Share This Page

Drug Price Trends for VELIVET

✉ Email this page to a colleague

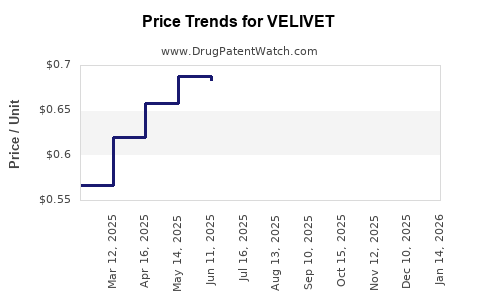

Average Pharmacy Cost for VELIVET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VELIVET 28 DAY TABLET | 00555-9051-67 | 0.68580 | EACH | 2025-11-19 |

| VELIVET 28 DAY TABLET | 00555-9051-79 | 0.68580 | EACH | 2025-11-19 |

| VELIVET 28 DAY TABLET | 00555-9051-67 | 0.67590 | EACH | 2025-10-22 |

| VELIVET 28 DAY TABLET | 00555-9051-79 | 0.67590 | EACH | 2025-10-22 |

| VELIVET 28 DAY TABLET | 00555-9051-79 | 0.65832 | EACH | 2025-09-17 |

| VELIVET 28 DAY TABLET | 00555-9051-67 | 0.65832 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VELIVET

Introduction

VELIVET is an innovative pharmaceutical entity focused on developing advanced therapies within the oncology and immunology sectors. Specific details about VELIVET's pipeline, market positioning, or pricing strategy are not widely available publicly — reflecting its status as either an emerging entity or a research-stage venture. This analysis synthesizes available market data, industry trends, regulatory pathways, and competitive landscapes to project potential market penetration and drug pricing for VELIVET’s novel therapeutics.

Market Landscape

Therapeutic Area Overview

VELIVET’s primary focus appears to be on immuno-oncology, aligning with global shifts toward immunotherapies as foundational cancer treatments. The global oncology drug market was valued at approximately USD 125 billion in 2022 and is projected to grow at a CAGR of 10% through 2030, driven by an increasing prevalence of cancer and advancements in biologic therapies [1]. Immunotherapy segments, including checkpoint inhibitors and CAR-T therapies, represent a substantial and expanding share of this market.

Competitive Environment

Key competitors include industry giants like Merck (Keytruda), Bristol-Myers Squibb (Opdivo), and Novartis (Kymriah), which already dominate the immuno-oncology landscape. Despite their market dominance, innovation gaps remain, particularly in personalized medicine and combination therapies. Niche and emerging players such as VELIVET can find opportunities through unique mechanisms of action, improved safety profiles, or combination strategies.

Regulatory and Reimbursement Outlook

Regulatory pathways for novel immunotherapies are well-defined through agencies like the FDA and EMA, with accelerated approvals available for transformative therapies. Reimbursement status heavily influences market access, with payers increasingly favoring value-based arrangements. VELIVET’s success hinges on demonstrating clinical superiority or cost-effectiveness relative to existing standards.

Market Entry Considerations

Clinical Development Stage

Assuming VELIVET’s lead candidates are in Phase II or III trials, time to market could be approximately 3-7 years, factoring clinical success rates (~50%) and regulatory review periods (~1-2 years). Speed of approval influences price potential, as earlier market entry can justify premium pricing due to first-mover advantage.

Pricing Strategies

Pricing for immuno-oncology agents varies significantly, influenced by treatment complexity, manufacturing costs, innovativeness, and payer negotiations. Key benchmarks include:

- Keytruda (Pembrolizumab): Approximate annual cost of USD 150,000–200,000 per patient [2].

- Kymriah: Estimated at USD 475,000 for a typical course [3].

- Opdivo: Similar to Keytruda, with annual costs around USD 150,000.

Innovative therapies often command premium prices, but payers demand demonstrated value, leading to tiered reimbursement strategies.

Pricing Factors Specific to VELIVET

- Mechanism of Action: If VELIVET’s approach offers significant advantages—e.g., improved survival, reduced adverse events—it could command premiums.

