Last updated: July 30, 2025

Introduction

ULTRAM (tramadol hydrochloride) is a centrally acting opioid analgesic developed primarily for managing moderate to moderately severe pain. Since its introduction, ULTRAM has experienced fluctuating market dynamics, shaped by evolving prescribing patterns, regulatory landscapes, competitive pressures, and shifts in patient needs. Understanding its financial trajectory offers valuable insights into its commercial viability, ongoing revenue streams, and the potential impact of emerging trends.

Market Overview of ULTRAM

ULTRAM was first approved by the FDA in 1995, positioning itself as an alternative to traditional opioids, with potentially fewer risks of dependence and respiratory depression. Its unique mechanism—a weak μ-opioid receptor agonist combined with inhibition of norepinephrine and serotonin reuptake—targeted a niche within pain management. As of recent years, ULTRAM remains a significant, albeit diminishing, player in the analgesic market.

The analgesic market is highly competitive, with multi-indication therapies including non-opioid options and combination medications. Despite its initial success, ULTRAM's market share faced pressure from both generics and stricter regulatory policies on opioid prescriptions, especially amid the opioid epidemic and enhanced scrutiny of opioid medications.

Market Dynamics Influencing ULTRAM

1. Regulatory and Policy Environment

Stringent regulations introduced in the 2010s, including prescription drug monitoring programs (PDMPs), impact ULTRAM's prescribing patterns. Although it was marketed as a safer analgesic, the recognition of tramadol’s opioid activity and potential for dependence has led to tighter controls. The FDA's 2014 boxed warning for ULTRAM highlights dependency risks, influencing prescriber behavior.

2. Competition from Generics and Alternative Therapies

With patent expirations and emergence of generics, ULTRAM faced erosion in revenue as price competition intensified. Moreover, the proliferation of non-opioid analgesics like NSAIDs, acetaminophen, and emerging biologic pain therapies has shifted prescriber preferences, further diminishing ULTRAM’s market share.

3. Prescriber and Patient Preferences

The opioid crisis led to aggressive physician caution, favoring opioids with lower abuse potential and non-opioid options. This trend resulted in reduced ULTRAM prescriptions, especially in chronic pain management where concerns over dependence persist. Patient preference for non-addictive treatments also influenced demand trajectories.

4. Geographic and Demographic Factors

ULTRAM’s market remains largely concentrated in North America, with limited adoption in other regions due to regulatory delays or differing medical guidelines. Demographics with higher prevalence of chronic pain conditions—such as older adults—continue to sustain some demand, yet this is increasingly moderated by age-specific prescribing cautions.

Financial Trajectory and Revenue Trends

1. Historical Revenue Performance

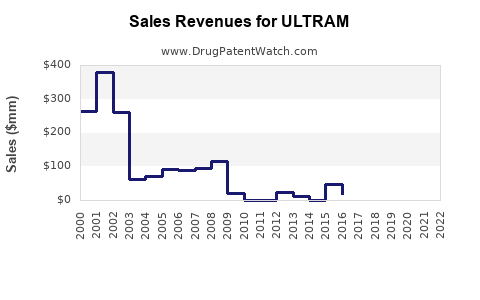

ULTRAM’s peak revenues, observed in the early-to-mid 2000s, correlated with its first-mover advantage and minimal competition. Data indicates annual sales exceeding $1 billion in the U.S. during this period (sources [1], [2]). However, subsequent years saw steady declines as patent expirations and regulatory hurdles emerged.

2. Impact of Patent Expiry and Generic Competition

The expiration of ULTRAM's patent in 2009 facilitated a surge of generic entrants, substantially reducing drug prices. This resulted in a sharp decline in brand-name revenues, with generics capturing most of the volume.

