UPTRAVI Drug Patent Profile

✉ Email this page to a colleague

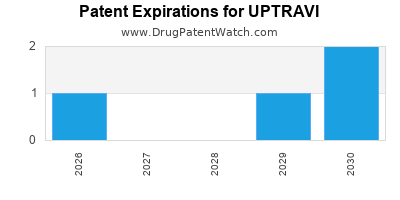

When do Uptravi patents expire, and what generic alternatives are available?

Uptravi is a drug marketed by Actelion and is included in two NDAs. There are six patents protecting this drug and two Paragraph IV challenges.

This drug has one hundred and seventy-seven patent family members in forty-two countries.

The generic ingredient in UPTRAVI is selexipag. There are two drug master file entries for this compound. Three suppliers are listed for this compound. Additional details are available on the selexipag profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Uptravi

A generic version of UPTRAVI was approved as selexipag by ALEMBIC on October 11th, 2023.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for UPTRAVI?

- What are the global sales for UPTRAVI?

- What is Average Wholesale Price for UPTRAVI?

Summary for UPTRAVI

| International Patents: | 177 |

| US Patents: | 6 |

| Applicants: | 1 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 78 |

| Clinical Trials: | 5 |

| Patent Applications: | 466 |

| Drug Prices: | Drug price information for UPTRAVI |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for UPTRAVI |

| What excipients (inactive ingredients) are in UPTRAVI? | UPTRAVI excipients list |

| DailyMed Link: | UPTRAVI at DailyMed |

Recent Clinical Trials for UPTRAVI

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Humanis Saglk Anonim Sirketi | PHASE1 |

| Sheffield Teaching Hospitals NHS Foundation Trust | Phase 4 |

| University of Glasgow | Phase 4 |

Pharmacology for UPTRAVI

| Drug Class | Prostacyclin Receptor Agonist |

| Mechanism of Action | Prostacyclin Receptor Agonists |

US Patents and Regulatory Information for UPTRAVI

UPTRAVI is protected by six US patents.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Actelion | UPTRAVI | selexipag | TABLET;ORAL | 207947-007 | Dec 21, 2015 | AB | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Actelion | UPTRAVI | selexipag | TABLET;ORAL | 207947-005 | Dec 21, 2015 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Actelion | UPTRAVI | selexipag | TABLET;ORAL | 207947-008 | Dec 21, 2015 | AB | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Actelion | UPTRAVI | selexipag | TABLET;ORAL | 207947-007 | Dec 21, 2015 | AB | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | ||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for UPTRAVI

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Janssen Cilag International NV | Uptravi | selexipag | EMEA/H/C/003774Uptravi is indicated for the long-term treatment of pulmonary arterial hypertension (PAH) in adult patients with WHO functional class (FC) II–III, either as combination therapy in patients insufficiently controlled with an endothelin receptor antagonist (ERA) and/or a phosphodiesterase type 5 (PDE-5) inhibitor, or as monotherapy in patients who are not candidates for these therapies., , Efficacy has been shown in a PAH population including idiopathic and heritable PAH, PAH associated with connective tissue disorders, and PAH associated with corrected simple congenital heart disease., | Authorised | no | no | no | 2016-05-12 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for UPTRAVI

When does loss-of-exclusivity occur for UPTRAVI?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 7242