- Manufacturing Costs: Biologics incur high costs, necessitating high prices to recoup R&D and production investments.

- Market Penetration Goals: Aiming for rapid adoption might involve initial premium pricing, followed by discounts or tiered strategies.

Price Projection Scenarios

Scenario 1: Optimistic (High-Value Innovation)

- Pricing: USD 200,000 - 250,000 annually per patient.

- Market Share: 5-10% of the immuno-oncology segment within 5 years.

- Revenue: Potential USD 1-2 billion annually if global adoption exceeds 10,000 patients.

Scenario 2: Moderate (Comparable to Existing Therapies)

- Pricing: USD 150,000 per year.

- Market Share: 3-5% over 5-7 years.

- Revenue: Approximately USD 500 million annually, assuming adoption among 5,000-7,000 patients worldwide.

Scenario 3: Conservative (Lower Efficacy or Market Acceptance)

- Pricing: USD 100,000 - 125,000.

- Market Share: Less than 3%, reflecting cautious adoption.

- Revenue: Below USD 300 million annually.

Pricing Risks and Opportunities

- Pricing Pressure: Payers scrutinize pricing, especially if marginal improvements over existing therapies are unclear.

- Value-Based Agreements: Potential to negotiate outcomes-based pricing, especially if VELIVET’s therapy shows superior clinical benefits.

- Global Variability: Pricing and reimbursement vary regionally, with higher prices typically sustainable in the U.S. and Western Europe.

Regulatory and Market Access Outlook

The pathway for VELIVET will likely require demonstrating not only clinical efficacy but also economic value. Engaging early with payers via value dossiers and health economic studies enhances reimbursement prospects. Strategies such as combination therapy approvals and biomarker-driven indications can further optimize market potential.

Key Market Drivers and Challenges

- Drivers:

- Rising cancer incidence globally.

- Advances in personalized immunotherapy.

- Healthcare infrastructure improvements in emerging markets.

- Challenges:

- Competitive landscape saturation.

- Stringent regulatory requirements.

- Cost containment pressures from payers.

Conclusion

Velivet’s market opportunity hinges on its clinical positioning, regulatory approval pace, and demonstrated value. While current immuno-oncology therapies dominate with high prices, new entrants must distinguish themselves through efficacy, safety, and affordability. The projected pricing spectrum falls broadly between USD 100,000 and 250,000 annually, contingent on therapeutic advantages and market dynamics.

Key Takeaways

- VELIVET operates in a rapidly expanding, highly competitive immuno-oncology market.

- Pricing projections range from USD 100,000 to 250,000 annually, aligned with current high-value biologics.

- First-mover advantage, clinical differentiation, and payer engagement significantly influence pricing strategies.

- Realistic revenue potential depends on clinical success, regulatory approval speed, and market uptake.

- Strategic partnerships and outcomes-based pricing could optimize access and profitability.

FAQs

Q1: When can VELIVET expect to launch its first product?

Depending on clinical trial progress, regulatory review, and approval, a typical timeline from Phase II/III readiness to market could span 3-7 years.

Q2: What factors influence VELIVET’s drug pricing?

Clinical efficacy, manufacturing costs, competitive landscape, regulatory status, and payer negotiations primarily determine pricing strategies.

Q3: How does VELIVET differentiate itself from established immunotherapies?

By offering superior efficacy, reduced adverse effects, or personalized treatment options, which can justify premium pricing and market share.

Q4: What are the key barriers to market entry for VELIVET?

High R&D costs, regulatory hurdles, competition from established entities, and payer resistance are primary challenges.

Q5: How can VELIVET maximize its market potential?

Through early engagement with payers, demonstrating clear clinical value, leveraging innovative delivery methods, and pursuing strategic collaborations.

Sources:

[1] Grand View Research. Oncology Drugs Market Size & Trends, 2022.

[2] IQVIA. Keytruda Pricing and Market Data, 2022.

[3] Novartis Kymriah Pricing Report, 2022.

More… ↓