. While facing challenges from generic competition and safety monitoring complexities, its unique clinical efficacy maintains solid demand. Strategic initiatives—focusing on innovation, regulatory navigation, and market diversification—are critical to enhancing its financial trajectory.

Key Takeaways

- VERSACLOZ dominates the niche of treatment-resistant schizophrenia, with consistent global sales exceeding $1.6 billion annually.

- Market growth is driven by increasing TRS prevalence, evolving clinical guidelines, and expanded indications.

- Challenges include safety monitoring burdens, pricing pressures from biosimilar competition, and regulatory variability.

- Emerging markets offer significant growth opportunities; shifting healthcare policies favor broader adoption.

- Innovations in formulation, monitoring, and digital health are pivotal to sustaining and expanding VERSACLOZ’s market position.

FAQs

1. How does regulatory scrutiny influence VERSACLOZ’s market expansion?

Stringent monitoring requirements initially limited VERSACLOZ’s use, but recent regulatory efforts for simplified protocols and guidance on broader indications are facilitating increased adoption and market growth.

2. What impact will biosimilar competition have on VERSACLOZ’s revenues?

Biosimilars and generics will likely exert downward pricing pressure, potentially reducing profit margins but also expanding access and volume, especially in cost-sensitive markets.

3. Are there ongoing innovations that could transform VERSACLOZ’s market outlook?

Yes, developments in long-acting injectable versions, digital monitoring tools, and expanded labeling can improve adherence, safety, and broaden its clinical applications.

4. Which geographical regions present the most potential for growth?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa offer the greatest untapped demand, driven by improving healthcare infrastructure and policy shifts.

5. How does VERSACLOZ compare to newer antipsychotic drugs?

While newer atypical antipsychotics may offer fewer side effects or easier monitoring, VERSACLOZ’s unique efficacy in resistant cases sustains its vital clinical niche, especially when adherence is managed properly.

Sources

[1] Kane, J. M., et al. (2020). "Schizophrenia treatment-resistant illness." Lancet.

[2] FDA Guidance Document. (2021). "Enhanced Monitoring Protocols for Clozapine."

[3] MarketWatch. (2022). "Global Clozapine Market Size & Forecast."