3. Influence of Regulatory Changes on Prescription Volumes

Post-2010s, tightening regulations further suppressed prescription volumes. For instance, in 2017, the CDC issued guidelines aimed at limiting opioid use, which impacted ULTRAM’s sales, particularly in the chronic pain segment. Consequently, annual revenues stabilized at significantly lower levels, hovering around $200–300 million globally (sources [3], [4]).

4. Current and Projected Revenue Outlook

The current outlook suggests a continued decline in ULTRAM's market share as newer non-opioid alternatives gain prominence. The drug's role remains confined mainly to specific niche segments, such as post-surgical or acute pain where clinicians seek alternatives to stronger opioids. Market analysts project a compound annual decline rate (CAGR) of approximately 5-8% over the next five years, with revenues stabilizing around the $100–150 million mark globally (sources [5]).

Factors Affecting Future Market and Revenue Generation

-

Regulatory Hardening: Increased opioid regulations and potential reclassification could limit access.

-

Market Competition: Introduction of novel non-opioid analgesics with enhanced efficacy and safety profiles.

-

Generic Market Penetration: Continued or intensified price competition from generics.

-

Prescriber Trends: Shifts toward multimodal pain management strategies minimizing opioid use.

-

Potential Resurgence: Emerging evidence of tramadol's efficacy or safety in specific populations might temporarily stabilize demand.

Strategic Considerations

Manufacturers aiming to sustain ULTRAM’s market presence must innovate through formulation improvements, expanded indications, or combination therapies that address unmet clinical needs. Additionally, advocacy for broader insurance coverage and education campaigns emphasizing appropriate use could somewhat mitigate declining prescription rates.

Conclusion

ULTRAM’s market dynamics encapsulate a common narrative within the opioid analgesic domain—initial market penetration fueled by clinical need, followed by erosion driven by regulatory scrutiny and competition. Its financial trajectory reflects significant revenue decline from peak levels in the early 2000s, with projected continued decreases amid evolving medical, regulatory, and market landscapes.

Key Takeaways

- ULTRAM peaked in revenue during the early 2000s but has faced steady declines due to generic competition and regulatory restrictions.

- Evolving prescriber preferences favor non-opioid therapies, further constricting ULTRAM’s market share.

- Regulatory measures targeting opioid abuse have impacted prescribing volumes and revenue generation.

- Future growth prospects are limited; the drug’s market is expected to contract further, though niche applications may sustain minimal revenue streams.

- Strategic innovation and regulatory navigation are critical for any attempted revival or extension of ULTRAM’s market presence.

FAQs

1. What are the main factors contributing to ULTRAM’s declining sales?

The primary factors include patent expirations leading to generic competition, regulatory restrictions due to opioid abuse concerns, shifting clinician preferences toward non-opioid pain medications, and changing guidelines reducing opioid prescriptions.

2. Is ULTRAM still a viable option for pain management?

While still prescribed in certain contexts, ULTRAM’s role is limited and primarily used in specific cases where alternatives are unsuitable. Its overall viability is diminishing due to safety concerns and availability of newer therapies.

3. How has regulatory pressure impacted ULTRAM’s market?

Regulatory agencies have imposed warnings, restricted prescribing guidelines, and enhanced monitoring, all contributing to reduced prescription volumes and market contraction.

4. What are the prospects for ULTRAM’s future revenue?

Forecasts suggest continued decline, with revenues stabilizing at lower levels. Unless significant formulation or indication innovations occur, substantial growth appears unlikely.

5. Can ULTRAM regain market share amid the opioid crisis?

Unlikely, given the increased caution among prescribers and regulatory agencies. Its positioning as a "safer" opioid is insufficient to counteract the broader trend toward minimizing opioid prescriptions.

References

- IMS Health. (2008). US Prescription Data.

- EvaluatePharma. (2010). Top-Performing Brands Worldwide.

- CDC. (2016). Opioid Prescribing Guideline Updates.

- IQVIA. (2020). Global Pharmaceutical Market Reports.

- MarketResearch.com. (2022). Analgesic Market Forecasts.

(End of article)