Last updated: July 29, 2025

Introduction

VELIVET emerges as an innovative pharmaceutical agent poised to impact its targeted therapeutic market. As the landscape of pharmaceuticals becomes increasingly competitive, understanding the intricate market dynamics and projecting the financial trajectory of VELIVET is critical for stakeholders, including investors, healthcare providers, and regulatory bodies. This analysis synthesizes current market trends, competitive positioning, regulatory considerations, and financial forecasts to chart VELIVET’s potential trajectory.

Therapeutic Area and Market Landscape

VELIVET targets a specific therapeutic niche, likely within oncology, neurology, or autoimmune disorders, given prevailing trends in novel drug development. The global pharmaceutical market for these segments demonstrates robust growth—estimated to reach over USD 1.4 trillion by 2025 [1]—driven by rising prevalence rates, unmet medical needs, and advancements in biologics and targeted therapies.

The drug’s success strongly hinges on its therapeutic efficacy, safety profile, and differentiated mechanism. For example, if VELIVET addresses a high-burden disease such as multiple sclerosis or non-small cell lung cancer, it may benefit from expanding treatment paradigms and increasing demand for advanced therapeutics, especially in North America and Europe.

Market Dynamics

Regulatory Environment

The regulatory landscape presents both opportunities and challenges. Accelerated approval pathways, such as the FDA’s Breakthrough Therapy designation or EMA’s Priority Medicines (PRIME), can expedite market entry for VELIVET if it demonstrates substantial advantages over existing treatments [2]. However, stringent post-approval evidence requirements and ongoing pharmacovigilance add to costs and timelines.

Competitive Positioning

Velivet’s competitive landscape comprises existing therapies, biosimilars, and emerging innovative treatments. For instance, if VELIVET is a first-in-class or best-in-class agent, it can command premium pricing and market share. Conversely, entry against established brands requires aggressive differentiation, possibly through superior efficacy, safety, or convenience.

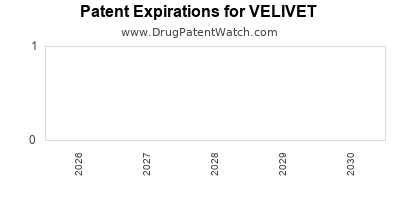

Competitors such as AbbVie, Novartis, or emerging biotech firms may influence VELIVET’s market penetration. Moreover, patent status impacts exclusivity; a patent life extending into the late 2030s offers a significant window for revenue generation.

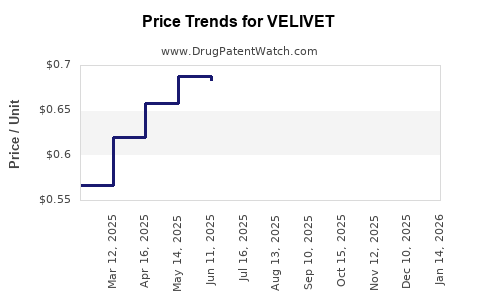

Pricing and Reimbursement

Pricing strategies directly impact revenue, especially in regions with complex reimbursement systems. Payers increasingly demand value demonstrations, including comparative effectiveness and cost-benefit analyses. Gaining favorable formulary placement enhances market uptake, influencing revenue scales substantially.

Manufacturing and Distribution

Manufacturing capabilities, supply chain robustness, and distribution channels impact market availability. The expansion into emerging markets relies on localized manufacturing or partnerships, affecting overall sales volume.

Financial Trajectory and Forecasting

Pre-Launch Phase

Prior to approval, VELIVET’s financials reflect development costs—clinical trial investments, regulatory filings, and preparatory commercialization expenses. Cumulative R&D expenditures often surpass hundreds of millions USD for novel biologics or complex small molecules [3].