Estimated Expiration: ⤷ Get Started Free

Patent: 1658

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 10263569

Estimated Expiration: ⤷ Get Started Free

Patent: 16366073

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 1015936

Estimated Expiration: ⤷ Get Started Free

Patent: 2018009534

Estimated Expiration: ⤷ Get Started Free

Patent: 2021005510

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 64475

Estimated Expiration: ⤷ Get Started Free

Patent: 05169

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 11003264

Estimated Expiration: ⤷ Get Started Free

Patent: 18001464

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2459198

Estimated Expiration: ⤷ Get Started Free

Patent: 4326991

Estimated Expiration: ⤷ Get Started Free

Patent: 8289890

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 30432

Estimated Expiration: ⤷ Get Started Free

Patent: 18006834

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0180171

Estimated Expiration: ⤷ Get Started Free

Patent: 0200539

Estimated Expiration: ⤷ Get Started Free

Patent: 0250572

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 19788

Estimated Expiration: ⤷ Get Started Free

Patent: 22893

Estimated Expiration: ⤷ Get Started Free

Patent: 18011

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 47254

Estimated Expiration: ⤷ Get Started Free

Patent: 75871

Estimated Expiration: ⤷ Get Started Free

Patent: 31607

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 18049108

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 47254

Estimated Expiration: ⤷ Get Started Free

Patent: 75871

Estimated Expiration: ⤷ Get Started Free

Patent: 84911

Estimated Expiration: ⤷ Get Started Free

Patent: 89855

Estimated Expiration: ⤷ Get Started Free

Patent: 31607

Estimated Expiration: ⤷ Get Started Free

Patent: 01404

Estimated Expiration: ⤷ Get Started Free

Finland

Patent: 31607

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 44788

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 36721

Estimated Expiration: ⤷ Get Started Free

Patent: 48467

Estimated Expiration: ⤷ Get Started Free

Patent: 71411

Estimated Expiration: ⤷ Get Started Free

Patent: 800015

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 6928

Estimated Expiration: ⤷ Get Started Free

Patent: 3287

Estimated Expiration: ⤷ Get Started Free

Patent: 9461

Estimated Expiration: ⤷ Get Started Free

Patent: 0203

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 2010150865

Estimated Expiration: ⤷ Get Started Free

Patent: 2017098998

Estimated Expiration: ⤷ Get Started Free

Patent: 25574

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 447254

Estimated Expiration: ⤷ Get Started Free

Patent: 2018008

Estimated Expiration: ⤷ Get Started Free

Patent: 47254

Estimated Expiration: ⤷ Get Started Free

Patent: 75871

Estimated Expiration: ⤷ Get Started Free

Patent: 31607

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 6531

Estimated Expiration: ⤷ Get Started Free

Patent: 8164

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 6318

Estimated Expiration: ⤷ Get Started Free

Patent: 5595

Estimated Expiration: ⤷ Get Started Free

Patent: 11013471

Estimated Expiration: ⤷ Get Started Free

Patent: 18006343

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 637

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 7352

Estimated Expiration: ⤷ Get Started Free

Patent: 2784

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 18015

Estimated Expiration: ⤷ Get Started Free

Patent: 47254

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 181072

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 015502824

Patent: CRYSTALS

Estimated Expiration: ⤷ Get Started Free

Patent: 015502825

Patent: CRYSTALS

Estimated Expiration: ⤷ Get Started Free

Patent: 018501161

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 47254

Estimated Expiration: ⤷ Get Started Free

Patent: 75871

Estimated Expiration: ⤷ Get Started Free

Patent: 31607

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 47254

Estimated Expiration: ⤷ Get Started Free

Patent: 75871

Estimated Expiration: ⤷ Get Started Free

Patent: 31607

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 56206

Patent: КРИСТАЛЛЫ (CRYSTALS)

Estimated Expiration: ⤷ Get Started Free

Patent: 35547

Estimated Expiration: ⤷ Get Started Free

Patent: 12102678

Patent: КРИСТАЛЛЫ

Estimated Expiration: ⤷ Get Started Free

Patent: 18123304

Estimated Expiration: ⤷ Get Started Free

San Marino

Patent: 01800077

Estimated Expiration: ⤷ Get Started Free

Patent: 02000177

Estimated Expiration: ⤷ Get Started Free

Saudi Arabia

Patent: 8391686

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 791

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 6915

Patent: CRYSTALS

Estimated Expiration: ⤷ Get Started Free

Patent: 201403313W

Patent: CRYSTALS

Estimated Expiration: ⤷ Get Started Free

Patent: 201804320Q

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 47254

Estimated Expiration: ⤷ Get Started Free

Patent: 75871

Estimated Expiration: ⤷ Get Started Free

Patent: 31607

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1109099

Patent: CRYSTALS

Estimated Expiration: ⤷ Get Started Free

Patent: 1804387

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2669213

Estimated Expiration: ⤷ Get Started Free

Patent: 2705198

Estimated Expiration: ⤷ Get Started Free

Patent: 2759845

Estimated Expiration: ⤷ Get Started Free

Patent: 2829415

Estimated Expiration: ⤷ Get Started Free

Patent: 120109457

Estimated Expiration: ⤷ Get Started Free

Patent: 170024165

Estimated Expiration: ⤷ Get Started Free

Patent: 180081141

Estimated Expiration: ⤷ Get Started Free

Patent: 240090716

Estimated Expiration: ⤷ Get Started Free

Patent: 240090717

Estimated Expiration: ⤷ Get Started Free

Patent: 250107951

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 60007

Estimated Expiration: ⤷ Get Started Free

Patent: 97124

Estimated Expiration: ⤷ Get Started Free

Patent: 30325

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 31565

Estimated Expiration: ⤷ Get Started Free

Patent: 50143

Estimated Expiration: ⤷ Get Started Free

Patent: 1111352

Patent: Crystal

Estimated Expiration: ⤷ Get Started Free

Patent: 1720444

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 8849

Patent: КРИСТАЛІЧНА ФОРМА 2-{4-[N-(5,6-ДИФЕНІЛПІРАЗИН-2-ІЛ)-N-ІЗОПРОПІЛАМІНО]БУТИЛОКСИ}-N-(МЕТИЛСУЛЬФОНІЛ)АЦЕТАМІДУ

Estimated Expiration: ⤷ Get Started Free

Patent: 4002

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering UPTRAVI around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Cyprus | 1122893 | ⤷ Get Started Free | |

| European Patent Office | 3300729 | ⤷ Get Started Free | |

| China | 102459198 | ⤷ Get Started Free | |

| Croatia | P20171917 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for UPTRAVI

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1400518 | CR 2016 00048 | Denmark | ⤷ Get Started Free | PRODUCT NAME: SELEXIPAG ELLER ET SALT DERAF; REG. NO/DATE: EU/1/15/1083 20160519 |

| 1400518 | CA 2016 00048 | Denmark | ⤷ Get Started Free | PRODUCT NAME: SELEXIPAG ELLER ET SALT DERAF; REG. NO/DATE: EU/1/15/1083 20160519 |

| 1400518 | 16C0042 | France | ⤷ Get Started Free | PRODUCT NAME: SELEXIPAG OU L'UN DE SES SELS; REGISTRATION NO/DATE: EU/1/15/1083 20160519 |

| 2447254 | 325 10-2018 | Slovakia | ⤷ Get Started Free | PRODUCT NAME: SELEXIPAG; REGISTRATION NO/DATE: EU/1/15/1083 20160519 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for Uptravi (Selexipag)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.