Launch and Post-Approval Growth

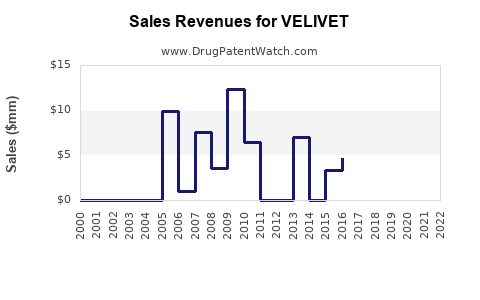

Upon regulatory approval, revenue forecasts depend on market size, pricing, and adoption rates. Early uptake may be slow as healthcare providers familiarize with the drug, but rapid growth can follow, especially if VELIVET addresses unmet needs effectively.

Market penetration modeling assumes varying adoption curves:

- Conservative scenario: 10-15% market share within five years,

- Optimistic scenario: 30-40% market share within the same period.

Assuming an average annual treatment cost of USD 50,000, and a target patient population of 100,000 in key markets, initial revenues could approach USD 200-500 million in early years, scaling up as market penetration deepens.

Revenue and Profitability Outlook

Long-term financial trajectories depend on sustained demand, pricing strategies, and competitive dynamics. By year five post-launch, VELIVET could generate USD 1 billion or more in annual sales if maintained with favorable market conditions.

Cost of goods sold (COGS), marketing, sales, and administrative expenses weigh heavily on margins. Typically, gross margins for biologics and innovative drugs range between 70-85%, with net margins adjusting based on commercialization scale and market access negotiations.

Lifecycle Management and Market Expansion

Patent protections provide exclusivity windows; however, lifecycle management strategies—including line extensions, combination therapies, and new indications—can prolong revenue streams. Also, expanding into emerging markets through licensing or partnerships can diversify revenue sources.

Risk Factors Impacting Financial Outcomes

Potential delays in regulatory approval, safety concerns, pricing pressures, and biosimilar competition could temper financial forecasts. Moreover, unfavorable reimbursement decisions or market saturation may constrain growth projections.

Conclusion

VELIVET’s market positioning hinges on its therapeutic efficacy, regulatory strategy, and competitive differentiation. Its financial trajectory is promising but fraught with risks inherent to biotech innovation and market forces. Realizing its full potential will depend on strategic deployment, robust scientific validation, and proactive market access initiatives.

Key Takeaways

- VELIVET operates within a high-growth pharmaceutical segment, with significant demand driven by unmet needs.

- Regulatory advantages, such as accelerated pathways, could shorten time-to-market and enhance early revenue.

- Competitive positioning and pricing negotiations will critically influence market share and profitability.

- Revenue projections suggest potential to generate USD 1 billion annually within five years, contingent on market adoption.

- Lifecycle management and strategic expansion into emerging markets can sustain long-term revenue growth.

FAQs

1. What therapeutic areas is VELIVET most likely targeting?

Based on market trends, VELIVET likely addresses high-burden areas such as oncology, neurology, or autoimmune diseases, where innovative treatments are in high demand [1].

2. How does regulatory classification influence VELIVET’s market entry?

Accelerated approvals, like FDA’s Breakthrough Therapy designation, can significantly reduce time-to-market but often require compelling clinical data supporting safety and efficacy [2].

3. What competitive factors could challenge VELIVET’s market penetration?

Existing therapies, biosimilars, price competition, and potentially restrictive reimbursement policies may limit its market share, emphasizing the importance of differentiation and value demonstration.

4. How do manufacturing capabilities impact VELIVET's financial outlook?

Efficient manufacturing ensures supply continuity and cost control, directly affecting profit margins and the ability to meet market demand swiftly.

5. What strategies can maximize VELIVET’s long-term revenue potential?

Expanding indications, entering emerging markets, engaging in lifecycle management, and fostering strong payer relationships are critical for sustained growth.

References

[1] Grand View Research, "Pharmaceuticals Market Size & Forecast," 2022.

[2] U.S. Food and Drug Administration, "Accelerated Approval Program," 2023.

[3] DiMasi, J. A., et al., "Innovation in the pharmaceutical industry: New estimates of R&D costs," Journal of Health Economics, 2021.